Trust-Led Reset in Eggs Category

Brand Leadership Compressed Sharply Post Trust Shock on Blinkit

Datum insights provides organizations with a deeper understanding of their customers, markets, and operations.

Brand Leadership Compressed Sharply Post Trust Shock on Blinkit

Datum Reports offers comprehensive, data-driven research on India’s most important technology companies, designed for clarity and decision-making.

Blinkit’s peanut butter category is already consolidated. Pintola and MyFitness together control ~73% of sales, showing how quick commerce rapidly rewards scale, recall, and price-pack efficiency over assortment breadth.

Blinkit’s popcorn category has rapidly consolidated into a two-brand market, with 4700BC and Act II controlling ~99% of sales, leaving virtually no competitive long tail.

Korean noodles now account for 34% of Blinkit's noodle sales in top Indian cities with Tier-2 markets outpacing metros. Quick commerce isn't just faster delivery; it's a cultural accelerant reshaping what Indians eat, buy, and aspire to.

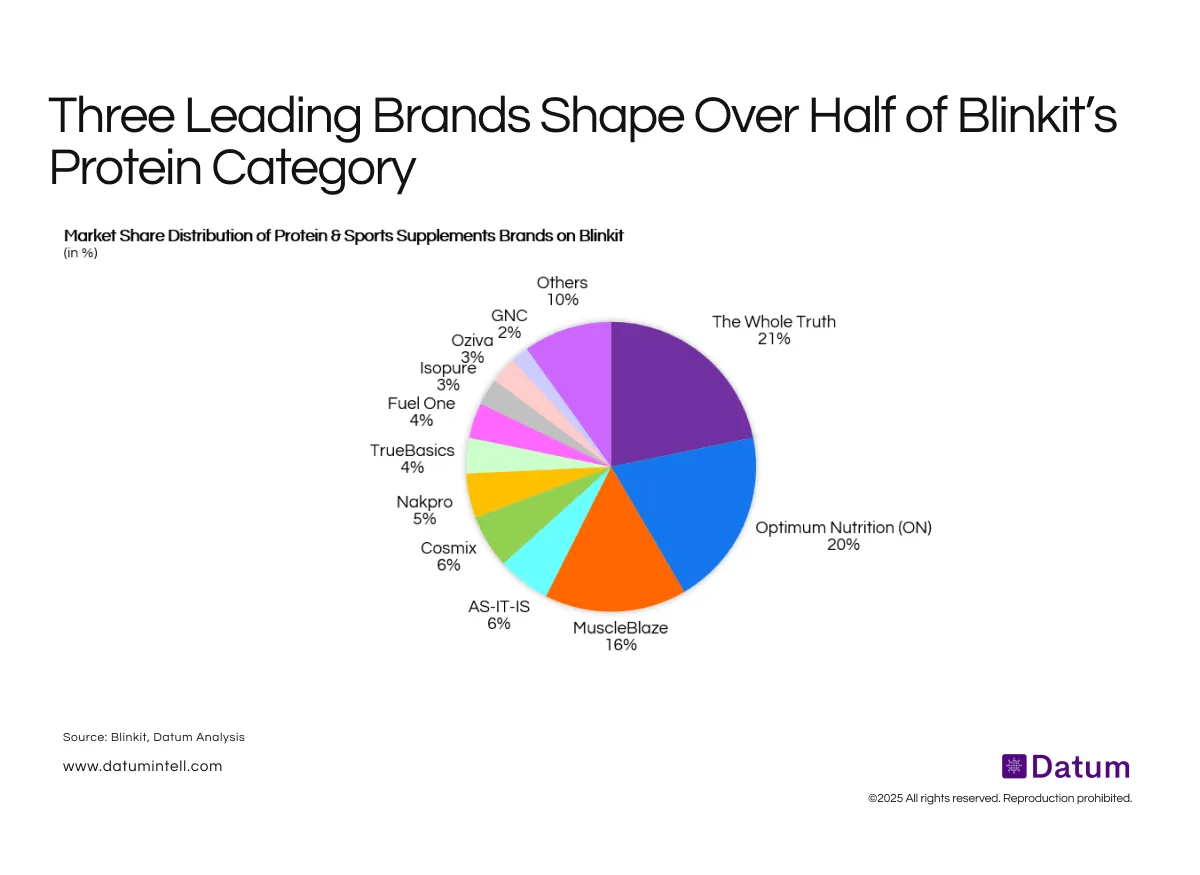

Three brands control 57% of Blinkit's protein sales. In quick commerce, trust and efficacy trump discovery. When speed meets high-stakes nutrition, brand credibility becomes everything.

Marico's 60% price hikes on Parachute coconut oil what CEO called "unheard of" in FMCG still couldn't prevent 970 basis point margin erosion as copra surged 113%. Company now depends on commodity deflation, not pricing, to restore profitability.

Same-store sales growth trends show the business transitioning from post-inflation volatility to measured recovery, with early signs of stabilisation but requiring continued focus on value, digital, and operational discipline to sustain momentum.

While recovery drove double-digit growth in 2023, increasing tariff costs, sluggish key market performance (China) and a reversal into negative growth by 2024 indicate that the next phase of growth will hinge on tighter execution, not just product cycles.

Colgate commands nearly half of Blinkit’s toothpaste market (47%), ahead of Sensodyne (19%), Dabur (9%), and Patanjali (6%). Together, these four brands contribute over 80% of total sales, highlighting a highly consolidated and habit-driven oral care category.

V2 Retail’s PSF remains stable even in softer quarters, underscoring a resilient value-fashion consumer and strong store-level unit economics.

ABFRL posted a strong 13% revenue uplift in Q2, powered by festive-led demand and broad-based momentum across segments.

Relaxo’s volumes have steadied, but GST disruption and mass-market weakness keep growth soft. Normalisation and distribution gains should support a gradual rebound.

Relaxo’s realisations have plateaued, with YoY growth slipping into negative territory as GST transition effects and mix softness dilute pricing gains. A recovery will hinge on stronger volumes and a shift toward higher-value segments.

Excess soft-luggage inventory, underutilised Bangladesh capacity, and discount-driven clearance compressed margins and stalled growth.

Manyavar’s once rapid expansion has flattened, with only 2 net store additions in FY25 and a decline of 7 stores in H1FY26. The brand is now shifting from footprint-led growth to a productivity- and optimisation-led strategy as the ethnic-wear market matures.