Table of Contents

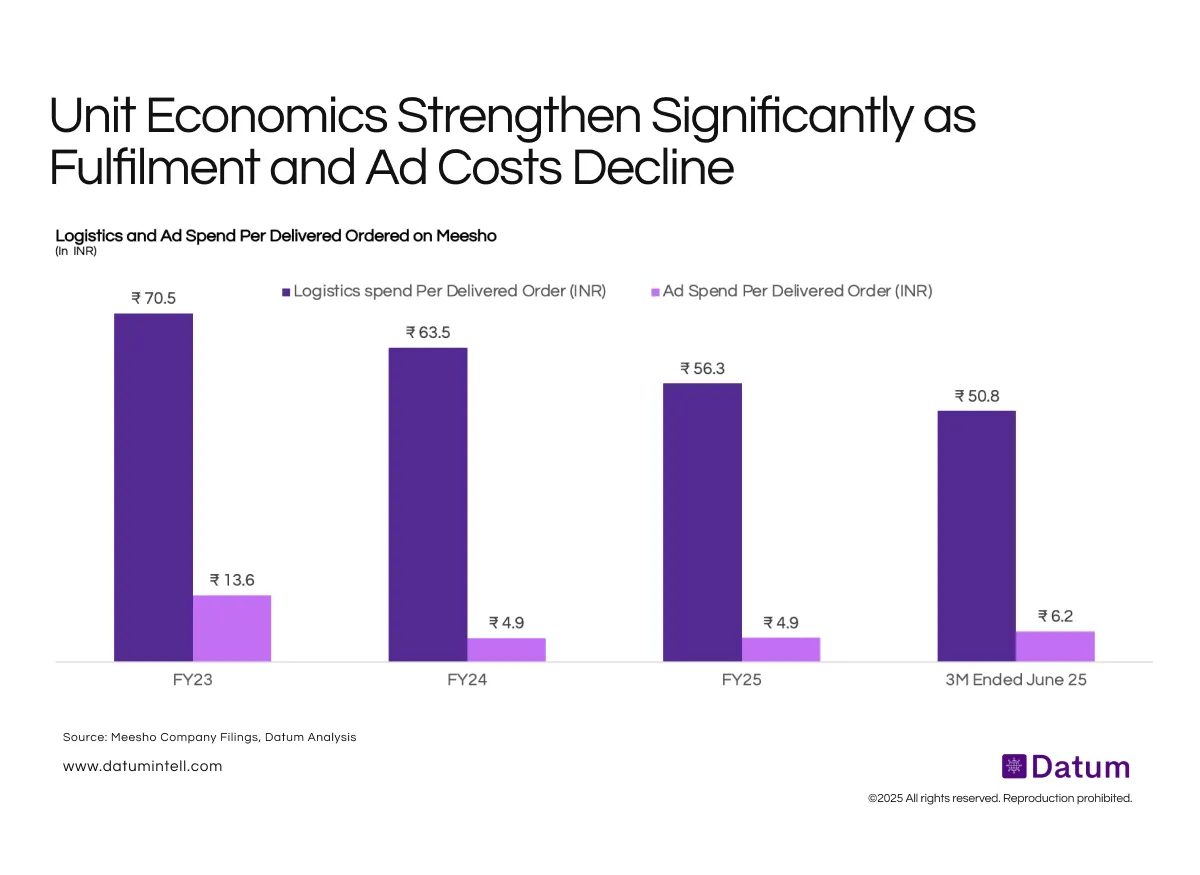

Between FY23 and FY25, Meesho reduced its logistics cost per delivered order from ₹70.5 to ₹56.3 and further to ₹50.8 in the June 2025 quarter - a decline of nearly 30% over two years. Simultaneously, ad spend per delivered order fell sharply from ₹13.6 to ₹4.9 during FY24–FY25, before a modest rise to ₹6.2 in Q1FY26.

This sustained decline reflects the platform’s maturing scale economics and improving order density, supported by the integration of Valmo, its in-house logistics arm, and a growing share of organic demand from repeat users.

What It Means

The data signals that Meesho has moved from a growth-by-spend to a growth-by-efficiency phase. Lower logistics cost shows improved network utilization and delivery productivity, while reduced ad spend highlights strong brand recall and retention-driven order growth.

The minor uptick in ad spend in Q1FY26 likely represents seasonal promotional activity rather than a structural shift — indicating Meesho’s cost discipline remains intact even as volumes expand. Together, these metrics point to a platform that’s approaching profitability leverage through operational maturity.

Delivered Orders refers to CoD or Prepaid Shipped Orders that were successfully delivered to the consumer on our marketplace, regardless of whether the product was subsequently returned divided by total CoD Shipped Orders.