Table of Contents

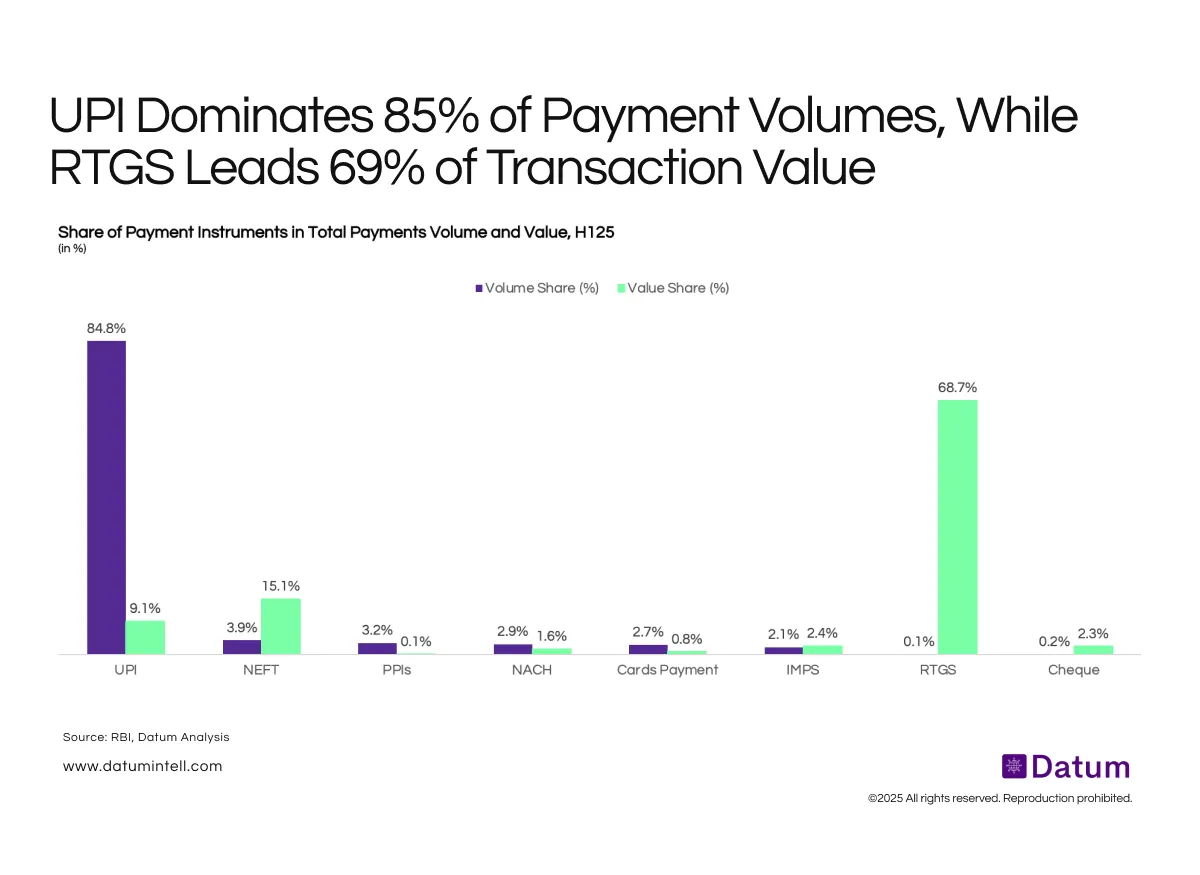

India’s digital payments ecosystem continues to display a sharp divide between high-frequency, low-value transactionsand low-frequency, high-value transfers. As of H1 FY25, UPI accounted for an overwhelming 84.8% of total payment volumes, underscoring its role as India’s everyday payment backbone. However, in terms of total transaction value, RTGS still dominates with 68.7% share, reflecting its importance in large-value B2B and interbank settlements.

Other modes such as NEFT (15.1%) and cards (0.8%) have seen their relative share of value compress as UPI continues to scale both in reach and ticket size.

What It Means

- Consumer Payments are Now Fully UPI-Driven: UPI’s near-total dominance in volume shows the consumer layer of India’s digital payment stack is complete, with strong penetration across both urban and semi-urban markets.

- High-Value Flows Remain Bank-Routed: The persistence of RTGS and NEFT in value share highlights that corporate, treasury, and interbank flows remain within the traditional banking rails.

- Shift from Cards & PPIs: The shrinking share of cards and wallets (PPIs) signals direct-to-bank transactions are displacing intermediary systems, reducing friction and cost in retail payments.

The dichotomy reflects a two-speed system - UPI leading inclusion and daily adoption, while RTGS anchors high-value institutional liquidity.