Table of Contents

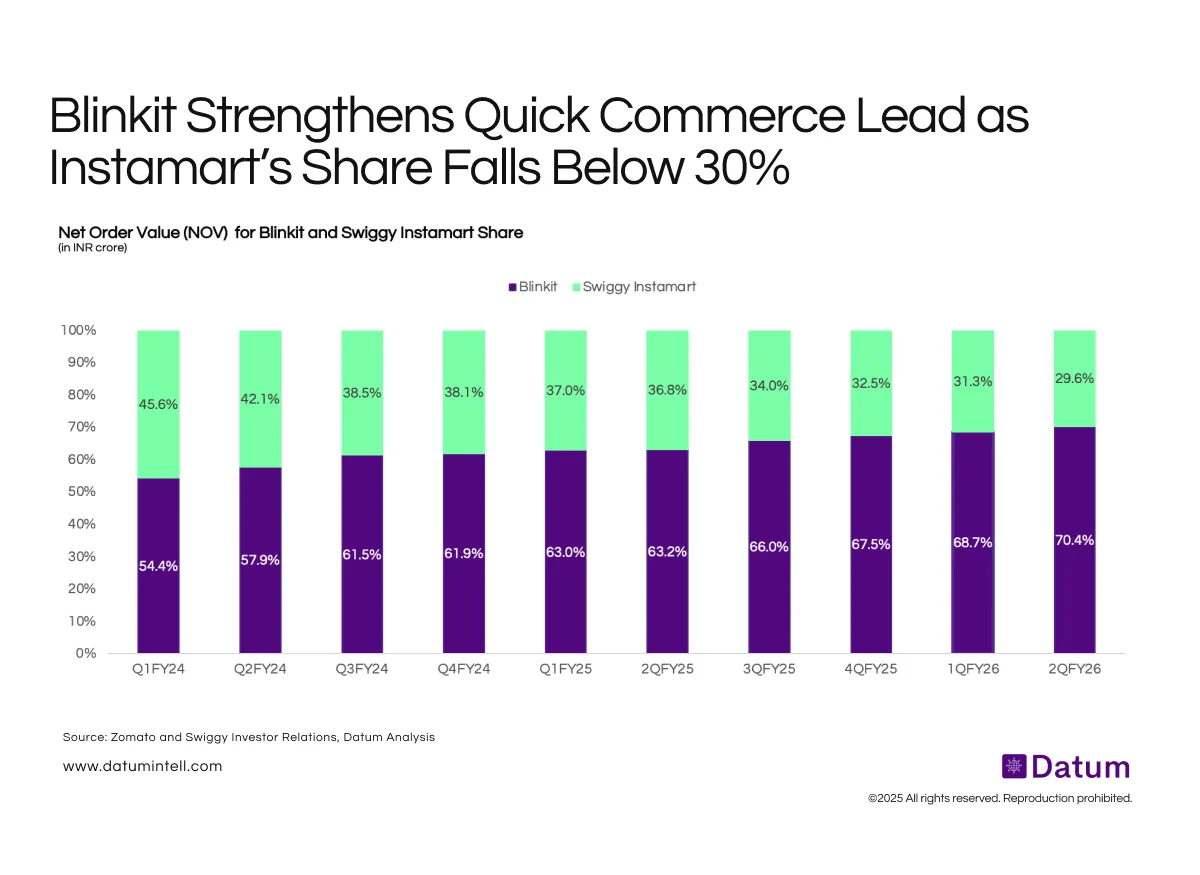

The Net Order Value (NOV) share between Blinkit and Swiggy Instamart reveals a steady divergence in India’s quick commerce market.

Blinkit’s NOV share has climbed from 54% in Q1 FY24 to 70% in Q2 FY26, while Instamart’s share has contracted from 46% to under 30% over the same period.

This shift coincides with Blinkit’s deeper integration into Zomato’s ecosystem, faster dark store expansion, and stronger execution in high-frequency categories. Meanwhile, Instamart’s focus has tilted toward margin improvement and operational efficiency, slowing its volume-led growth.

What It Means

- Market Leadership Consolidation: Blinkit is extending its lead, becoming the primary volume driver in India’s ₹25,000+ crore quick commerce sector.

- Strategic Divergence: Blinkit is pursuing scale and category breadth; Instamart is recalibrating toward profitability and utilization.

- Competitive Pressure: Instamart’s deceleration opens whitespace for players like Zepto, which continue to gain urban market share.