Table of Contents

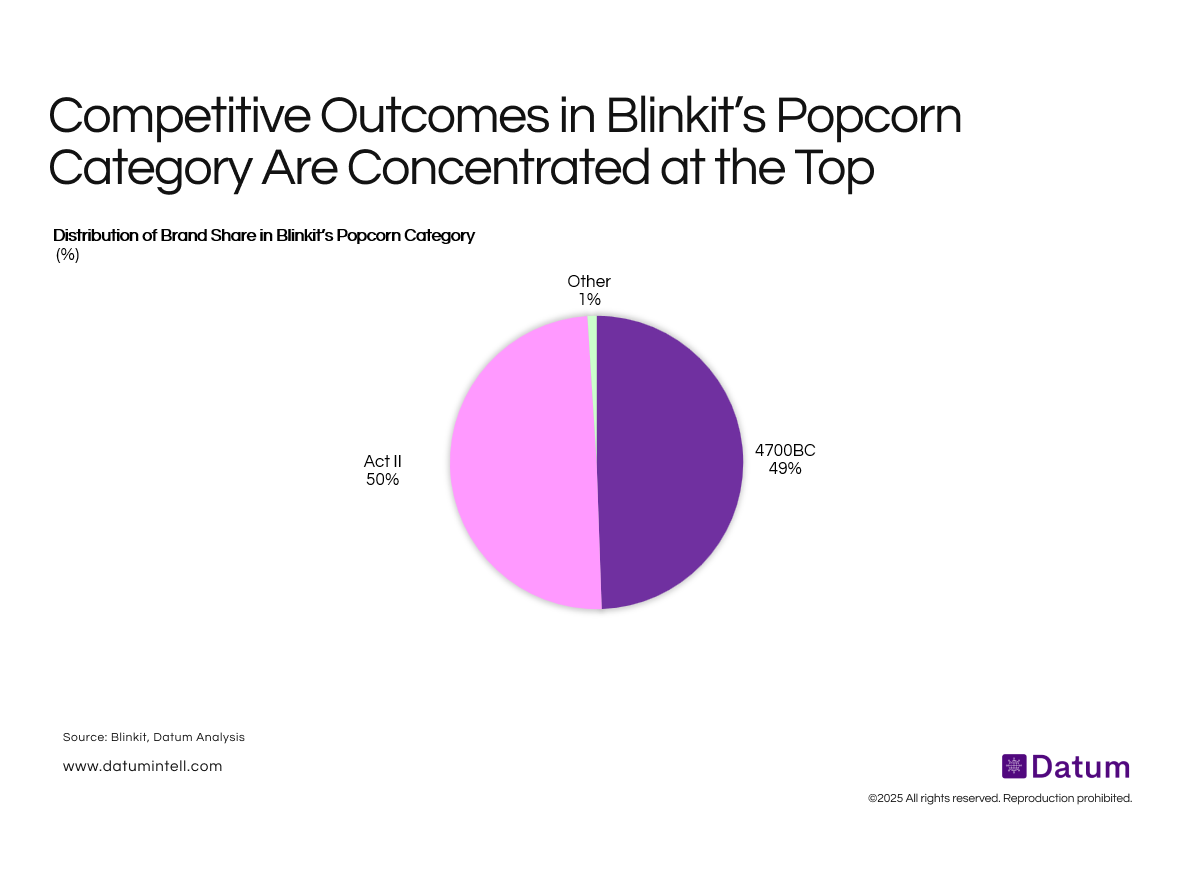

Blinkit’s popcorn category exhibits one of the clearest examples of winner-takes-most dynamics on Indian quick commerce.

Two brands -4700BC and Act II together control ~99% of category sales, leaving virtually no competitive long tail.

This level of concentration signals a category that has already moved beyond experimentation into a mature, scale-driven equilibrium, where leadership is determined by price architecture, pack strategy, and SKU velocity rather than breadth of choice.

