Table of Contents

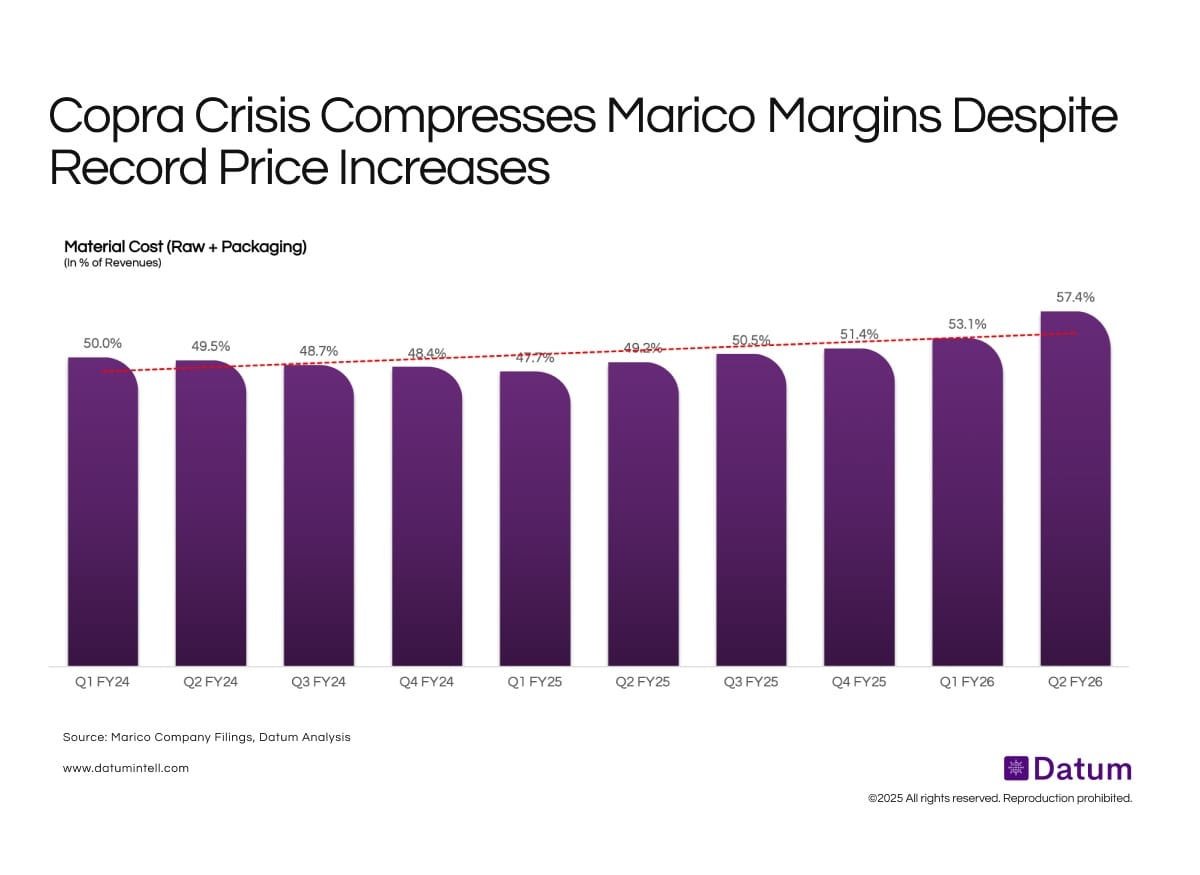

Marico Limited faces severe margin pressure as material costs surged from 47.7% to 57.4% of revenues between Q1 FY25 and Q2 FY26-a 970 basis point deterioration driven primarily by copra prices increasing 113% year-over-year. Despite implementing what CEO Saurabh Gupta called unprecedented 60% price increases on flagship Parachute coconut oil, the company could not outrun commodity inflation, revealing the limits of pricing power even for dominant FMCG brands in managing extreme input cost shocks.

