Table of Contents

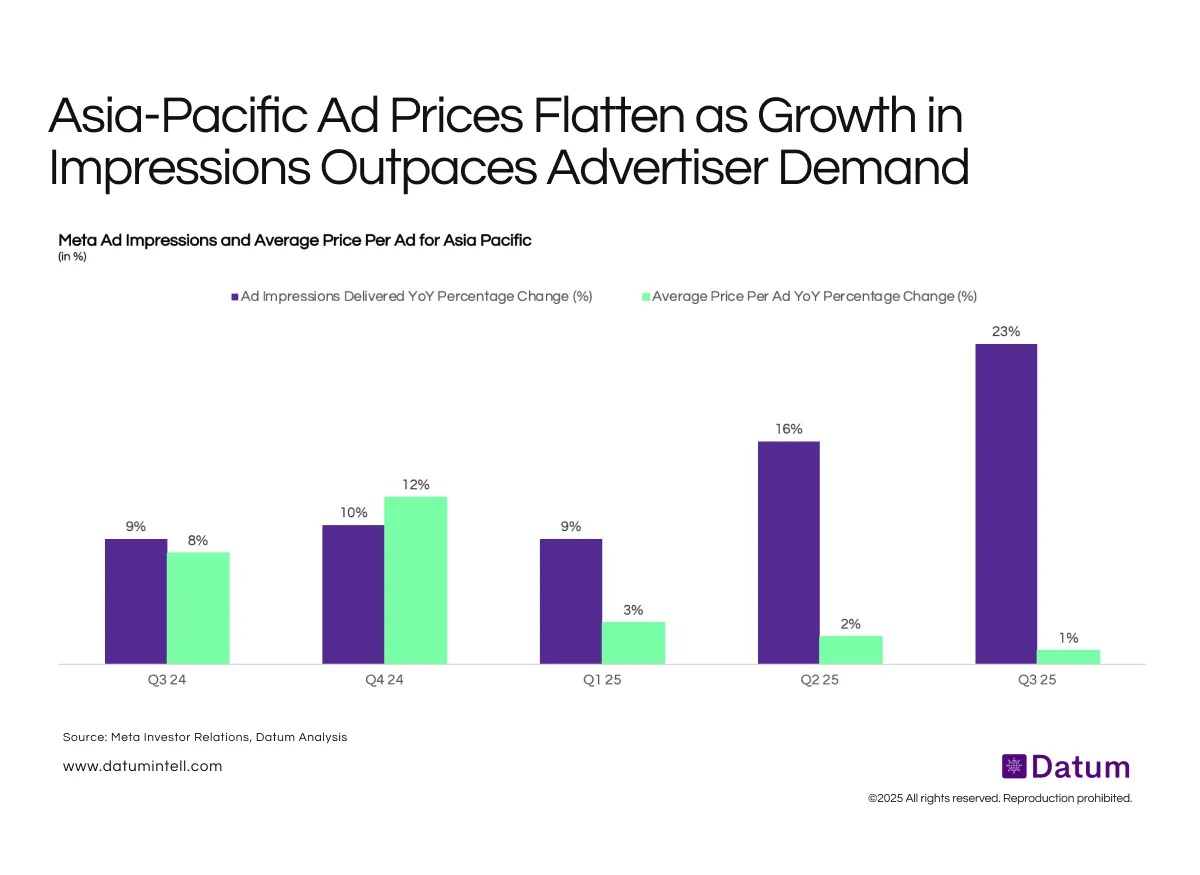

Meta’s ad pricing data shows a sharp divergence across regions. While Europe (+19%) and the U.S. (+13%) are seeing strong year-on-year increases in ad prices, Asia-Pacific has slowed to just +1% in Q3 FY25, down from 8–12% a year ago. This flattening comes despite the region driving the largest increase in total ad impressions globally, reflecting robust user growth and engagement across India, Indonesia, and Southeast Asia.

Why This Is Happening

- Ad Supply Expansion:Meta has massively increased ad inventory through Reels, Stories, and new user markets in Asia-Pacific. However, ad demand has not kept up, creating a surplus of impressions that suppresses CPMs.

- Advertiser Base Maturity:The region is dominated by small and medium advertisers with lower spending capacity. Many campaigns are focused on reach and awareness rather than performance optimization, limiting bid intensity.

- Shift to Lower-Yield Formats:User time is shifting toward short-form video (Reels) and emerging market inventory, both of which have lower monetization rates compared to Feed or Stories.

- Currency and FX Effects:With several Asian currencies weakening against the USD (e.g., INR, IDR, PHP), ad prices appear lower in dollar terms even if local currency rates remain stable.

What It Means

The Asia-Pacific region remains Meta’s volume growth engine but not its pricing driver. User engagement continues to expand rapidly, yet the monetization per user lags far behind developed markets. To sustain revenue growth, Meta will need to:

- Deepen advertiser sophistication and adoption of performance formats,

- Improve yield on short-form video inventory, and

- Gradually raise CPMs as digital commerce and payment maturity rise in the region.

This dynamic underscores the asymmetric growth in Meta’s global business — with Asia driving scale, and the West driving profitability.