Category Structure: Extreme Concentration with No Middle Tier

Brand-level outcomes in Blinkit’s popcorn category are unusually polarized. 4700BC holds ~49.6% share, Act II ~49.7%, and all other brands combined account for just ~1%. The absence of a meaningful third player suggests that competitive advantage has consolidated early, driven by operational scale, repeat consumption, and price-pack efficiency, rather than novelty or discovery.

This structure indicates that quick commerce does not reward incremental differentiation in popcorn. Instead, scale advantages accrue rapidly, compressing the competitive window for mid-sized or emerging brands.

Price Bands Define the Category’s Economic Core

Despite popcorn’s premium associations, Blinkit data shows that the category remains decisively value-led. Nearly 84% of total category sales come from packs priced below ₹100, split between <₹50 (43.7%) and ₹50–99 (40.2%) price bands. Higher price tiers contribute marginally: all packs priced above ₹200 contribute less than 10% of sales, while ₹500+ products are almost irrelevant at 0.1%.

This confirms that on quick commerce, popcorn functions less as an indulgent premium snack and more as a high-frequency, low-friction impulse purchase.

Divergent Price Strategies, Similar Outcomes

While 4700BC and Act II are evenly matched at the category level, their growth engines diverge meaningfully by price architecture.

Act II is firmly anchored in mass affordability, with ~58% of sales coming from sub-₹50 price points, reinforcing its role as the category’s high-frequency, entry-level option.

4700BC, by contrast, skews modestly upward on the price curve. While ~46% of its sales sit in the ₹50–99 band, the brand also generates ~17% of sales from the ₹200–299 range, indicating stronger traction in premium and gifting-oriented formats—without diluting its core volume base.

Despite these differences, both strategies converge on the same outcome: commanding leadership in low-friction price bands. The data underscores a central quick-commerce reality—pricing discipline and pack architecture outweigh brand storytelling in determining category leadership.