Key Insights

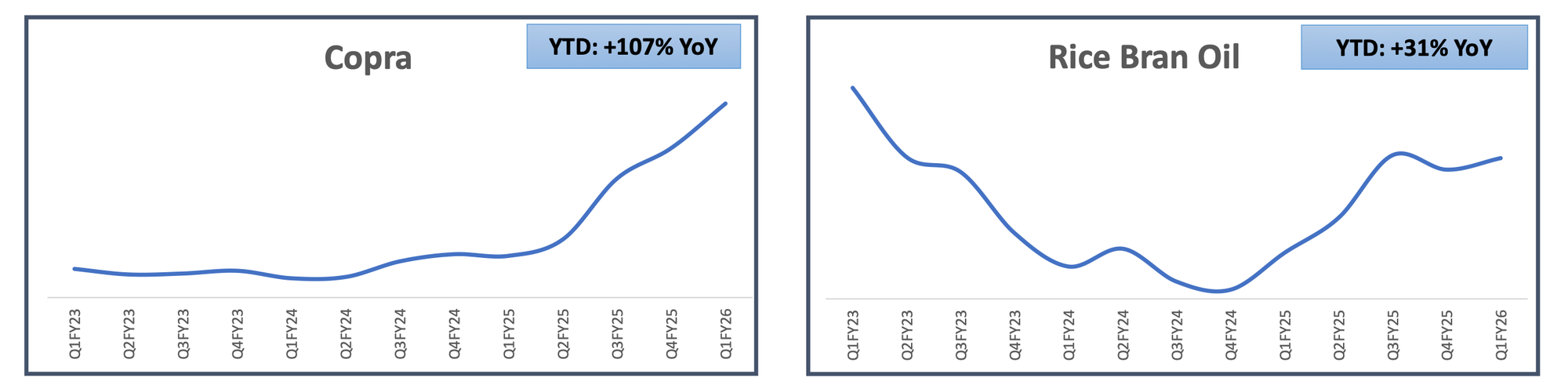

- Brief Relief Gives Way to Unprecedented Inflation Material costs reached a favorable trough of 47.7% in Q1 FY25 as copra prices stabilized and rice bran oil costs declined. This brief window reversed sharply as copra began its exponential ascent from Q2 FY25 onwards, with the 113% year-over-year surge representing one of the most severe inflation cycles in recent FMCG history.

- Record Pricing Actions Fall Short of Commodity Surge Management implemented pricing that Gupta acknowledged was "unheard of in large FMCG economies"-raising Parachute's one-liter bottle from INR 230 to approximately INR 700 (60% year-over-year) while key SKUs increased 40-60%. Yet material costs still deteriorated 970 basis points, demonstrating that even maximum viable pricing could not close the gap. The company simultaneously sacrificed volumes and absorbed margin compression.

- Dual Commodity Squeeze Eliminates Alternatives The convergence of copra inflation (up 113%) with rice bran oil increases (up 31%) eliminated reformulation options. Q2 FY26 alone saw a 430 basis point quarterly spike from 53.1% to 57.4% as both primary oil inputs inflated simultaneously, forcing Marico to absorb costs without technical mitigation pathways.

- Margin Recovery Depends on Commodity Deflation, Not Pricing CFO Pawan Agrawal declared no price rollbacks despite slight copra cooling, stating any commodity relief would repair margins rather than stimulate volumes. This signals management's acceptance that pricing alone cannot restore profitability-Marico requires 700-900 basis points of commodity cost deflation to return to acceptable margin structures.

What This Means

Marico's copra crisis exposes the vulnerability of commodity-dependent FMCG businesses lacking vertical integration or hedging capabilities. The company deployed pricing at the outer limits of brand equity-volumes went "muted" per management admission yet still absorbed catastrophic margin compression. This binary outcome reveals that copra inflation effectively exceeded 150-200% on a weighted procurement basis, beyond what any consumer brand can pass through without market share collapse.

The company now depends entirely on agricultural commodity normalization rather than operational levers. If copra mean-reverts over 12-18 months, material costs could decline toward 48-50%, delivering the 700-900 basis points of relief needed to validate the aggressive pricing strategy. However, if elevated copra prices persist due to supply constraints or climate impacts, Marico remains structurally trapped at 55-57% material costs-unable to generate acceptable returns without further volume-destroying pricing. The absence of backward integration or futures hedging leaves profitability almost entirely dependent on coconut farmer planting decisions and monsoon patterns outside management control.