Table of Contents

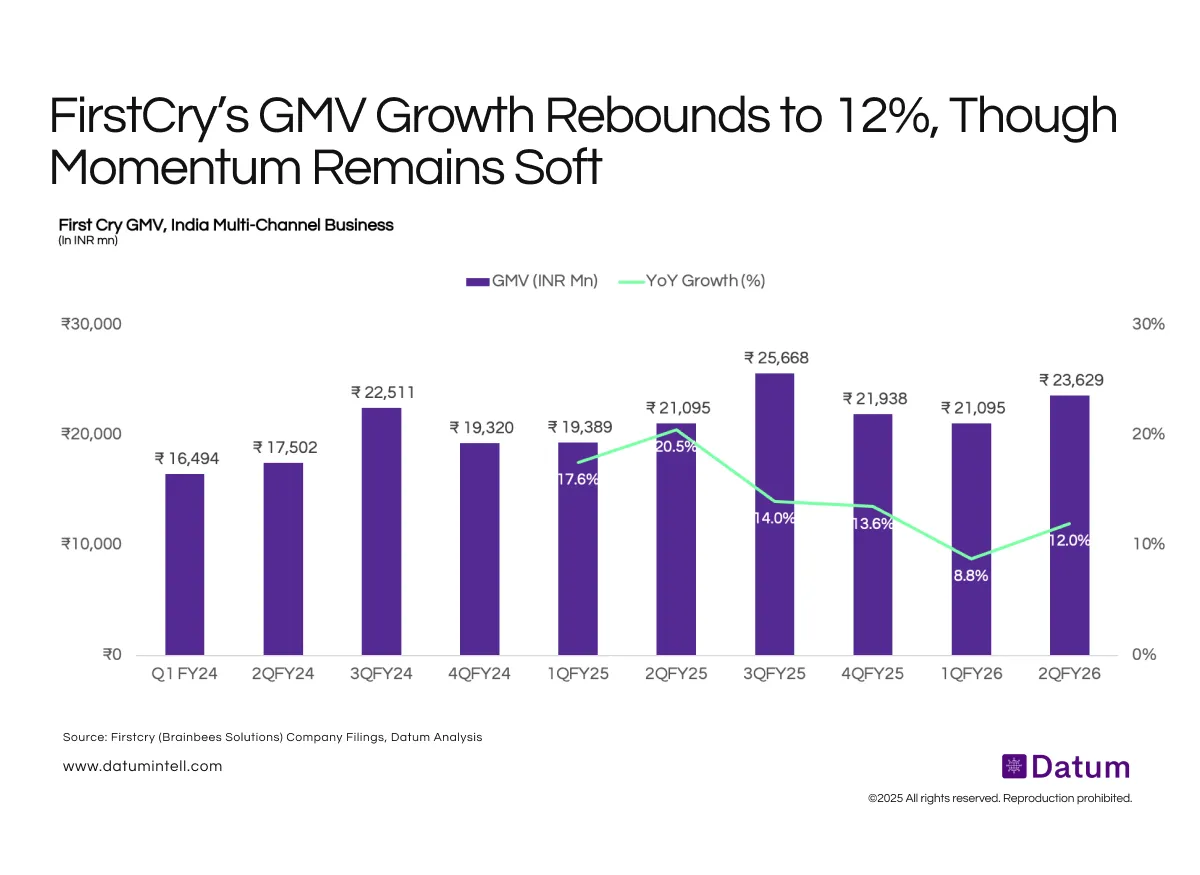

FirstCry’s India multi-channel GMV has remained on a steady growth trajectory, rising from ₹16.5 bn in Q1FY24 to ₹23.6 bn in Q2FY26. Growth strengthened meaningfully during FY25, with GMV touching ₹25.7 bn in Q3FY25-its highest quarterly level in the period. YoY growth has consistently stayed in double digits, peaking at 20.5% in Q2FY25 before moderating to 12% in Q2FY26. The performance reflects healthy omnichannel execution, improving store productivity, and continued scale-up in online demand, particularly in core categories across baby apparel, essentials, and gear.

Management highlighted continued investments in faster delivery, expanding coverage from 4 cities to 13 this quarter, with a goal of covering half of all shipments by mid-FY27. FirstCry also added 30 net stores in the quarter (predominantly FOFO).

At the same time, the company is realigning its product portfolio to deepen assortments rather than widen them, aiming to strengthen repeat categories and improve customer experience.

International business (via GlobalBees and other regions) grew 13–14% YoY, while adjusted EBITDA beat estimates with a 20 bps QoQ margin improvement to 5.8%.

What It Means

FirstCry’s multi-channel model continues to deliver resilient growth despite a softer discretionary environment. The ability to sustain double-digit GMV momentum indicates strong customer acquisition, improved repeat behaviour, and strengthened integration across online and offline channels. While growth has moderated from FY25 peaks, the business remains in a structurally expanding phase with improving operational leverage.