Table of Contents

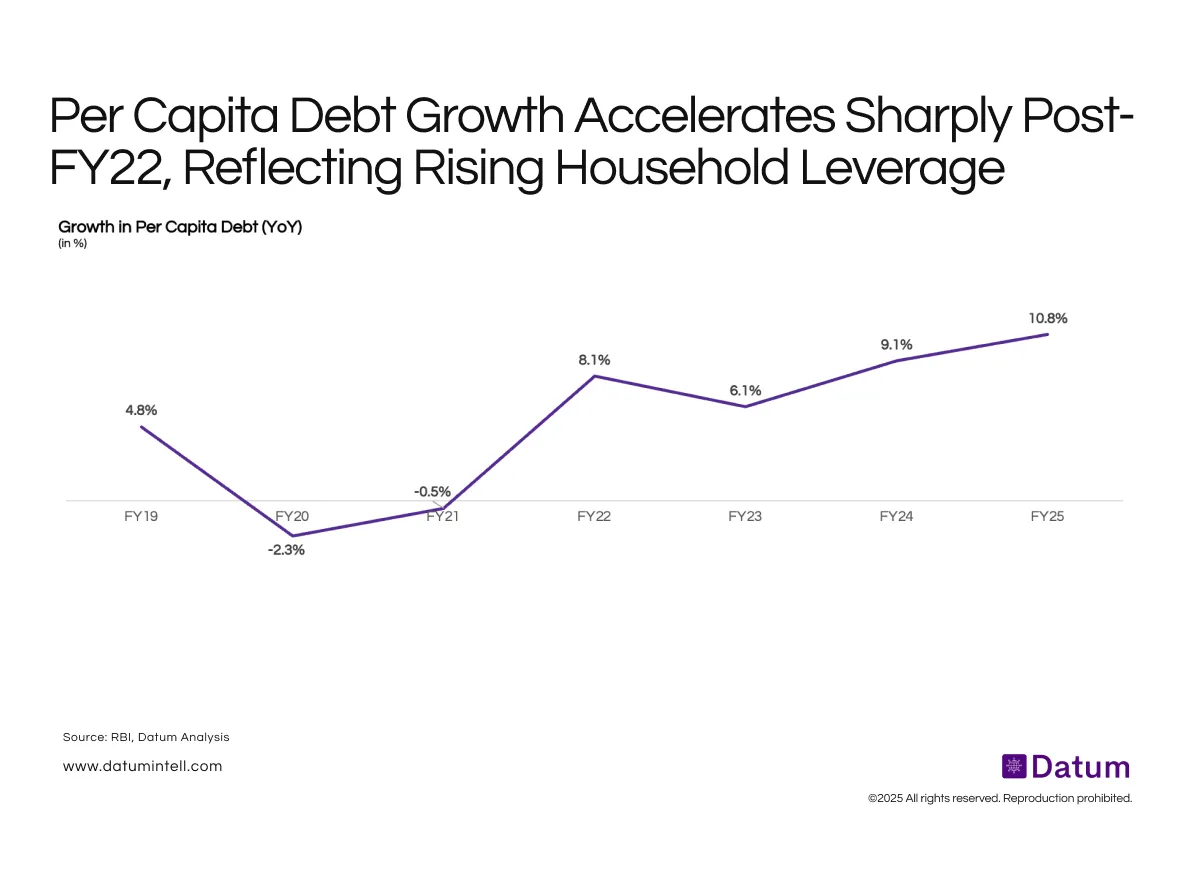

India’s per capita debt levels have risen consistently since FY22, reversing the pandemic-era deleveraging trend. According to RBI after contracting by 2.3% in FY20 and remaining nearly flat in FY21 (-0.5%), per capita debt surged 8.1% in FY22 and has since maintained a steady upward trajectory, reaching 10.8% growth in FY25.

This acceleration coincides with the post-COVID recovery in consumption, expansion of credit penetration through NBFCs and fintech platforms, and strong growth in unsecured personal loans.

What It Means

The data points to a structural increase in household leverage, signaling both financial inclusion and potential vulnerability.

- Financial inclusion effect: Broader access to formal credit-especially in semi-urban and rural India-has expanded retail borrowing.

- Consumption-led borrowing: Much of the recent debt growth is linked to discretionary consumption, vehicle loans, and lifestyle credit, rather than asset creation.

- Rising risk exposure: The steady climb in FY23–FY25 suggests increasing dependency on credit to sustain consumption momentum amid stagnant wage growth.

If the trend continues, India’s household balance sheets could become more sensitive to interest rate cycles and income shocks, even as credit deepening supports GDP growth.