Table of Contents

India’s card payment ecosystem has undergone a clear structural divergence over the last six years.

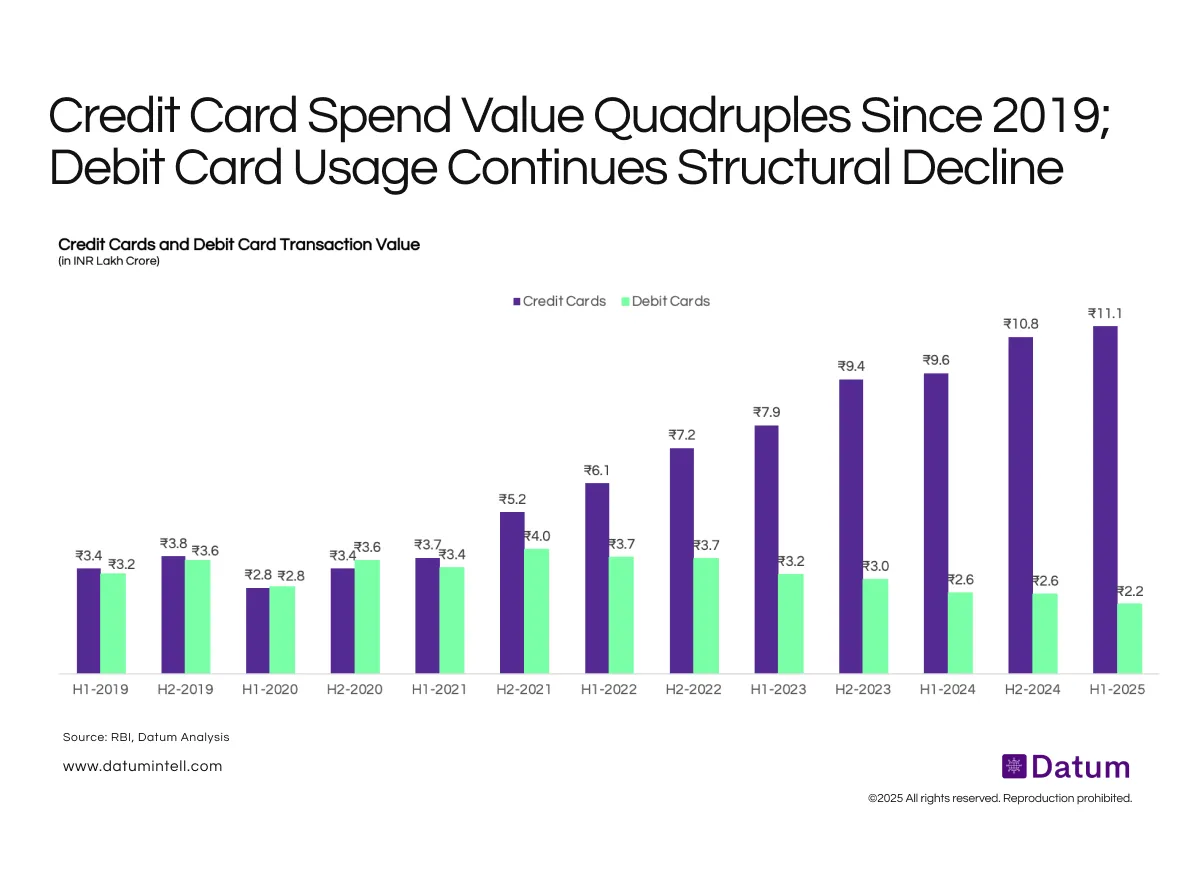

Credit card transaction value surged from ₹3.4 lakh crore in H1 2019 to ₹11.1 lakh crore in H1 2025 — a 3.3× increase, driven by expanding card issuance, rising consumer credit appetite, and accelerated adoption for online and lifestyle purchases.

Conversely, debit card spending has nearly halved - from ₹3.2 lakh crore in H1 2019 to ₹2.2 lakh crore in H1 2025, reflecting both the UPI substitution effect and the shift of small-ticket payments away from bank-linked cards.

What It Means

- Credit Becomes Consumption Backbone: Credit cards have evolved from a niche urban product to a mainstream spending instrument, supported by fintech-led co-branded cards, EMI conversions, and reward-led usage.

- UPI Crowds Out Debit: UPI’s instant, zero-cost convenience has cannibalised debit card usage for routine payments, pushing debit cards back toward ATM withdrawals and low-frequency utility spends.

- Polarised Growth Curve: The gap between credit and debit usage highlights India’s two-track digital finance story — affluent consumers deepening credit engagement, while the mass base uses UPI as the de facto transaction layer.