Table of Contents

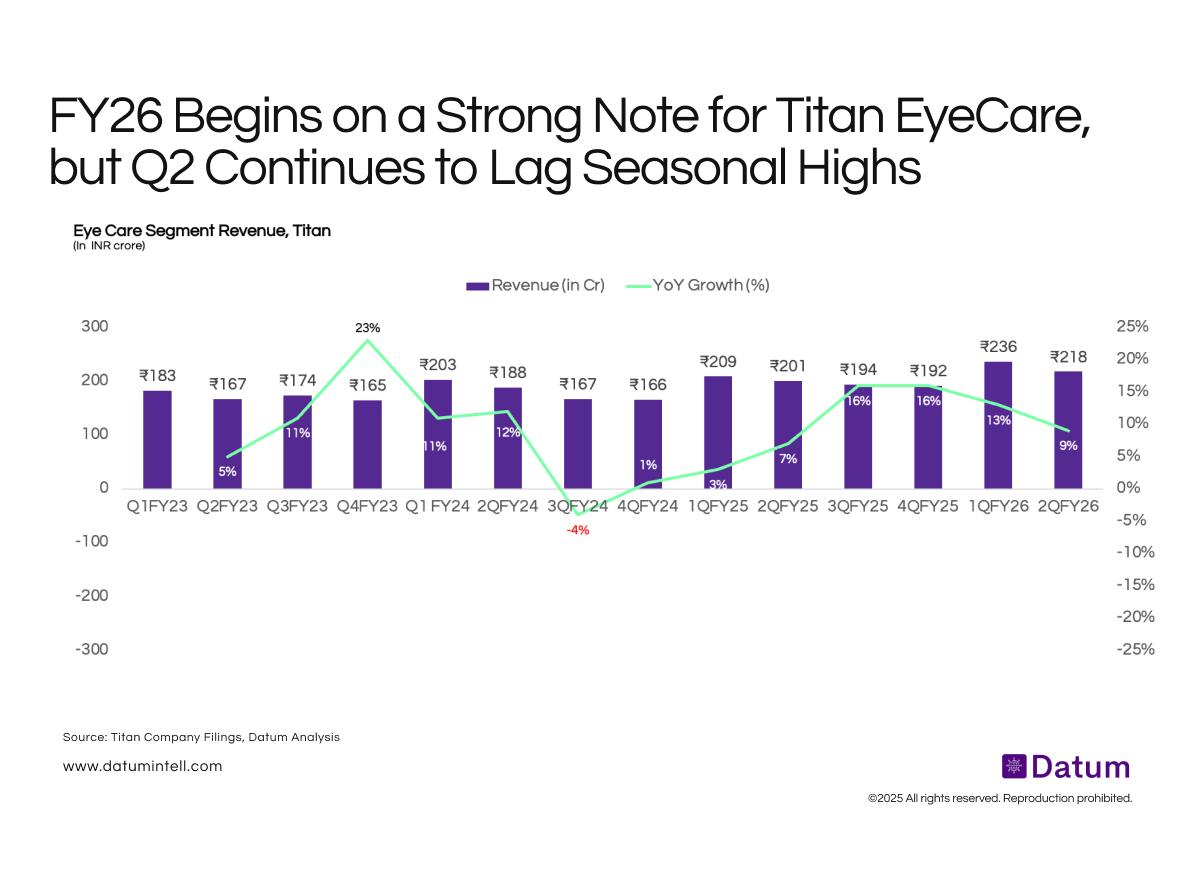

Titan’s EyeCare segment shows a clear recovery trajectory after the soft performance in FY24. Revenues rose sharply in Q1 FY26 to ₹236 crore (13% YoY), marking the strongest first-quarter performance in the last four years. However, Q2 FY26 revenue moderated to ₹218 crore (9% YoY), reflecting a recurring pattern where Q2 underperforms relative to Q1 and the festive-led Q3. Historical data shows Q2 is consistently slower due to lower discretionary spending, fewer store upgrades, and absence of promotional triggers.

Eyecare industry is growing at 7-8%, and Titan is growing ahead of the industry. The company’s market share is less than 5%, providing a significant headroom for growth. The management expects to clock 13-14% growth in eyecare business in FY26. - Titan Management

What It Means

Q2’s continued softness highlights a structural seasonal dip, not a weakness in category fundamentals. While Q1 and Q3 are driven by higher footfall and festive buying, Q2 acts as a consolidation period where growth normalises. Importantly, even with the slower growth rate, Q2 FY26 revenue is significantly above prior-year Q2 levels, indicating that the business is operating from a higher baseline. This suggests that Titan’s EyeCare recovery is intact, but quarterly momentum will remain uneven until product mix, marketing cadence, and store activation are more evenly distributed across the year.