Table of Contents

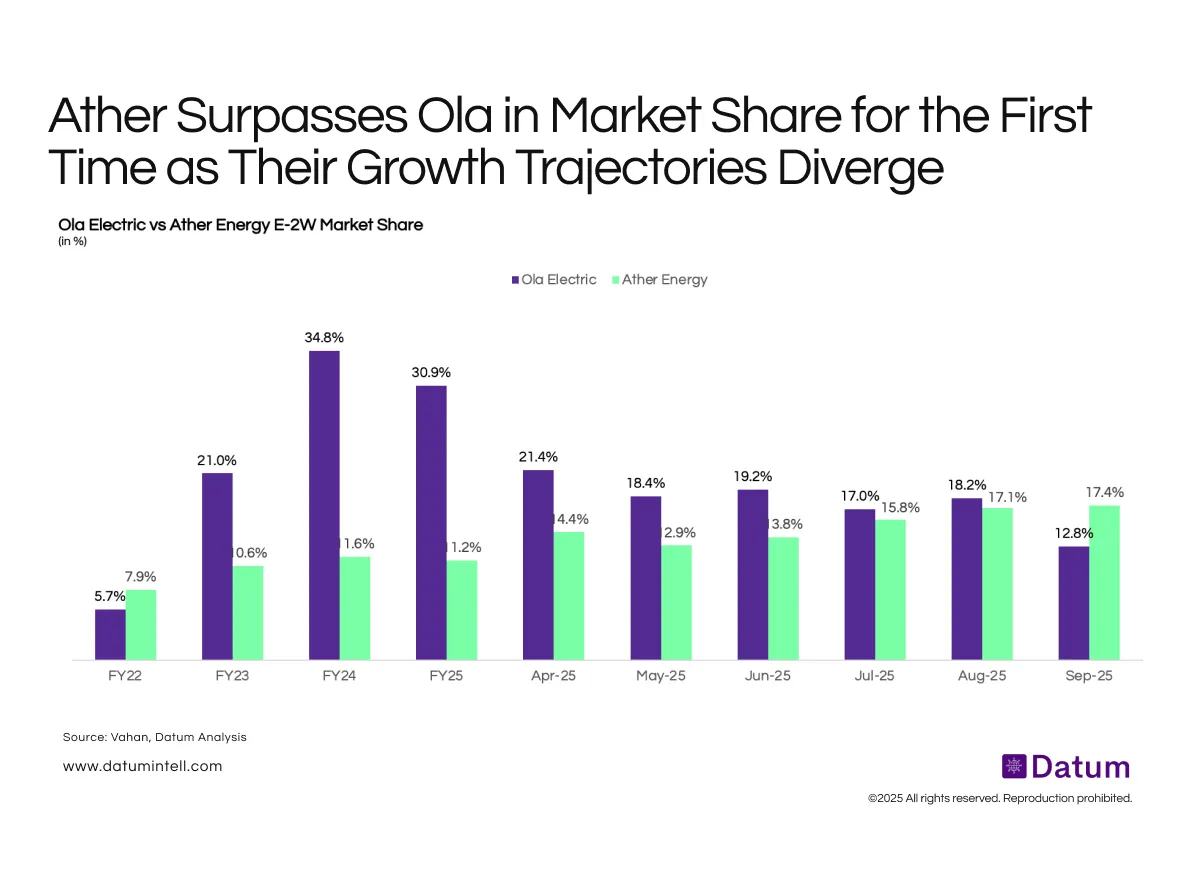

Ola Electric’s early-mover advantage in the E-2W segment has moderated through FY25, with its market share declining from a peak of 34.8% in FY24 to ~13% by Sep-25. Ather Energy, meanwhile, has steadily expanded its share from 10.6% in FY23 to 17.4% in Sep-25, supported by a stronger retail network, improved delivery timelines, and consistent software upgrades.

Ola’s share erosion post-FY24 coincides with increased competitive intensity from TVS, Bajaj, and Hero MotoCorp, as well as consumer pushback on reliability and service concerns.

What It Means

The E-2W market is entering a multi-brand equilibrium phase where scale, reliability, and after-sales service will outweigh early-mover advantages.

- Ola’s dominance is fading as established OEMs and Ather capture share through steady execution.

- Ather’s trajectory suggests it is evolving from niche premium to mainstream challenger.

- Industry structure is shifting from a single-leader dynamic to a diversified top-four, signaling a more sustainable and competitive market environment.