Table of Contents

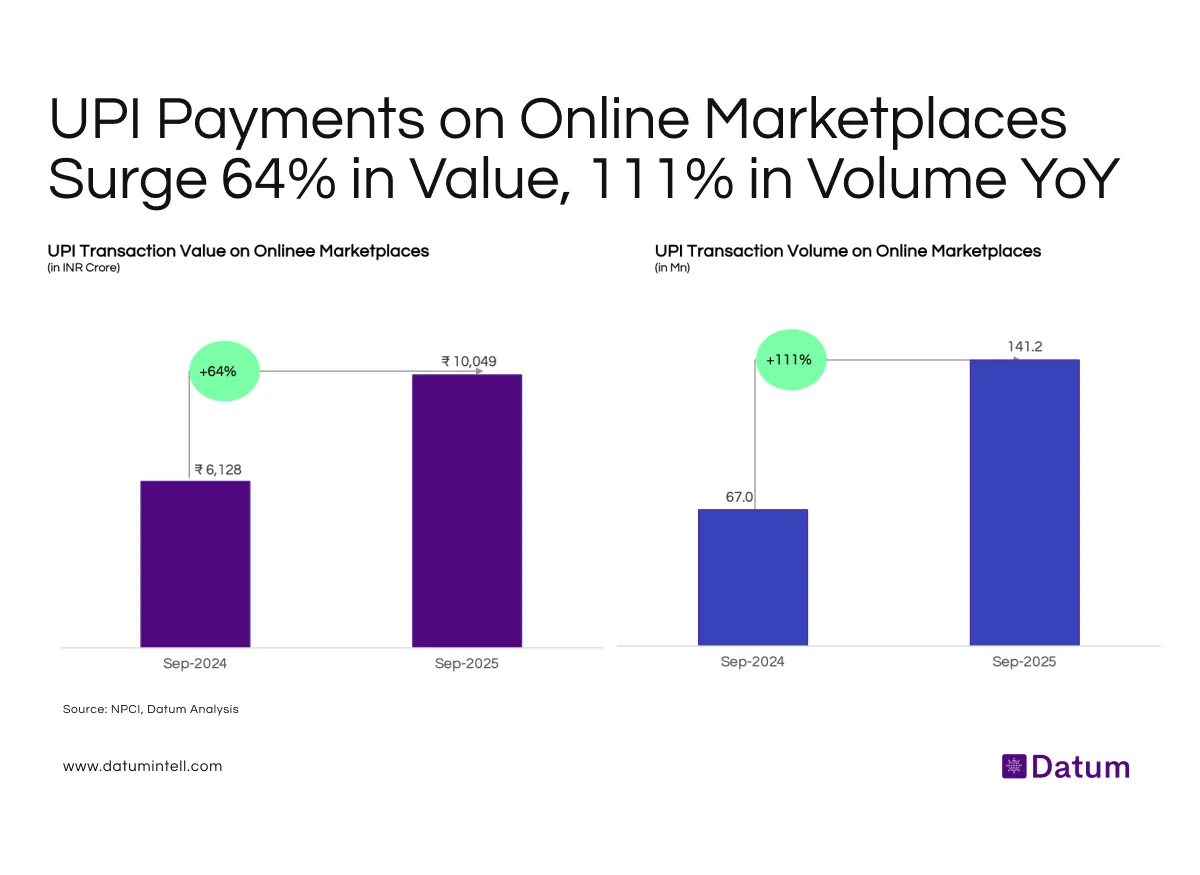

UPI has become the backbone of India’s digital commerce, and nowhere is that clearer than in the online marketplace ecosystem.

Between September 2024 and September 2025, total UPI transaction value on e-commerce platforms rose from ₹6,128 crore to ₹10,049 crore, while volumes more than doubled (67 million → 141 million).

This growth signals not just more transactions, but a fundamental shift in consumer spending behavior. Indians are transacting more frequently, across more platforms, and at higher average ticket sizes. Digital wallets and credit-linked UPI (like RuPay Credit and UPI Lite) have also broadened access to mid- and premium-value purchases online.

What It Means:

- Rising digital consumption: Online marketplaces are capturing the surge in discretionary and convenience-led spending -from groceries to electronics - as consumers become more comfortable with digital-first shopping.

- UPI as a mirror of real consumption: The 64% jump in value reflects not just adoption, but inflation-adjusted growth in household spending capacity, particularly among younger and Tier-2/3 consumers.

- More frequent, smaller spends: The 111% spike in transaction volume points to rising purchase frequency - flash sales, subscriptions, and instant delivery orders - reshaping digital commerce economics.

- The ₹10,000 crore milestone: Crossing this value mark reinforces how UPI has become the default checkout layer for India’s digital economy, replacing cards and COD as trust in digital payments matures.

- Broader macro signal: As consumer demand expands post-FY24 normalization, UPI data is a leading indicator of India’s return to consumption-led growth, with marketplaces driving much of that recovery.