Table of Contents

After a slow start to the year, online retail sales began to recover from March 2025 onward, helped by improved consumer sentiment and steady income growth.

Momentum strengthened further with a strong Amazon Prime Day in July, which primed shoppers for big-ticket purchases ahead of the festive season.

The GST rate cuts announced in September - reducing taxes on several large appliances and mid-priced apparel - created an additional tailwind by making many products 6–8 % cheaper at checkout.

Early-Week Spike

The festive season opened with an exceptional surge in sales activity. 22 September 2025 emerged as the largest single-day of sales in the entire first week. Two structural factors concentrated demand on Day-1:

- Early-access for loyalty members:Both Amazon Prime and Flipkart Plus/Black members were allowed to start shopping hours before the sale was opened to the wider public. These early windows typically attract high-value customers who are more likely to buy premium categories such as mobiles, large appliances, and consumer electronics.

- Price-driven urgency:Consumers moved quickly to secure launch-day discounts, exchange offers, and the newly-reduced GST priceson key categories like refrigerators and dishwashers.

The effect of these factors was visible immediately: the first two days (22–23 September) generated about 33 % of the entire first-week GMV, even though the sale spanned seven days. This concentration highlights the trend of front-loaded festive demand, where consumers rush to lock in the best offers as soon as sales open.

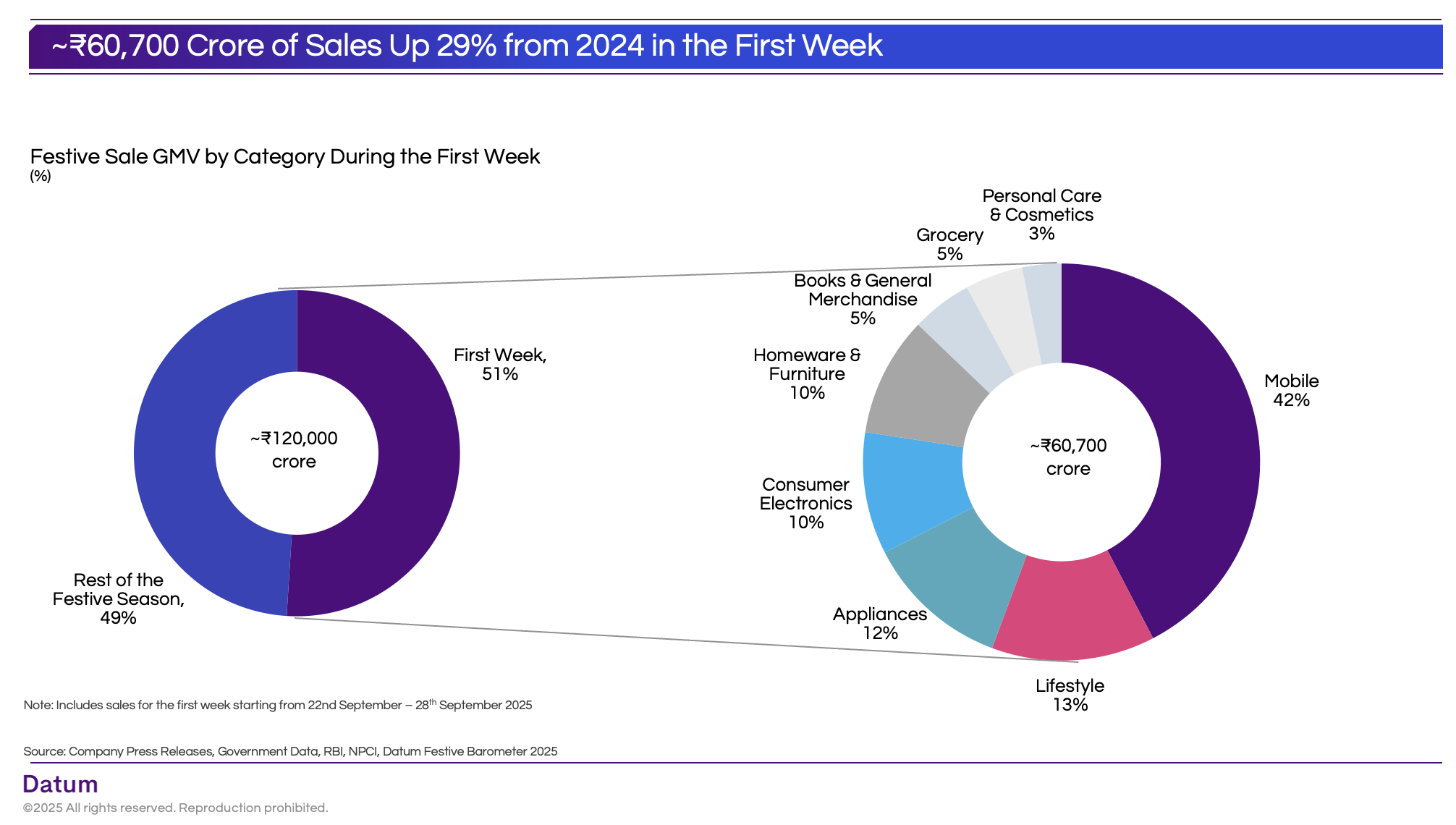

The 2025 festive season opened with robust momentum for India’s online retail sector. Total festive sales are projected to grow 27 % year-on-year (YoY) to cross ~₹ 1.2 lakh crore, with the first week alone generating ~₹ 60,700 crore GMV, about 51 % of the season’s total.

