Table of Contents

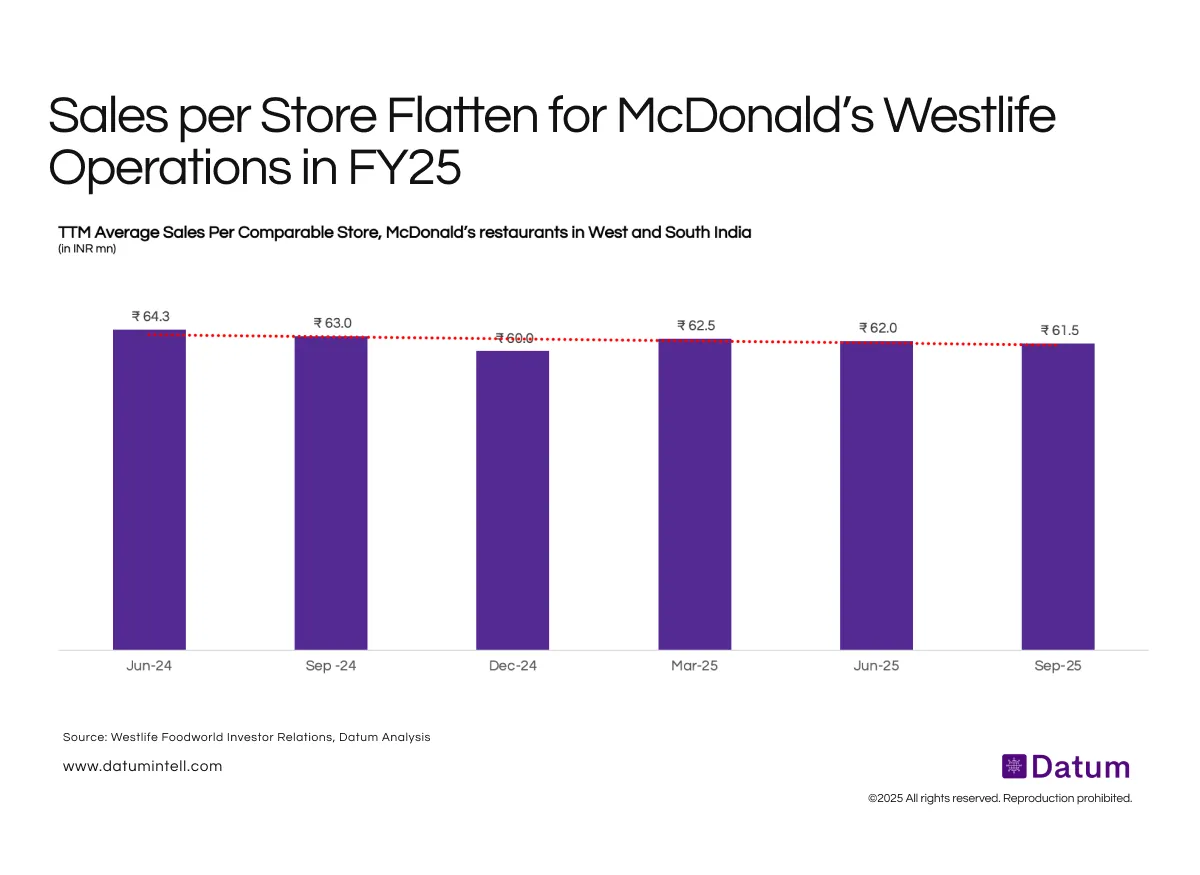

McDonald’s (Westlife Foodworld) has seen a gradual softening in its TTM average sales per comparable store, declining from ₹64.3 million in June 2024 to ₹61.5 million by September 2025. While overall store network expansion remains strong, comparable store productivity is showing early signs of stabilization after several quarters of post-pandemic recovery.

This moderation follows the high base of FY23–FY24, when same-store sales were lifted by strong dine-in recovery, menu premiumization, and increased delivery frequency. The recent quarters reflect a normalization of consumer spending and slower discretionary demand growth, particularly in Tier-1 and Tier-2 urban markets.

Why This Is Happening:

- Soft Consumption Environment: Urban discretionary categories -including QSR, apparel, and casual dining - are seeing weaker footfall growth as consumers rebalance spending amid inflation and flat real wages.

- Base Effect: FY24 had unusually strong growth driven by festive recovery and high delivery adoption. FY25 comparables reflect a normalization trend.

- Regional Mix: South India, where store additions are accelerating, has lower per-store sales versus mature metro markets like Mumbai or Pune, slightly diluting overall averages.

- Check Size Plateau: Average order values have stabilized despite menu innovation, with limited pricing actions to maintain affordability perception.

What It Means

McDonald’s West and South India business (operated by Westlife Foodworld) is entering a phase of steady growth rather than rapid recovery. The company is likely to focus on expanding network reach, especially in drive-thru and delivery-first formats, while protecting margins through operating efficiency rather than pricing.

In essence, volume growth will drive top-line expansion, but per-store productivity may remain flat in the near term. A recovery in discretionary spending and successful new product launches will be key to re-accelerating same-store sales growth in FY26.