SKU Strategy: Focus vs. Breadth

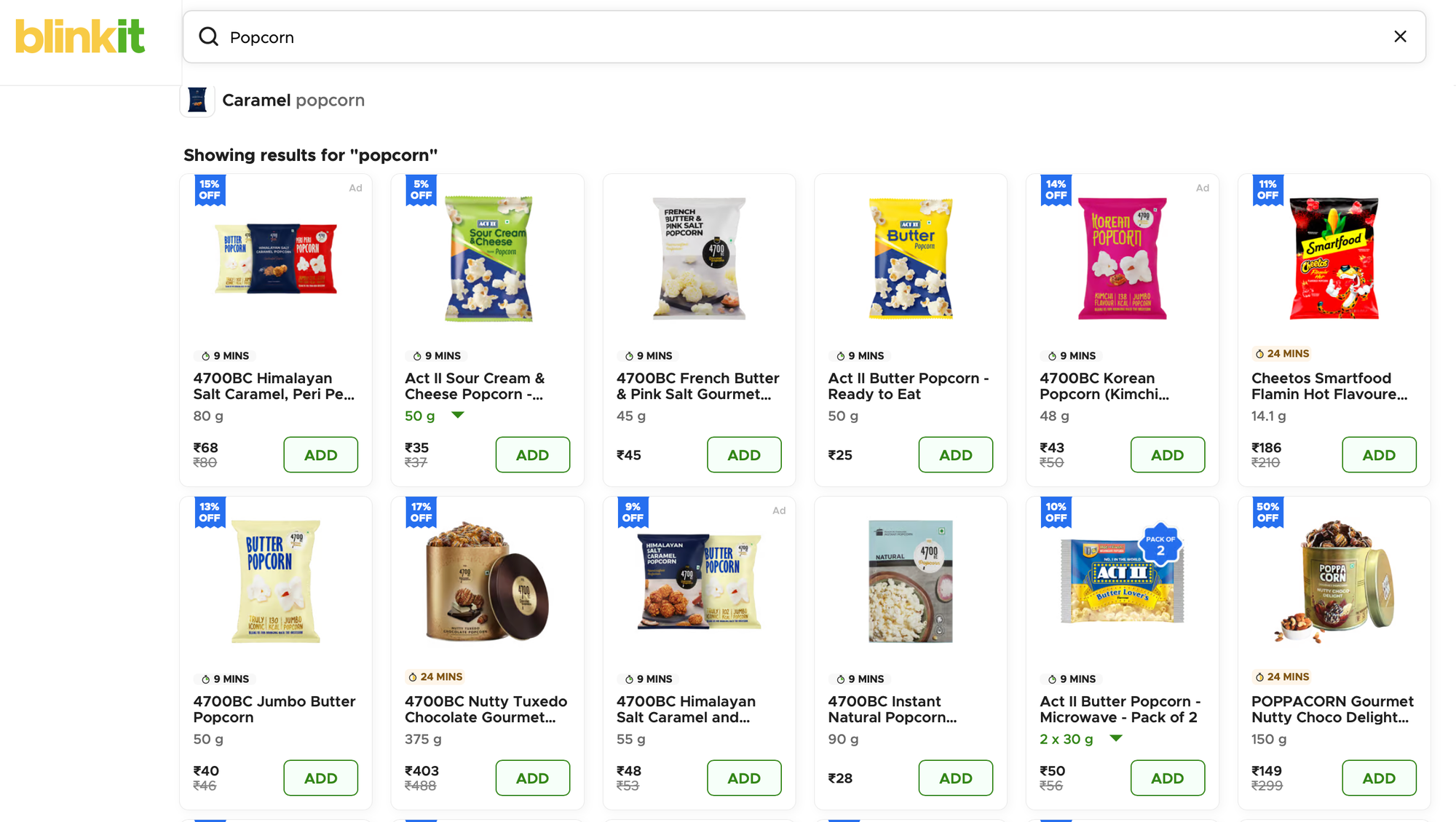

The contrast between Act II and 4700BC is most pronounced at the SKU and pack-architecture level, where two fundamentally different scaling models are visible.

At the unit-size level, both brands derive a similar share of sales (~30%), but through very different mechanics.

For Act II, ~30% of brand sales are concentrated in a single high-velocity SKU—the 47g + 50g Butter + Sour Cream & Cheese combo—indicating extreme reliance on one hero configuration.

In contrast, 4700BC’s ~30% sales contribution is distributed across ~10 SKUs, primarily within the 45g, 50g, and 60g pack sizes, reflecting a broader but shallower unit-size spread.

At the product level, the divergence is even sharper.

For Act II, the top three products account for ~66.3% of total brand sales, underscoring a tightly focused hero-SKU strategy with limited long-tail dependence.

For 4700BC, the top three products contribute only ~21% of brand sales, with demand fragmented across a wider set of flavors, formats, and packs.

Notably, 4700BC operates with roughly three times the number of SKUs as Act II, yet both brands converge at near-identical category market shares. The implication is clear: in quick commerce, SKU breadth redistributes demand more than it creates it. Scale is built not through assortment expansion, but through velocity concentration around a small number of winning SKUs.

What This Signals About Quick Commerce Snack Categories

Blinkit’s popcorn category illustrates how quick commerce compresses category evolution. Leadership is built through:

- Mastery of sub-₹100 price points

- Dominance in small, single-consumption pack sizes

- Relentless focus on high-velocity hero SKUs

In such environments, categories consolidate rapidly, leaving little room for “middle-of-the-road” brands. Either a brand wins on affordability and repeatability, or it struggles to scale.

Strategic Implications

- For challenger brands: Entry without a sharply defined price-pack architecture is unlikely to scale. Premium positioning alone is structurally disadvantaged.

- For FMCG incumbents: SKU discipline and velocity matter more than range expansion; hero-product economics should guide portfolio decisions.

- For quick commerce platforms: Highly concentrated categories improve predictability and operational efficiency, but also reduce supplier diversity over time.

We decode how Indian consumers discover, decide, and transact. For custom research on quick commerce, food trends, or category disruption, reach out at hello@datumintell.com