Table of Contents

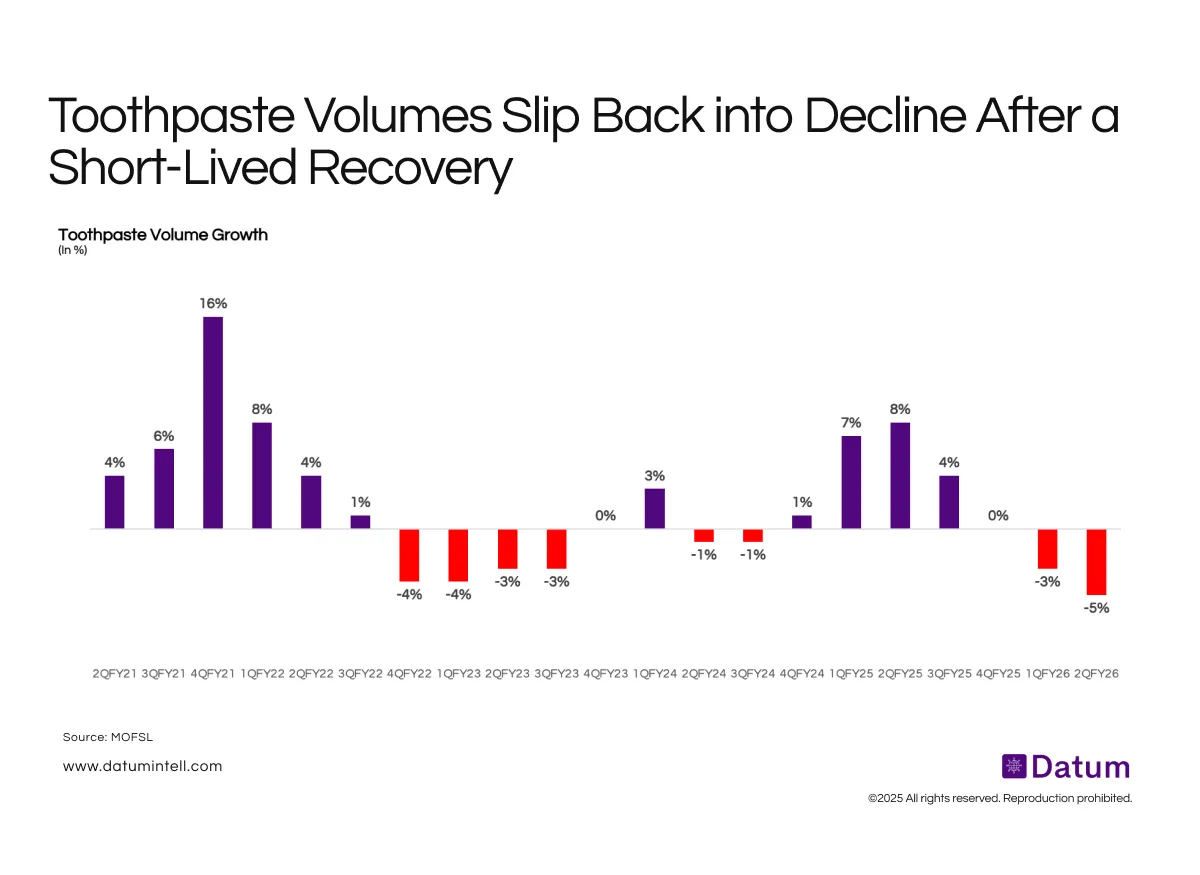

After two consecutive years of recovery, India’s toothpaste category has once again entered negative growth. Quarterly data from Motilal Oswal Financial Services (MOFSL) shows that the sector, which recorded 7–8% growth in 1Q–2QFY25, has declined by 3–5% in FY26, reversing earlier gains.

This pattern follows a volatile three-year trend — a strong post-pandemic rebound in FY21, demand normalization through FY22–FY23, and a shallow recovery in FY25 driven primarily by restocking, marketing activations, and price corrections. However, weak rural offtake, muted household frequency, and heightened competition have once again pressured volumes in FY26.

Toothpaste usage in India is almost universal (~98%), meaning there’s no room to add new users. However brushing frequency remains low - 80% of urban India brushes once a day and Only 50% of rural India brushes daily. This behavioral ceiling caps potential usage growth - there’s limited scope to expand frequency or volume naturally. According to Colgate, consumers adjust their spending by using less toothpaste per session, not by trading down or exiting the category. This means that volume decline comes from smaller dollops per brush, not fewer consumers. This along with smaller brushes and the premiumization of products also forces customers to use less paste.

What It Means

The data points to a structurally stagnant oral care market, where incremental volume growth is proving elusive despite broader FMCG recovery. Three strategic implications emerge:

- Rural fatigue persists – Lower disposable income and slower consumption recovery outside metros continue to weigh on base volumes, particularly for mass brands.

- Premiumization, not penetration, will drive growth – Categories such as whitening, herbal, and sensitivity are expanding faster than the mainstream segment, indicating that future growth will come from trading up, not adding new users.

- Brand competitiveness intensifies – Market leaders like Colgate face growing share pressure from herbal entrants (e.g., Dabur, Patanjali), which are capturing value-conscious consumers through localized positioning and smaller SKUs.

Overall, the shift suggests a price-led rather than volume-led growth environment in FY26, with margins increasingly dependent on mix improvement and cost control.