Table of Contents

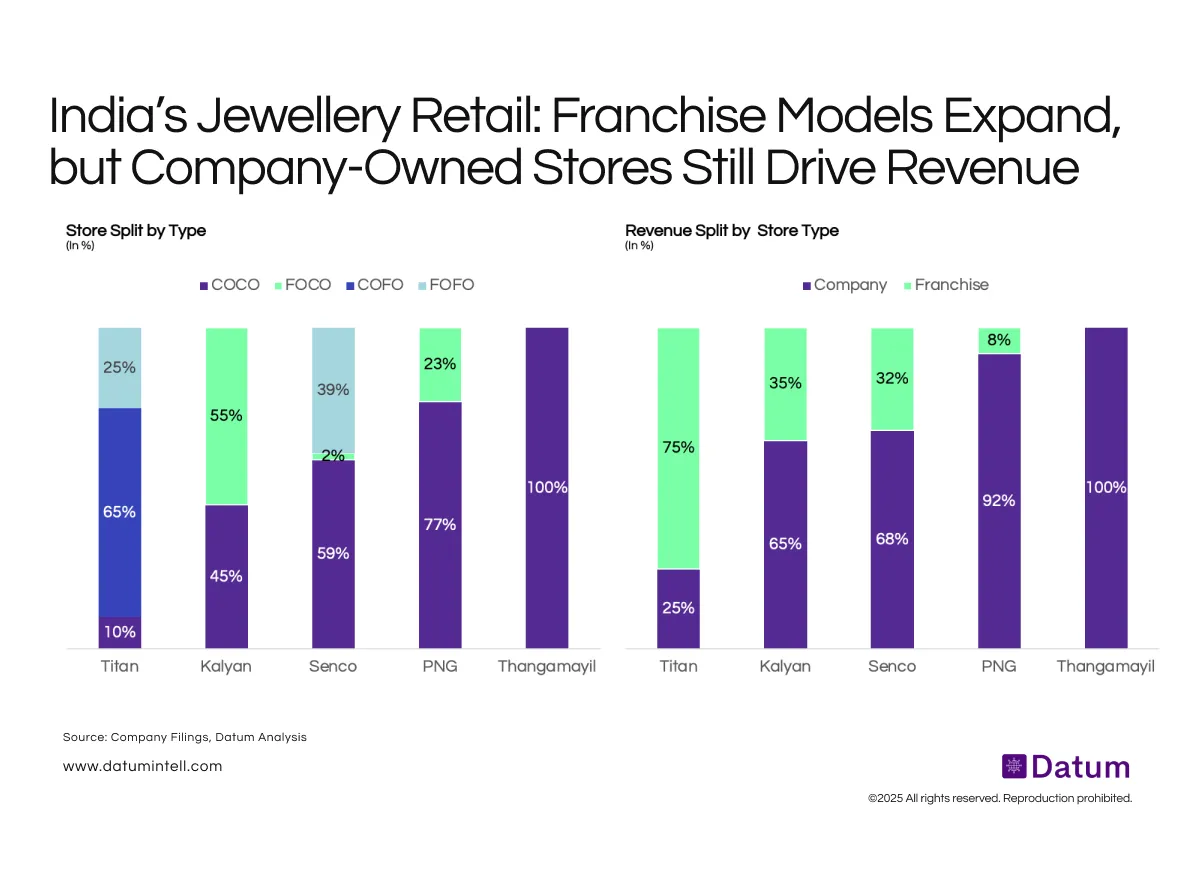

India’s leading jewellery chains have increasingly adopted hybrid ownership models, balancing growth through franchise partnerships with control via company-operated outlets. Titan and Kalyan have the highest franchise exposure - with 65–75% of their stores under FOCO/COFO formats - yet these stores contribute a smaller share of overall revenue (25–35%). In contrast, regional players like PNG Jewellers and Thangamayil operate almost entirely through company-owned formats, generating over 90% of sales from these outlets.

Titan began franchising in 1996, and today, around 75% of its stores operate under franchise formats, contributing roughly 25% of total revenue. Kalyan Jewellers, which entered franchising much later in 2022, has 35% of its stores franchisee-owned, contributing about 32–35% of overall revenue.

Titan operates through a three-tier store framework designed to balance profitability, asset efficiency, and market reach:

L1 (COCO): Fully company-owned and the most capital-intensive format, featuring premium merchandise, larger stores, and lower asset turns. Despite higher investment, it remains the most profitable, and Titan continues to open about 10% of new stores under this model.

L2 (COFO-like): The most preferred format, where the franchisee invests in capex while Titan owns inventory. This model offers better asset turns than L1 and maintains strong revenue recognition as sales are booked only upon customer purchase.

L3 (FOFO): The least profitable format, with Titan recording revenue upon sale to the franchise partner rather than the end customer. Given lower control, limited oversight, and a gold-heavy inventory mix, Titan uses this format selectively—typically in remote or low-density markets.

Senco Gold & Diamonds started franchising in 1998; about 40% of its stores are franchisee-owned, contributing 32% of its revenue (excluding franchise fees and discounts) in FY25. PNG Jewellers, a relatively recent entrant, began franchising in 2018 and currently has 23% of stores under franchise ownership, accounting for only 8% of its revenue.

In contrast, Thangamayil remains a fully company-owned model, prioritizing operational control and brand consistency across all stores.

What it Means

The data highlights a key structural reality in Indian jewellery retail - scale is franchise-led, but profitability remains company-led. Franchise formats accelerate footprint expansion in Tier-2 and Tier-3 cities, but company-owned stores deliver higher revenue productivity and serve as brand anchors for trust, design, and customer experience. As operating costs stabilize, players are likely to pursue a calibrated COCO–franchise balance to achieve both capital efficiency and revenue growth.