Protein-Led Demand Is Reshaping Blinkit's Peanut Butter Category

Blinkit’s peanut butter category is already consolidated. Pintola and MyFitness together control ~73% of sales, showing how quick commerce rapidly rewards scale, recall, and price-pack efficiency over assortment breadth.

Latest

Introducing Datum Reports: Deep Dive Research on India's High-Growth Companies

Datum Reports offers comprehensive, data-driven research on India’s most important technology companies, designed for clarity and decision-making.

Blinkit Data Shows Why Popcorn Has Become a Two-Brand Category

Blinkit’s popcorn category has rapidly consolidated into a two-brand market, with 4700BC and Act II controlling ~99% of sales, leaving virtually no competitive long tail.

The Korean Noodle Takeover: How Blinkit Data Reveals India's Fastest Food Trend

Korean noodles now account for 34% of Blinkit's noodle sales in top Indian cities with Tier-2 markets outpacing metros. Quick commerce isn't just faster delivery; it's a cultural accelerant reshaping what Indians eat, buy, and aspire to.

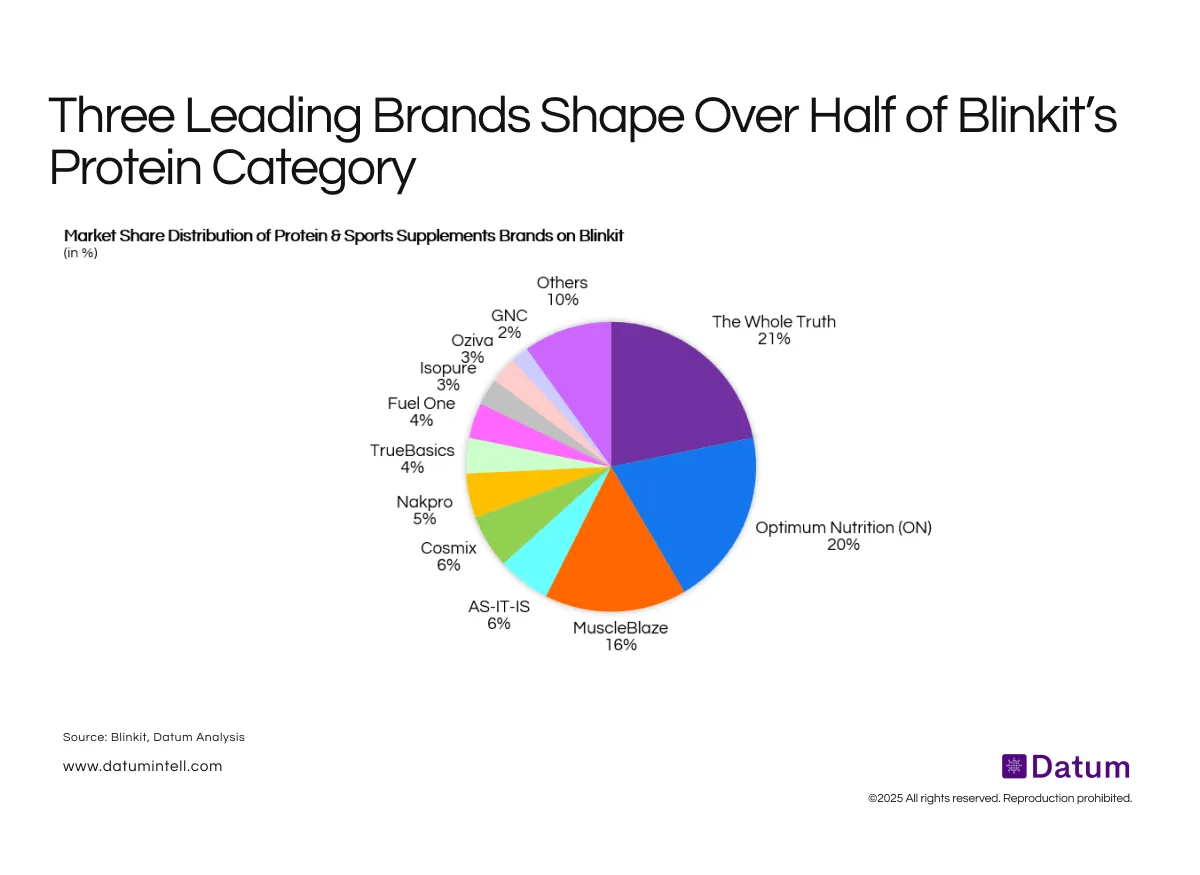

Blinkit’s Protein Category Shows Sharp Premiumisation and High Loyalty

Three brands control 57% of Blinkit's protein sales. In quick commerce, trust and efficacy trump discovery. When speed meets high-stakes nutrition, brand credibility becomes everything.