Table of Contents

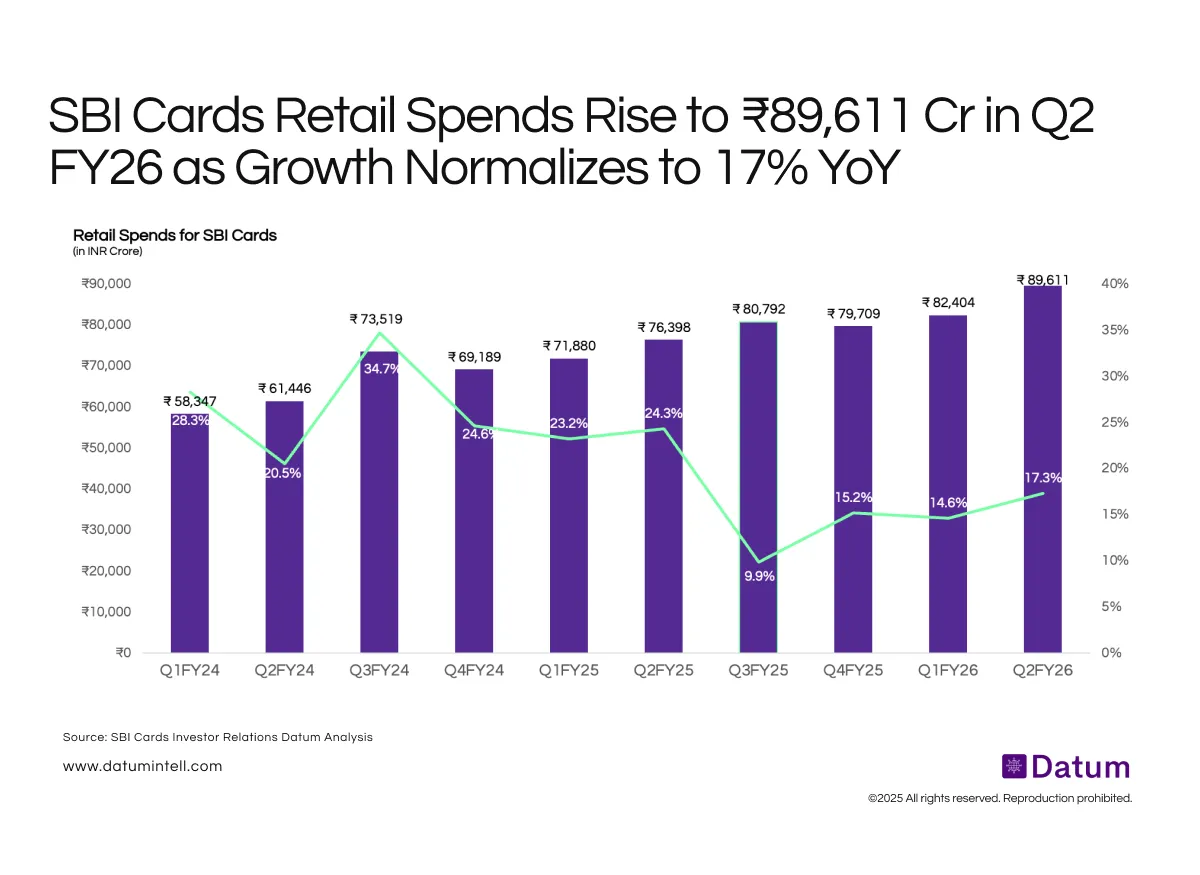

After two years of strong post-pandemic recovery, India’s credit card spending momentum is showing early signs of stabilization. SBI Cards - one of the largest issuers in the country - reported ₹89,611 crore in retail spends during Q2 FY26, up 17.3% YoY.

This comes after several quarters of elevated growth (28–35%) seen through FY24, supported by pent-up demand and travel-led discretionary spending.

What It Means

The moderation in growth reflects a base-effect adjustment and consumer caution amid tighter household budgets and rising interest costs. While overall volumes remain healthy, spending patterns are shifting toward premium and travel categories rather than broad-based consumption.

At the same time, the continued rise in total retail spends signals that card usage is entrenched in India’s consumption fabric, supported by expanding acceptance infrastructure and digital payment integration.