Table of Contents

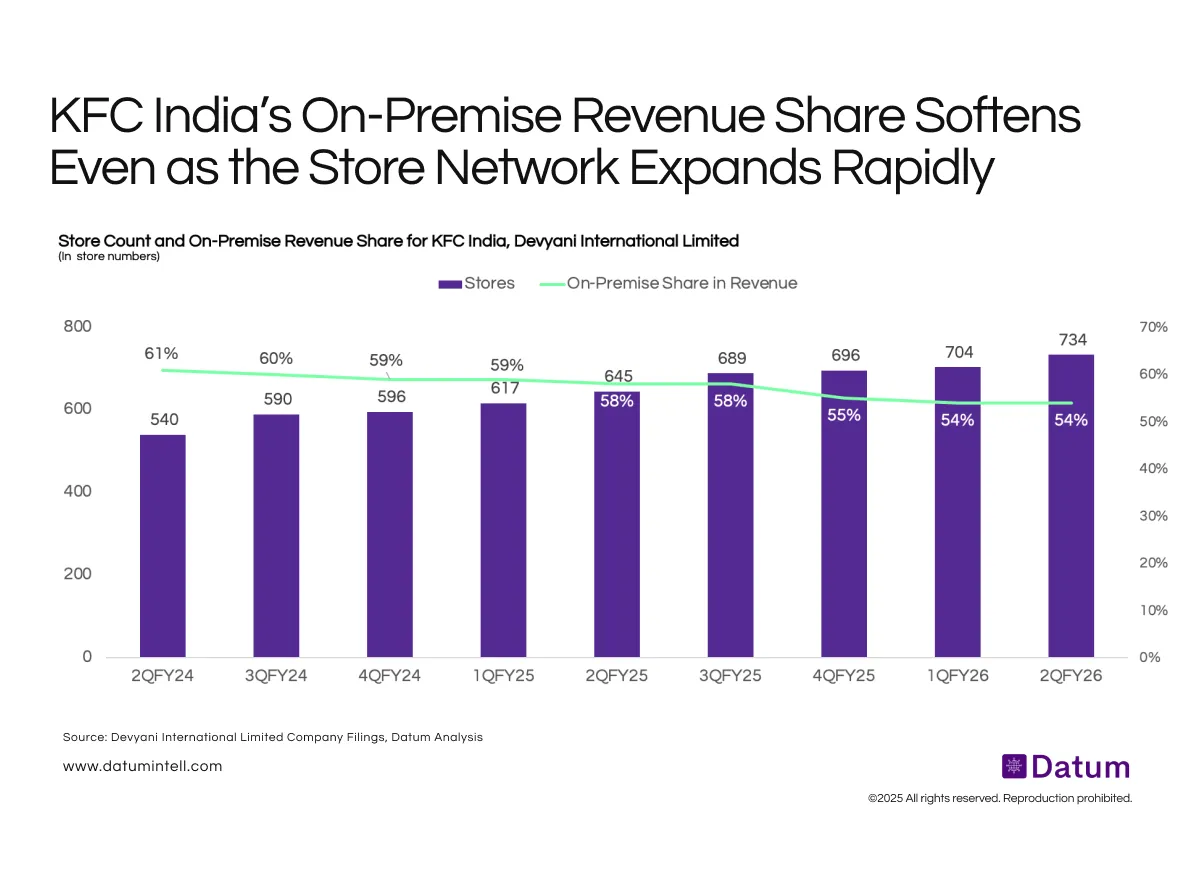

KFC India has continued its aggressive store expansion-from 540 units in 2QFY24 to 734 units in 2QFY26-marking a nearly 200-store addition over eight quarters. However, over the same period, the share of on-premise revenue has steadily declined from 61% to 54%. This shift reflects a structural rebalancing in KFC’s revenue mix as delivery, takeaway, and aggregator-led demand deepen across markets, particularly in urban and suburban catchments.

What It Means

The widening gap between store growth and the falling dine-in share signals a strategic transition in KFC’s unit economics. As newer stores open in lower-traffic micro-markets or delivery-led neighbourhoods, the business becomes increasingly reliant on off-premise channels for throughput. While this supports scale, delivery-heavy revenue mixes come with higher aggregator commissions and weaker dine-in margins-raising potential pressure on profitability unless offset by operating leverage and menu engineering.