Table of Contents

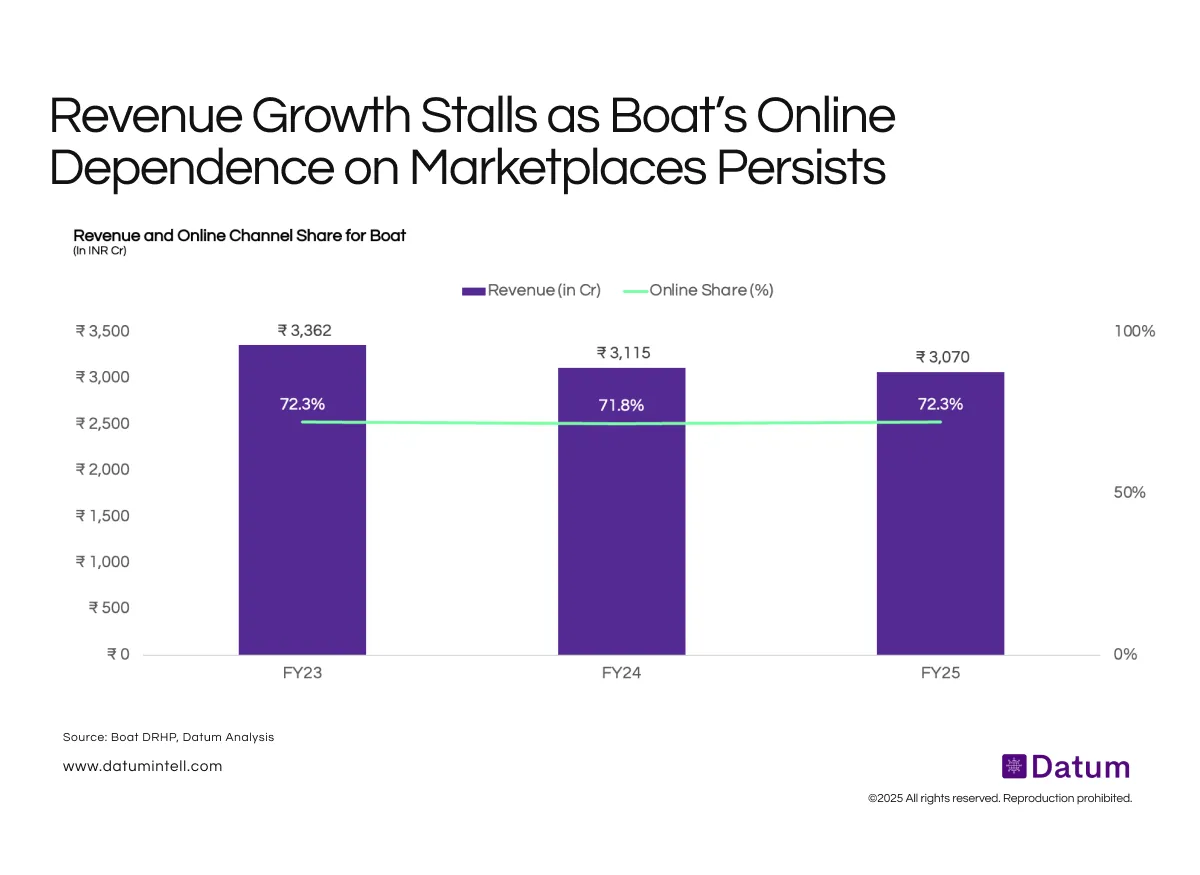

Boat’s revenue slipped from ₹3,362 Cr in FY23 to ₹3,070 Cr in FY25, signaling a growth slowdown after years of rapid scale-up in India’s audio and wearables market.

While the brand continues to hold a strong digital presence, its online channel share has remained stuck around 72%, indicating heavy reliance on e-commerce platforms like Amazon and Flipkart.

What It Means

- Revenue stagnation reflects saturation in the mass-market TWS and smartwatch segments.

- Persistent 70%+ online mix underscores over-dependence on marketplaces, exposing Boat to discount cycles and platform-driven pricing pressure.

- Limited offline penetration constrains reach in premium and lifestyle categories where rivals are expanding.

- Future resilience will hinge on broadening offline retail and building brand-led D2C differentiation beyond aggregator platforms.

For IPO investors, this has two key implications:

- Revenue Stagnation Risk: Flat topline growth suggests that the initial hyper-growth phase has ended; investors will scrutinize new growth drivers (international markets, wearables, smart rings, lifestyle accessories).

- Channel Concentration Risk: With >70% of sales online, Boat’s fortunes are tightly linked to marketplace visibility and discounting cycles — a structural weakness compared to peers building strong offline or brand-owned channels.