Table of Contents

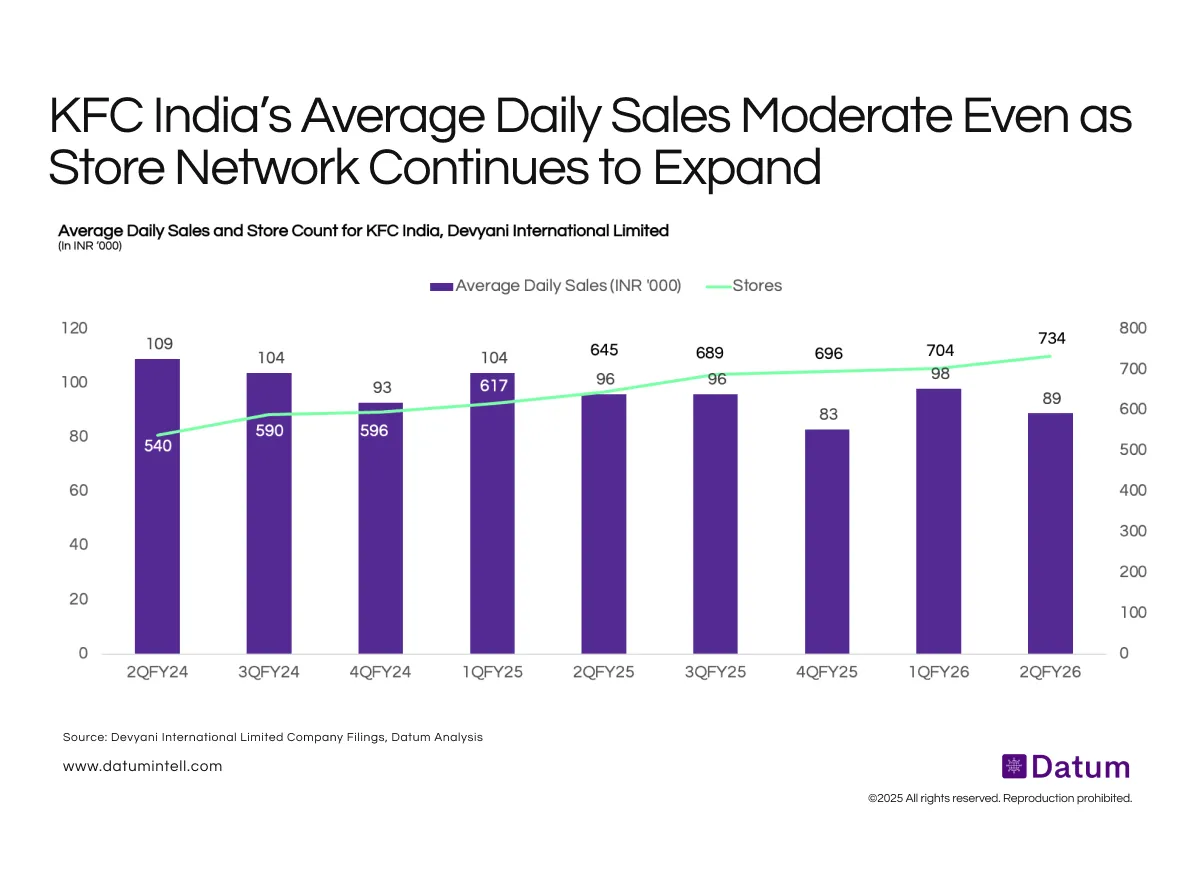

KFC India’s quarterly performance shows a divergence between sales productivity and network growth. While the store count has steadily increased from 540 in 2QFY24 to 734 in 2QFY26, average daily sales have softened meaningfully-from a peak of ₹109,000 per day in 2QFY24 to ₹83,000 in 4QFY25 before partially recovering to ₹89,000 in 2QFY26. This moderation follows a period of strong post-pandemic growth and reflects both a normalising demand environment and inflation-led pressure on discretionary QSR categories.

What It Means

The widening gap between store expansion and per-store sales productivity suggests that incremental units are diluting averages or entering lower-throughput trade areas. While network growth supports long-term share gains, the softer ADS trajectory indicates pressure on like-for-like performance, potentially driven by weaker urban discretionary spend, rising competitive intensity, and slower dine-in recovery. This trend underscores the importance of balancing expansion with unit economics and sustaining higher-margin channel mix.