Table of Contents

Bata India’s revenue trajectory shows clear signs of stagnation through FY24–FY26.

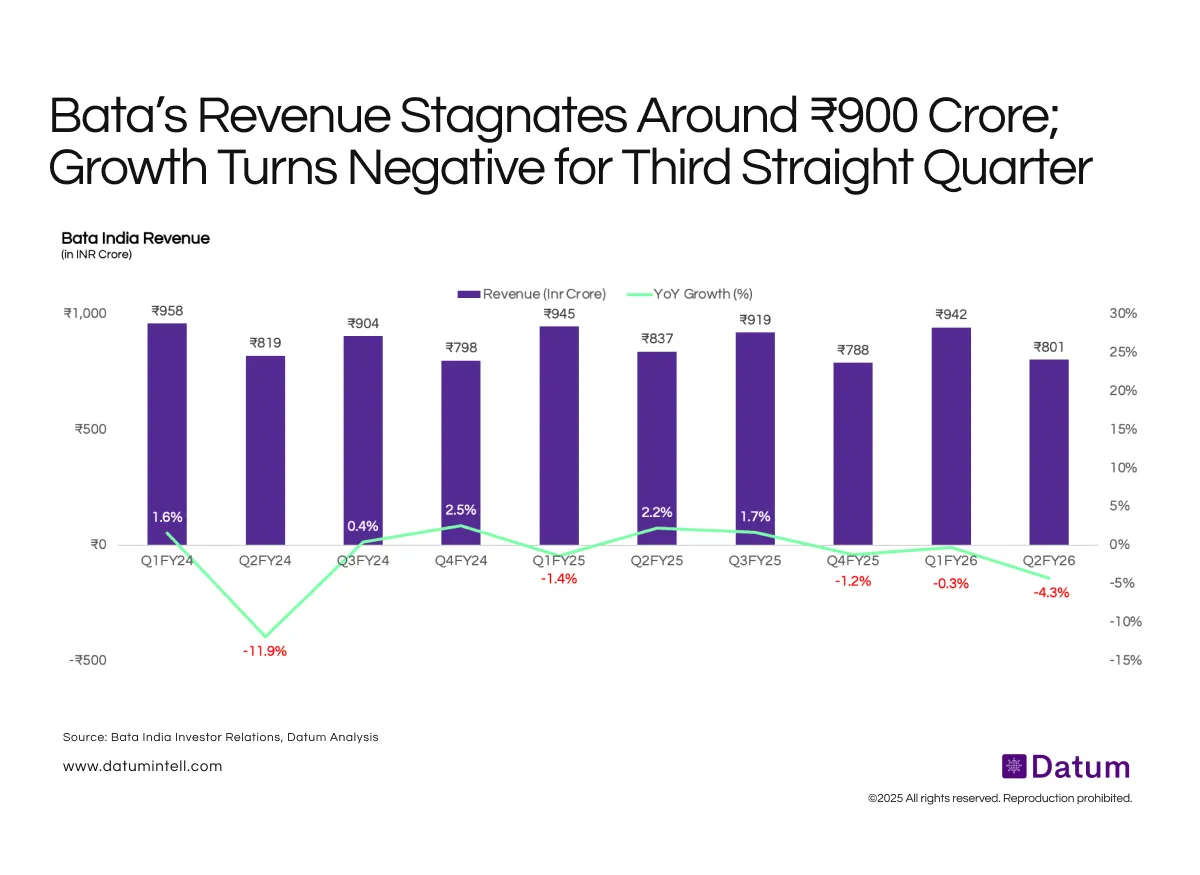

After peaking at ₹958 crore in Q1 FY24, revenue has largely hovered between ₹800–₹950 crore for six consecutive quarters, indicating a plateau in post-pandemic recovery.

Year-on-year growth has remained weak, turning negative in four of the last six quarters, including –4.3% in Q2 FY26. This signals slower consumer momentum in the mid-priced footwear segment despite brand-led marketing and retail expansion efforts.

What It Means:

- Volume and pricing pressures: Weak discretionary demand and competition from emerging D2C and value brands are likely weighing on sales.

- Shift in mix: Premium and urban-focused formats may be offset by underperformance in smaller cities and institutional channels.

- Need for reset: With consistent sub-2% growth, Bata may require portfolio innovation or category diversification (e.g., athleisure, casual comfort) to reignite top-line momentum.