Category-Wise Growth

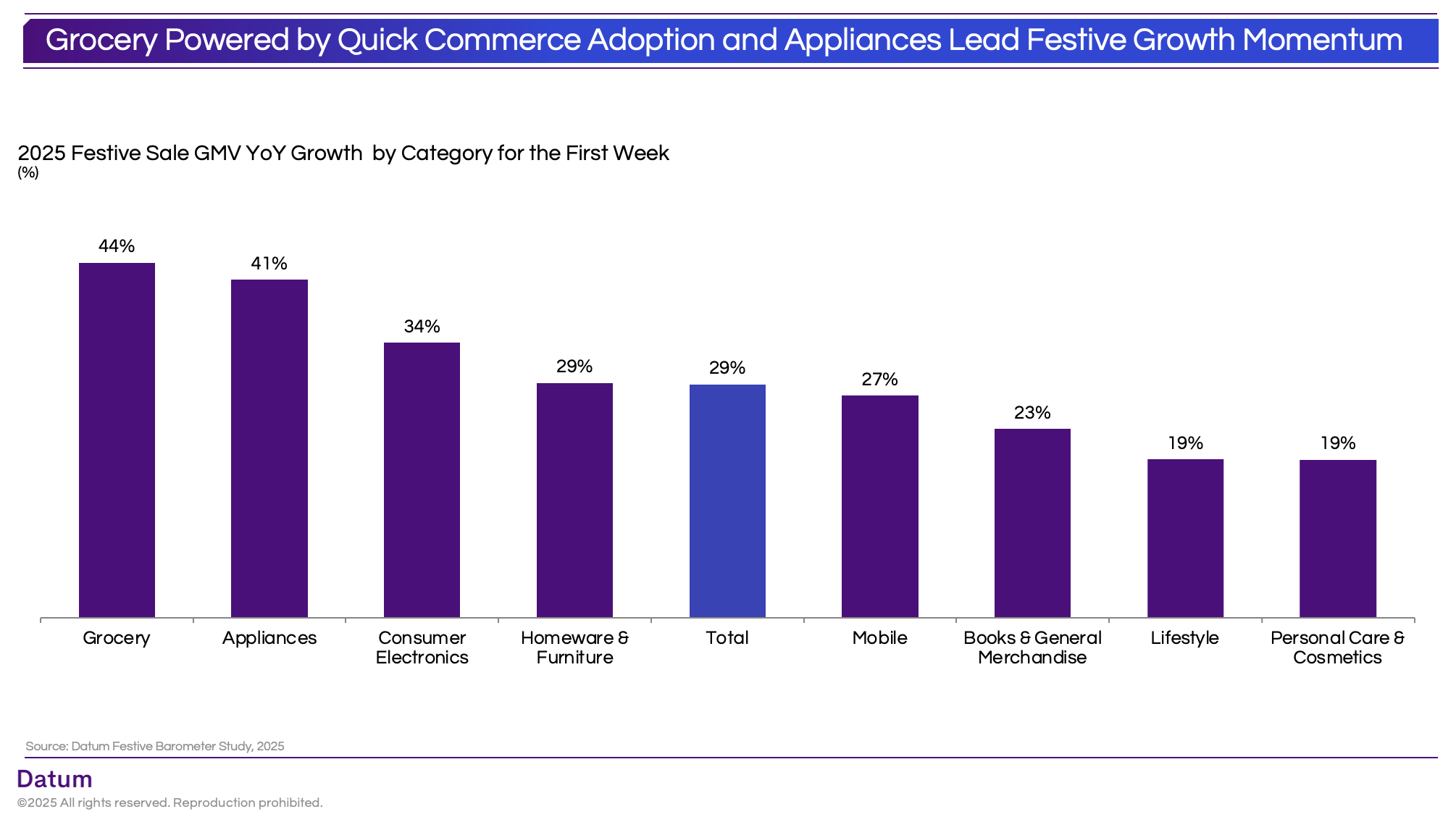

While mobiles remained the single largest contributor to GMV, the strongest momentum came from essentials and household upgrades such as grocery, appliances, and premium electronics.

- Mobiles stayed the largest GMV category (~42 % share) but grew +27.2 % YoY, slightly below the market average .

- Grocery (+44 % YoY) was the fastest-growing category, lifted by expanding quick-commerce penetrationversus last year; it is expected to remain a key driver as gifting baskets and essentials peak .

- Appliances (+41 % YoY) saw a notable lift from the GST cut and strong demand for refrigerators (+20 %), dishwashers (+15 %) and inverter batteries .

- Consumer Electronics (+34 % YoY) benefitted from premium TVs (QLED/Mini-LED), wearables, and laptops .

- Homeware & Furniture (+29 % YoY) continued to grow on the back of festive décor and urban refurbishments .

- Lifestyle & Personal Care (~+19 % YoY) recorded moderate gains, with professional beauty, Korean skincare, premium watches, and lab-grown diamonds showing strong sub-segment momentum .

- Quick-commerce demand is expected to be more evenly distributed across the month, rather than concentrated solely in the opening sale days.

- However, spikes typically occur around key festive dates - such as Navratri, Dussehra, and Diwali - when households stock up on gifting packs, sweets, beverages, and last-minute essentials.

- This pattern suggests that while week-one grocery sales benefited from early excitement, quick-commerce platforms are likely to see recurring peaks around each festival, sustaining momentum through the season.

The first week of the 2025 festive season reflects a structural shift in India’s online retail story.

Mobiles remain the largest revenue anchor, but the strongest momentum came from grocery, appliances, and premium electronics, supported by quick-commerce penetration and GST-driven price relief.

Festive demand is now broader and more sustained, extending beyond one-off gadget upgrades to include everyday essentials, home improvements, and premium discretionary buys.

With quick-commerce keeping grocery sales active through the month and tax-related savings prompting household upgrades, the season’s growth is poised to remain steady beyond the initial week-one surge.

Download the complete report of festive season outlook