Table of Contents

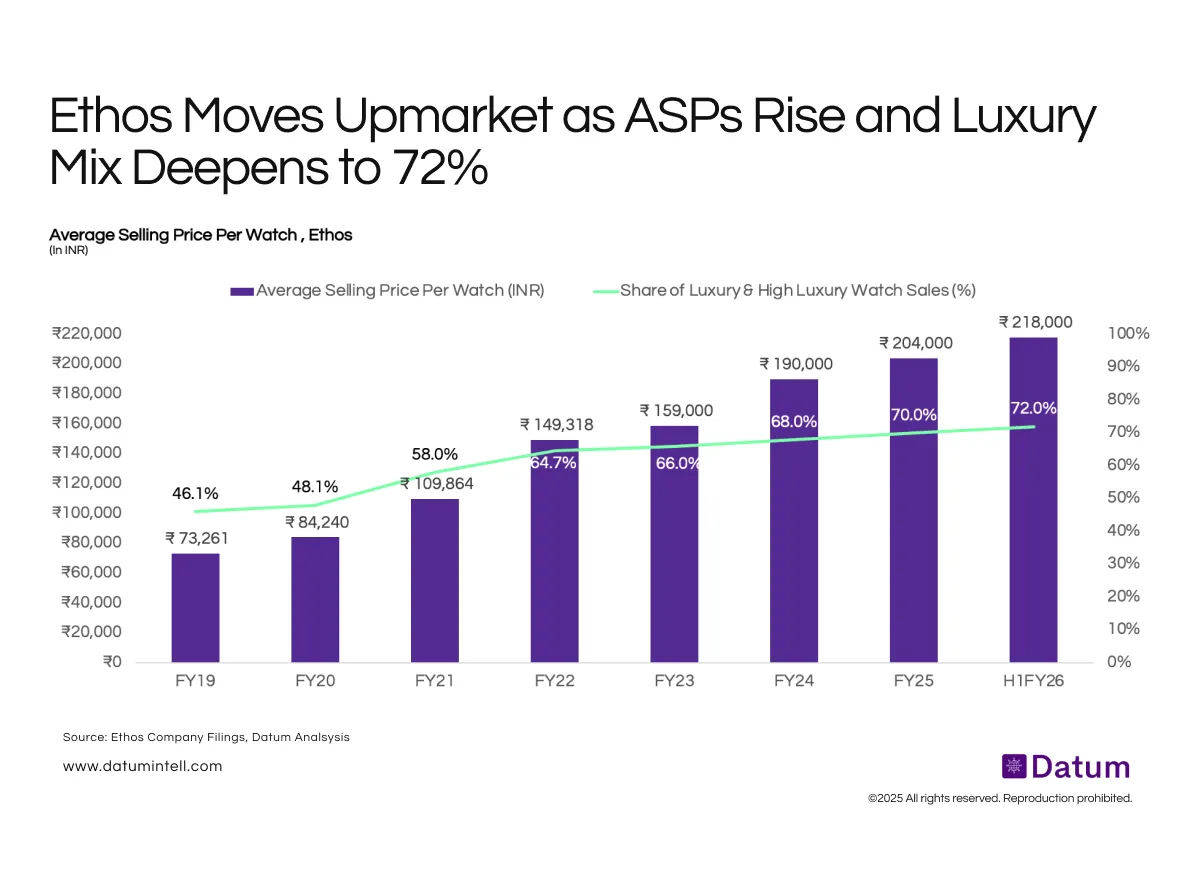

Ethos has seen a sustained premiumisation shift over FY19–H1FY26, with the average selling price per watch increasing from ₹73,261 to ₹218,000-nearly a 3x jump over seven years. This rise has been driven by a steady expansion in the share of luxury and high-luxury watches, which has grown from 46% in FY19 to 72% in H1FY26. The mix upgrade reflects stronger demand for high-end Swiss brands, rising affluent consumption, and a deliberate pivot toward higher-margin categories.

What it Means

The sharp rise in ASP reflects Ethos’ successful transition toward a higher-value, luxury-centric portfolio. With customers increasingly trading up to premium and high-luxury timepieces, Ethos benefits from stronger margins, improved inventory productivity, and a more affluent, repeat-purchase customer base. The consistent uptrend signals a structurally stronger business model-less dependent on mid-tier volumes and more anchored in high-ticket, brand-led demand that enhances long-term profitability and pricing power.