Table of Contents

Sai Silks Kalamandir (SSKL), one of South India’s leading ethnic apparel retailers, continues to demonstrate strong regional depth and store-level productivity across key southern markets.

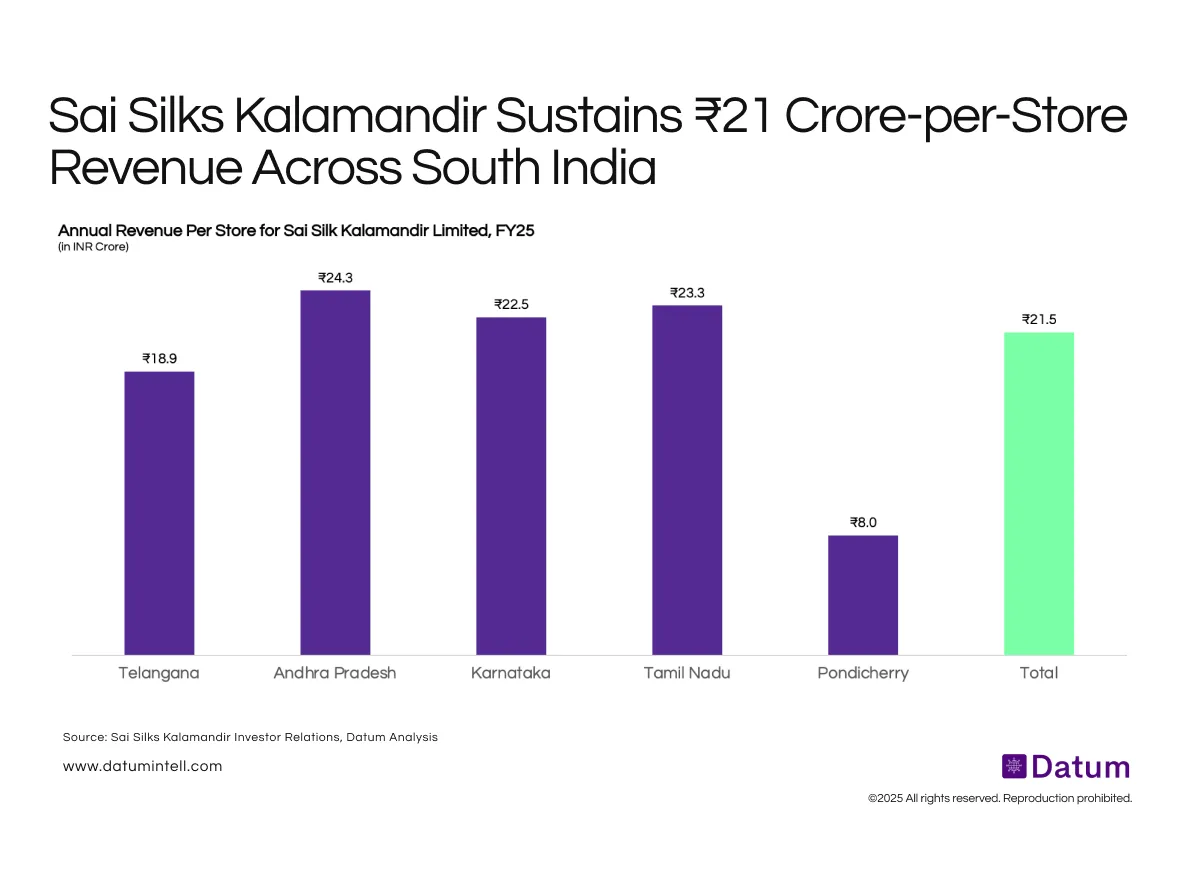

In FY25, the company reported a total revenue of ₹1,462 crore from 68 stores across five southern states - translating to an impressive ₹21.5 crore per store on average.

- Andhra Pradesh emerged as the most productive state, generating ₹24.3 crore per store, backed by high regional brand affinity and a loyal festive-season customer base.

- Tamil Nadu (₹23.3 crore) and Karnataka (₹22.5 crore) followed closely, underscoring consistent traction in premium silk and wedding-wear categories.

- Telangana, SSKL’s home market, saw slightly lower productivity (₹18.9 crore per store), reflecting the brand’s expansion into newer towns and larger format stores.

- Pondicherry, with just one store, recorded ₹8 crore in annual sales.

What It Means

The strong per-store revenue performance highlights SSKL’s ability to scale profitably in a category often considered regional and fragmented.

Its cluster-based expansion across South India ensures operational efficiency, localized assortment, and sustained margins despite rising rental costs and inventory pressures.

With an average store size of around 10,000–12,000 sq. ft., the brand’s model mirrors the playbook of regional apparel leaders transitioning from legacy retail to data-driven, high-velocity formats.

Sai Silks’ continued focus on South India — especially Tier-2 and Tier-3 clusters — positions it well to capture India’s ₹1.5 lakh crore ethnic apparel market, which is witnessing rapid formalization.

As it expands beyond its stronghold states, the challenge will be maintaining per-store productivity while building national brand recall in a deeply regional category.