Table of Contents

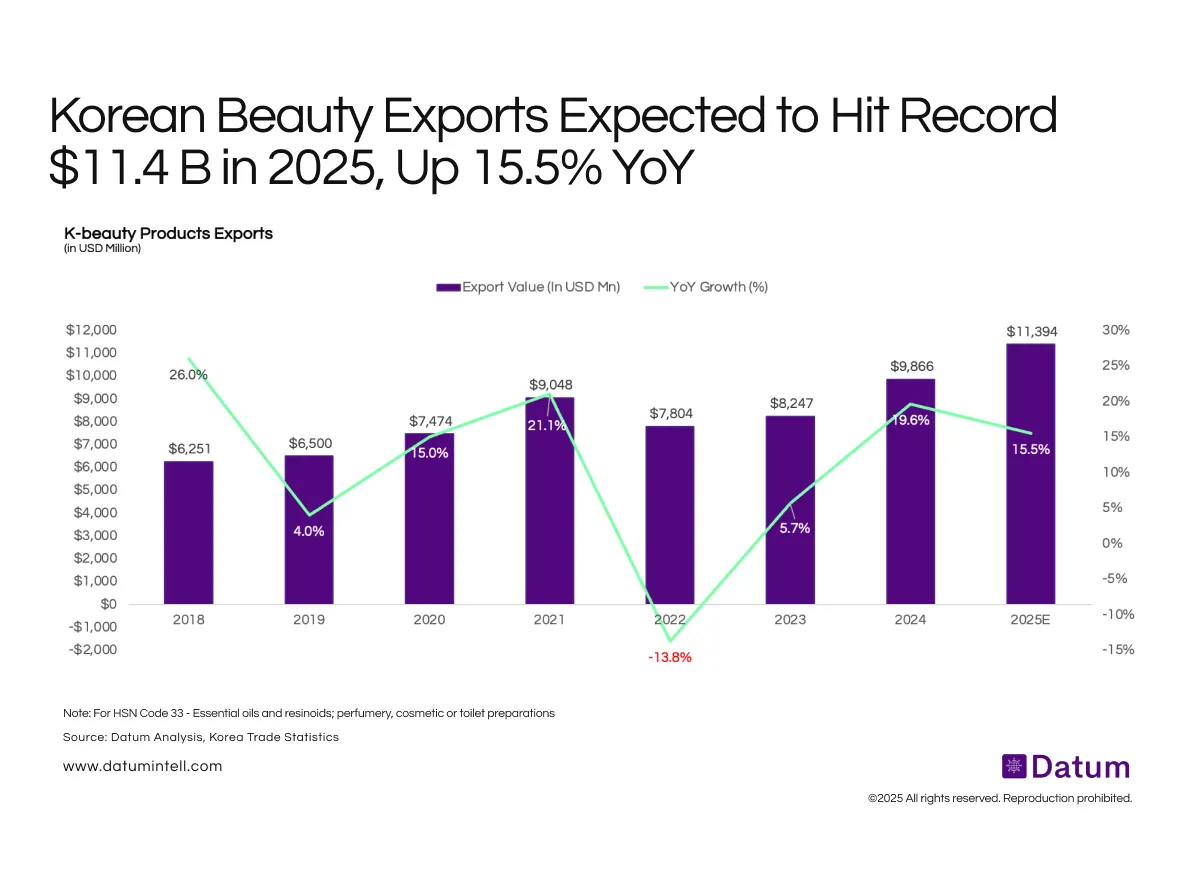

K-Beauty exports have rebounded sharply after a brief contraction in 2022, underscoring South Korea’s growing dominance in global skincare and cosmetics.

From $6.25 B in 2018 to an estimated $11.4 B in 2025, exports have nearly doubled in seven years, driven by strong global appetite for Korean skincare formulations, innovative textures, and clean-beauty positioning.

After a pandemic-era dip (-13.8% in 2022), the industry quickly regained momentum - growing +5.7% in 2023, +19.6% in 2024, and projected +15.5% in 2025.

What It Means

- Global Demand Surge: Korean skincare continues to lead export growth, supported by premium repositioning in markets like the US, Japan, and Southeast Asia.

- Innovation-Led Resilience: Despite earlier supply-chain shocks, K-Beauty’s rapid rebound shows the strength of its R&D-driven ecosystem, ingredient transparency, and social-media-led global marketing.

- Export Dependence: With exports accounting for over 70% of total industry revenue, Korean beauty remains heavily international-demand-driven, exposing it to currency and trade dynamics.

- Outlook 2025: Sustained double-digit growth suggests K-Beauty will exceed $11 B in exports, reaffirming its role as a key global beauty innovation hub.