Table of Contents

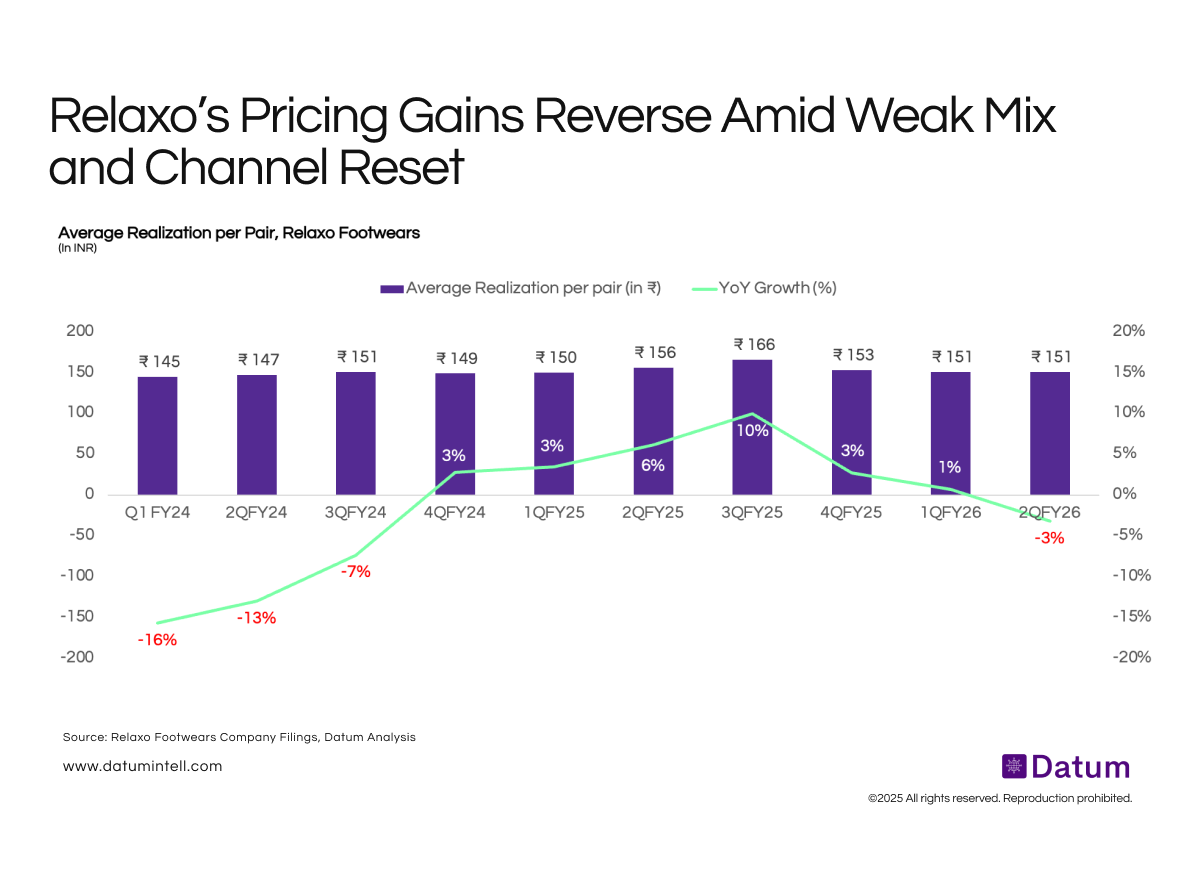

Relaxo’s average realisation per pair has remained largely range-bound between ₹145–₹156 over the last eight quarters. After a period of pricing-led growth in FY25—peaking at 10% YoY in Q3 FY25-realisations have begun to moderate. The GST 2.0 transition created temporary channel disruption, with distributors focusing on clearing pre-GST inventory, which skewed the product mix. At the same time, weaker mass-market demand limited the company’s ability to push premium SKUs, resulting in realisation growth dropping to –3% YoY in Q2 FY26.

What It Means

The flattening of average realisations signals that the pricing-led growth cycle has ended, and Relaxo will now rely more on volume recovery to drive topline momentum. GST-related disruptions and a softer mix have weighed on realisation growth, but as the channel normalises and distribution expansion picks up, pricing should stabilise. However, meaningful improvement will depend on a revival in mass-market demand, stronger traction in mid-priced and premium segments, and continued cost discipline to protect margins.