Table of Contents

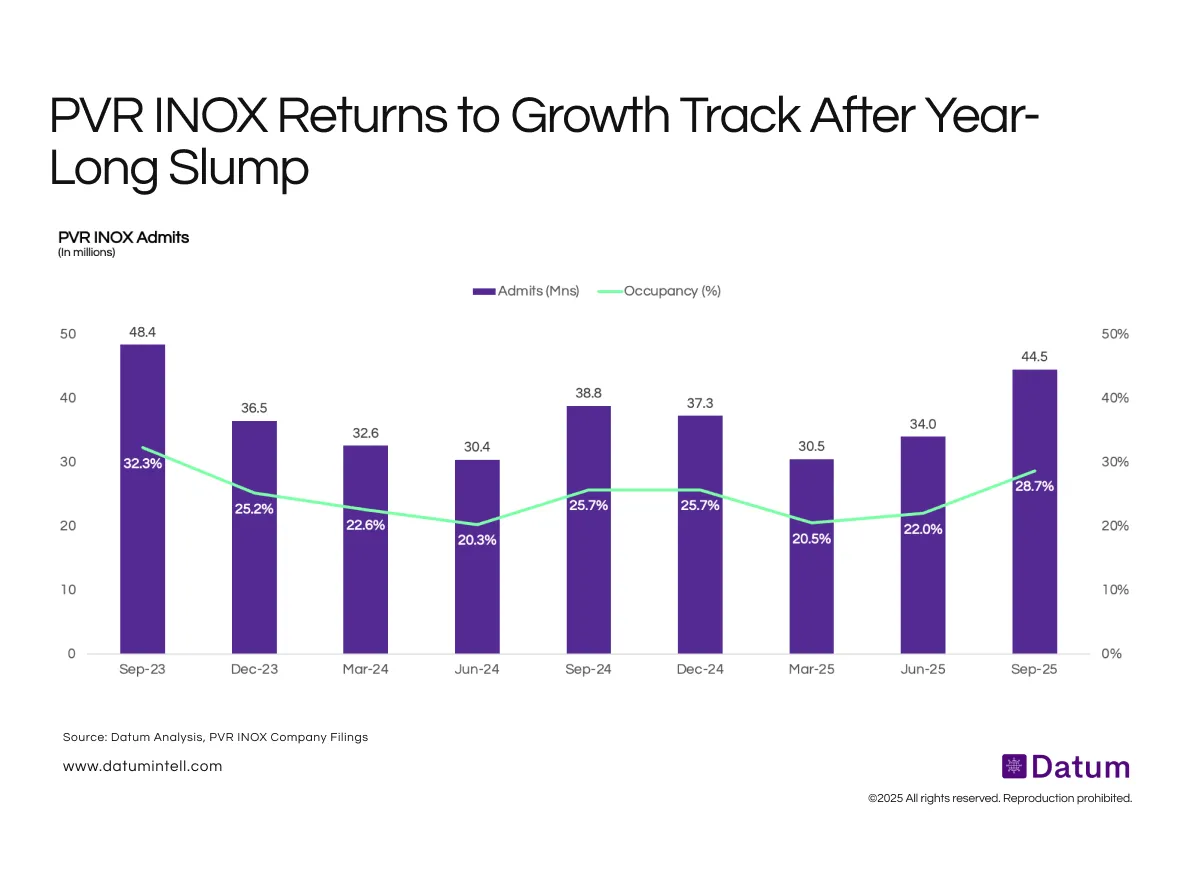

After four consecutive quarters of subdued admissions and occupancy rates, India’s largest multiplex chain, PVR INOX, saw a strong recovery in Sep 2025, with 44.5 million admits and 28.7% occupancy. This rebound follows a low base in Mar–Jun 2025, when occupancy hovered near 20–22%.

Quarterly patterns show a consistent cyclical dip in Q1 (Apr–Jun) and a recovery in Q2 (Jul–Sep), aligning with festive and big-release windows. The trend mirrors the broader industry’s dependence on blockbuster content and festival-season footfalls.

Management Commentary

PVR INOX delivered its strongest quarter in two years, reporting revenue of ₹1,843 crore, EBITDA of ₹327 crore, and PAT of ₹127 crore. The performance reflected a broad-based recovery across Hindi, regional, and Hollywood content, underscoring a structural rather than cyclical rebound in theatrical demand.

Key Operating Metrics

Footfalls rose to 44.5 million (+15% YoY, +31% QoQ), supported by higher occupancy (28.7%) and steady ATP at ₹262. F&B spend per head reached ₹134, while advertising revenue grew 16% YoY to ₹126 crore, marking the best Q2 since the pandemic.

Content Mix Performance

- Hindi cinema saw a sharp resurgence with 12 films crossing ₹100 crore in Q2 and 22 films in H1, led by Saiyaara (₹400 crore) and Mahavatar Narsimha (₹300 crore).

- Hollywood contributed over ₹500 crore to the industry box office, driven by blockbuster franchises such as Jurassic World, Conjuring Superman, and Fantastic Four.

- Regional cinema remained a key growth driver, with Kannada box office up 100% YoY (Su), Malayalam up 50% (Loka: Chapter 1), and strong Tamil/Telugu releases including Coolie, OG, and Mirai.

What It Means

The uptick in Q2 FY26 signals audience return post-content lull, aided by strong Hindi and regional film line-ups. With occupancy climbing back near the 30% threshold - its best since Sep 2023 - exhibitors are entering the festive quarter on a stronger footing. Sustained recovery, however, hinges on consistent content performance and pricing discipline.