Table of Contents

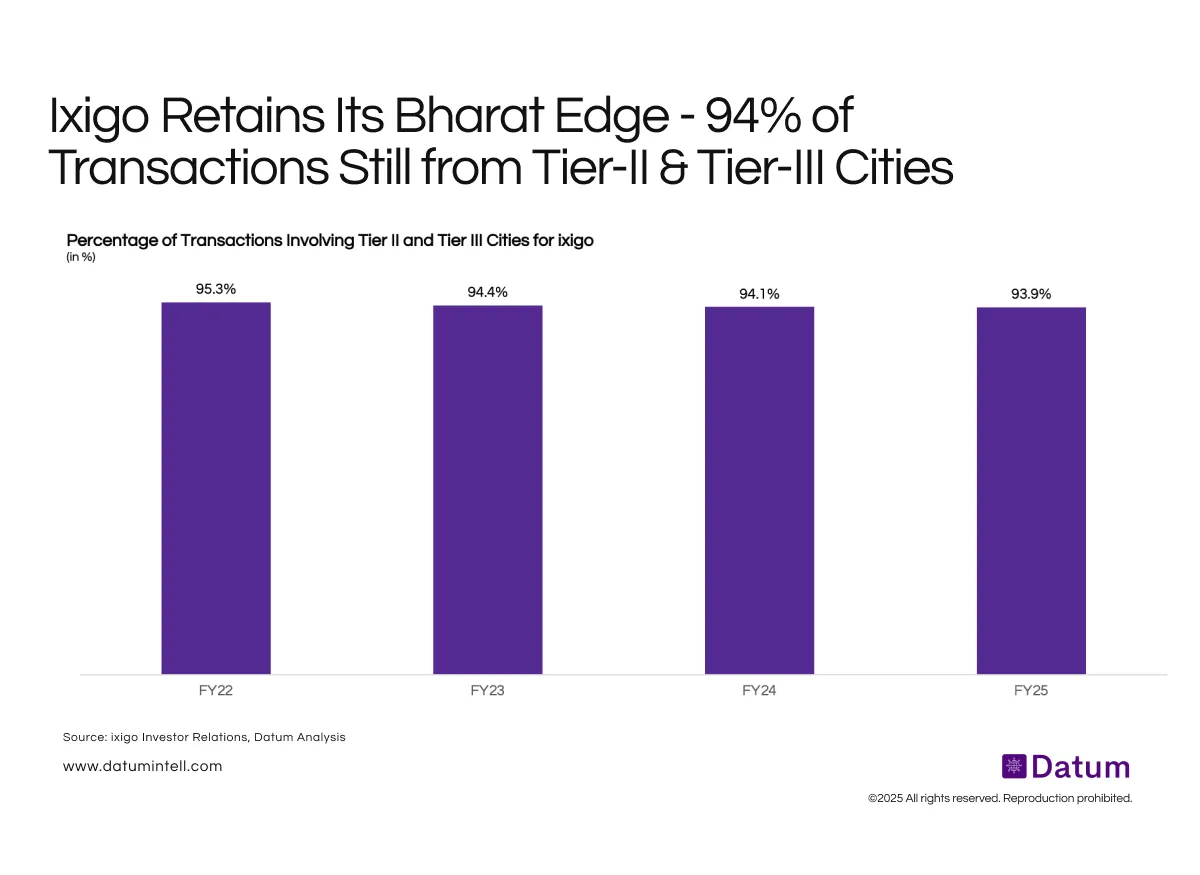

Ixigo’s dominance in India’s value and regional travel ecosystem remains unshaken - with 94–95% of all transactions consistently coming from Tier-II and Tier-III cities over FY22–FY25.

This stable mix highlights Ixigo’s deep penetration in smaller cities, where rail, bus, and affordable air travel segments continue to drive digital adoption.

The platform has effectively leveraged regional language support, affordable product tiers, and IRCTC-linked user acquisition to maintain its leadership among Bharat-first travelers.

What It Means

Ixigo’s transaction geography reinforces its defensible moat in non-metro India:

- Saturation at scale: A near-constant 94% Tier-II/III share suggests Ixigo already commands critical mass in these markets.

- Expanding ARPU potential: As digital payment adoption and premium travel products rise outside metros, Ixigo is well-positioned to capture upsell and cross-sell opportunities.

- Strategic differentiation: Unlike metro-heavy peers, Ixigo’s focus on affordability, reliability, and local connectivity cements its status as India’s most inclusive travel super-app.

Definitions

Tier II/III Penetration. % of transactions booked through ixigo group’s OTA platforms where either an origin or destination was a non-Tier I city.