Table of Contents

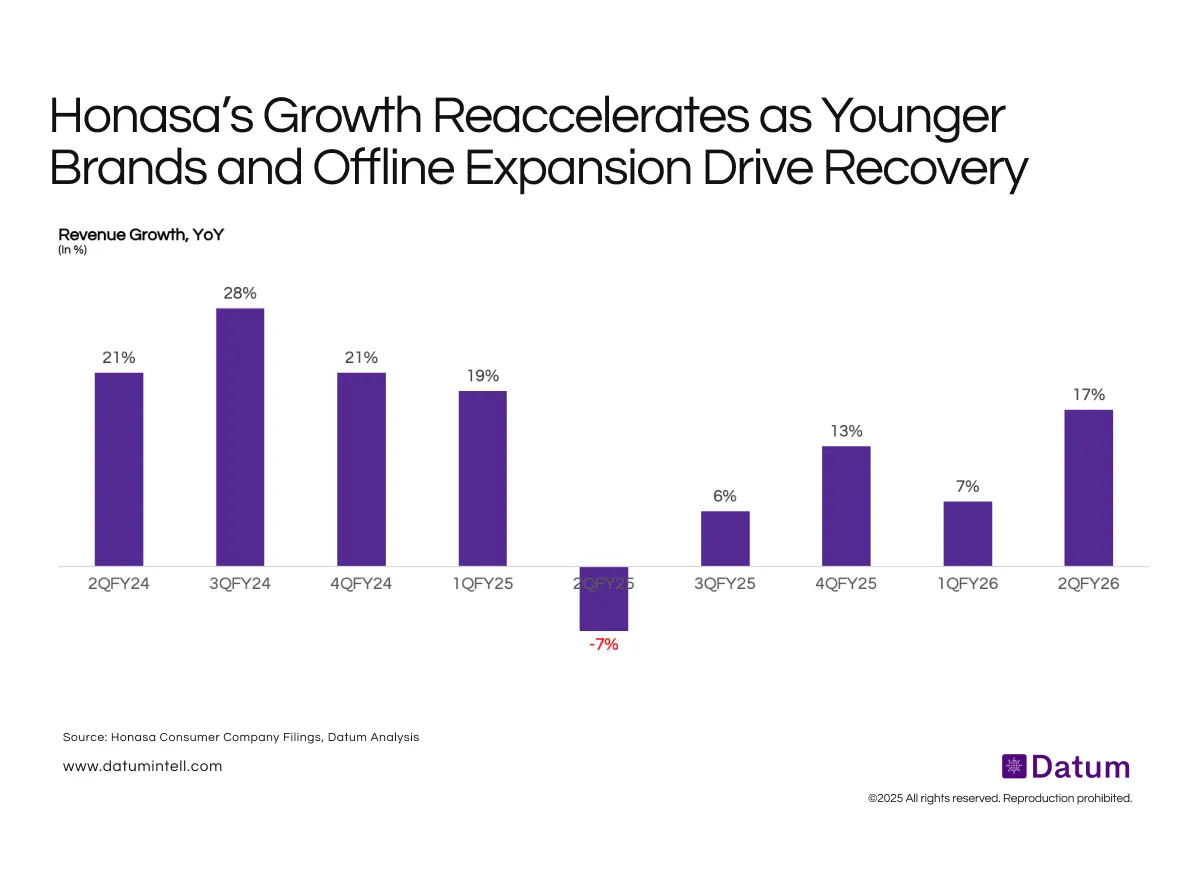

Honasa’s revenue trajectory shows a sharp correction in Q2FY25 (–7% YoY), followed by a steady recovery through FY25 and into FY26. The rebound aligns with broader operational improvements highlighted in the latest results: volume-led growth, double-digit LFL performance, and stronger traction across younger brands such as The Derma Co., Aqualogica, and Dr. Sheth’s. Core categories-face wash, sunscreen, moisturisers, and haircare-continue to deliver broad-based performance. With The Derma Co. crossing the INR 7,500mn ARR milestone and emerging as India’s #1 sunscreen brand, category relevance and premiumisation reinforced the recovery.

Honasa also expanded its distribution reach significantly, with direct-to-retail coverage growing 35% YoY and offline presence now spanning 0.25 million FMCG outlets. This strengthening of physical distribution, alongside disciplined cost control and portfolio replenishment, supported margin stability as growth returned.

What It Means

The move from negative growth to mid-teens revenue expansion underscores Honasa’s improved execution and stabilised demand environment. Q2FY26’s 17% growth reflects the combined impact of younger-brand scale-up, portfolio innovation, and widening offline distribution. The recovery suggests that the Q2FY25 contraction was largely a one-off-driven by base effects and temporary softness-rather than a structural slowdown.

However, sustaining this trajectory will require Honasa to continue balancing premium innovation with mass accessibility, maintaining strong distribution momentum, and scaling high-potential adjacencies such as Luminéve (premium skincare) and Fang (premium oral care). Younger brands now contribute more than 50% of total revenue, reducing reliance on any single category and improving long-term resiliency.