Table of Contents

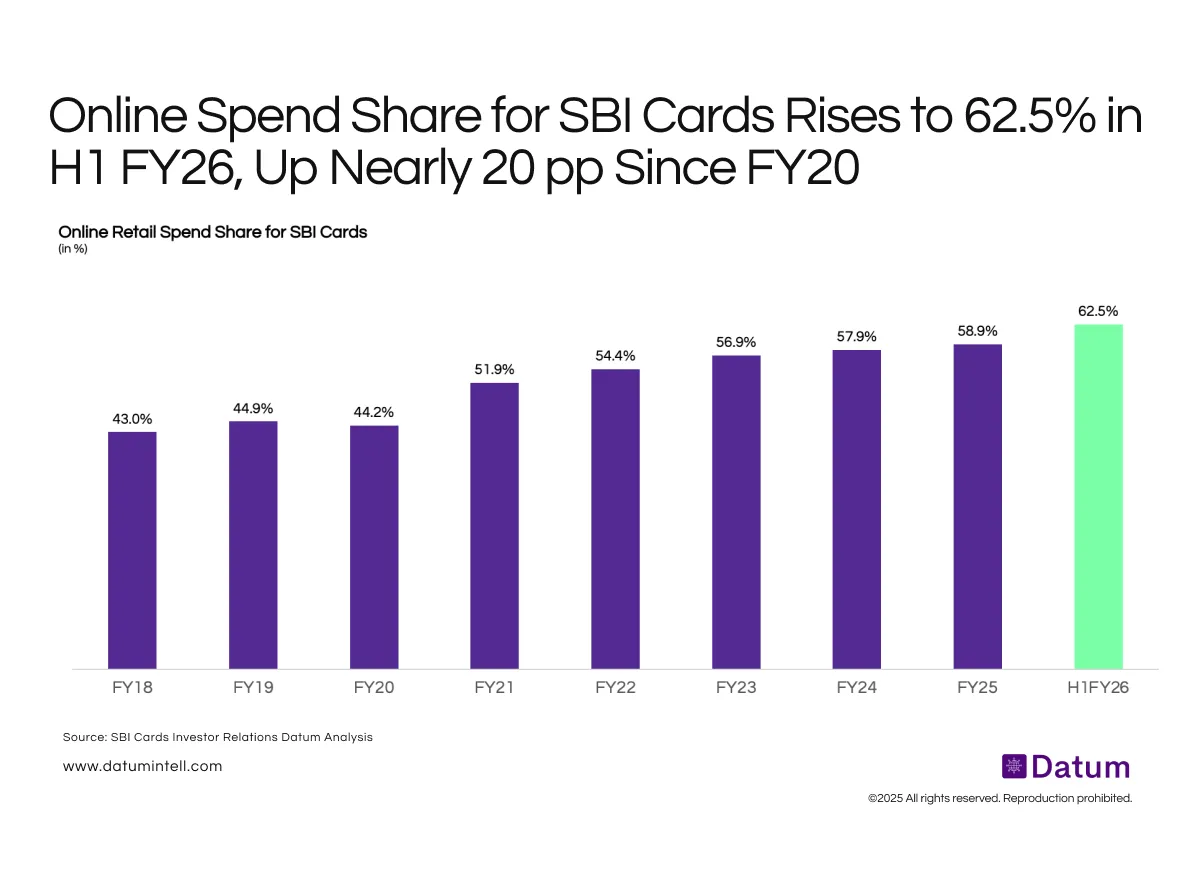

Online transactions now account for nearly two-thirds of SBI Cards’ total retail spends - up from 44% in FY20.

The acceleration began during the pandemic years as lockdowns shifted consumption to online platforms. However, even after physical retail reopened, the share of digital transactions continued to rise steadily, signaling that this behaviour has become entrenched.

The sustained rise reflects India’s structural shift toward digital consumption, powered by e-commerce penetration, contactless payments, and growing comfort with online purchases.

What It Means

This data signals a structural, not cyclical, shift in consumer behaviour:

- Digital-first consumption: Online channels have evolved from being convenience-led to habit-driven, with discretionary categories like travel, lifestyle, and electronics now anchored in digital ecosystems.

- Higher transaction visibility: For issuers like SBI Cards, a larger share of online spending offers better transaction-level data, enabling sharper credit profiling and targeted marketing.

- Premium consumer consolidation: Digital spending tends to skew toward higher-income segments, strengthening the premium base of SBI Cards and supporting cross-sell opportunities in loans, EMIs, and co-branded products.

- Competitive intensity rising: The same digital adoption that benefits incumbents also lowers entry barriers for fintechs, leading to greater competition in rewards, credit offerings, and loyalty ecosystems.