Table of Contents

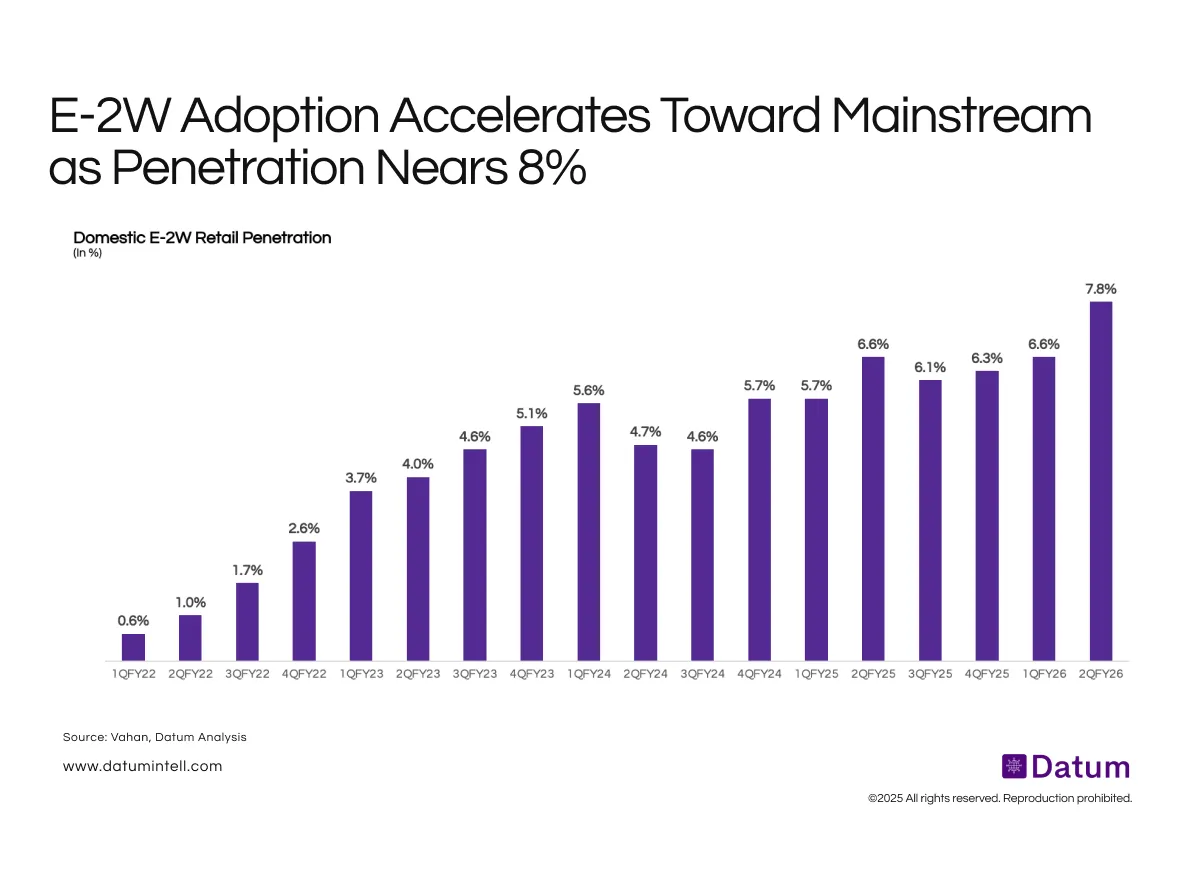

India’s electric two-wheeler (E-2W) retail penetration has risen sharply over the past three years - from 0.6% in 1QFY22 to 7.8% in 2QFY26, according to Vahan and Datum Analysis. The segment’s growth trajectory reflects rapid model launches, expanded dealer networks, and improving consumer acceptance supported by government incentives and rising fuel costs.

Notably, penetration accelerated in FY23 and FY24 following strong adoption by urban commuters and delivery fleets, before stabilizing above 6% in FY25. The renewed uptick in FY26 indicates the next phase of market expansion beyond metro centers.

What It Means

E-2W adoption in India is transitioning from early adoption to mainstream uptake.

- Policy tailwinds - Successive FAME schemes, state-level subsidies, and GST concessions have lowered acquisition barriers.

- Expanding supply ecosystem - Entry of mainstream OEMs alongside startups has diversified product offerings and improved reliability.

- Shift in consumer economics - Rising fuel prices and improved total cost of ownership (TCO) awareness are driving long-term conversion from ICE to electric.

However, penetration remains concentrated in top 8–10 states, suggesting that infrastructure readiness and affordability will define the next growth curve.