Table of Contents

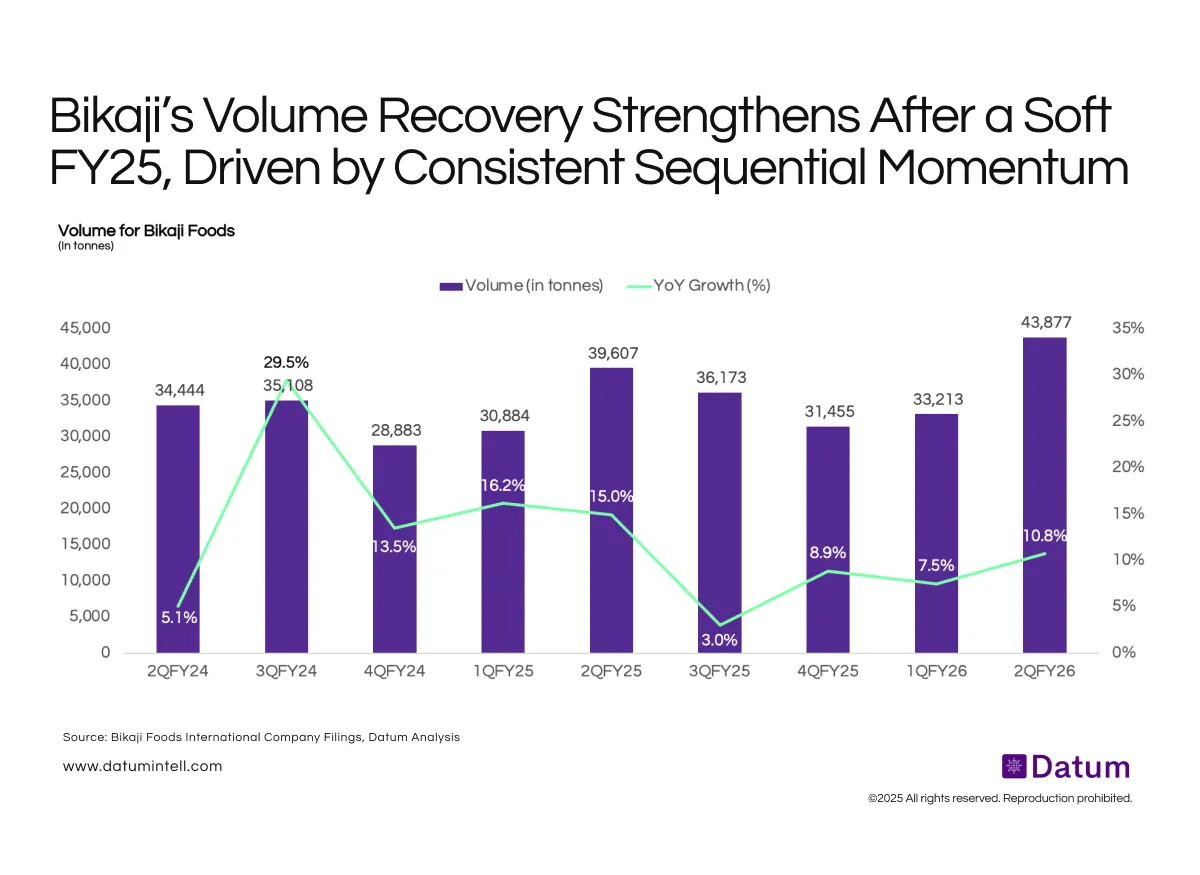

Bikaji Foods’ quarterly volumes show a strong rebound after the early-FY25 slowdown. Volumes dipped to ~28,800 tonnes in 4QFY24 and again moderated to ~31,400 tonnes in 3QFY25, reflecting seasonality and demand normalization post-festive. However, subsequent quarters indicate clear recovery-with 2QFY26 touching an all-time quarterly high of ~43,900 tonnes. While YoY growth rates remain volatile, the underlying volume base has stabilised and is now expanding steadily.

What It Means

The data indicates that Bikaji has moved from a period of uneven quarterly performance to a more consistent growth trajectory. Despite fluctuations in YoY growth-from a high of ~29.5% to a low of ~3%-absolute volumes are trending upward, suggesting improved distribution, better demand execution, and sustained category penetration. The strong 2QFY26 print implies that Bikaji’s core markets are expanding again, supported by broader snacking consumption and increasing modern-trade and quick-commerce contribution.