Table of Contents

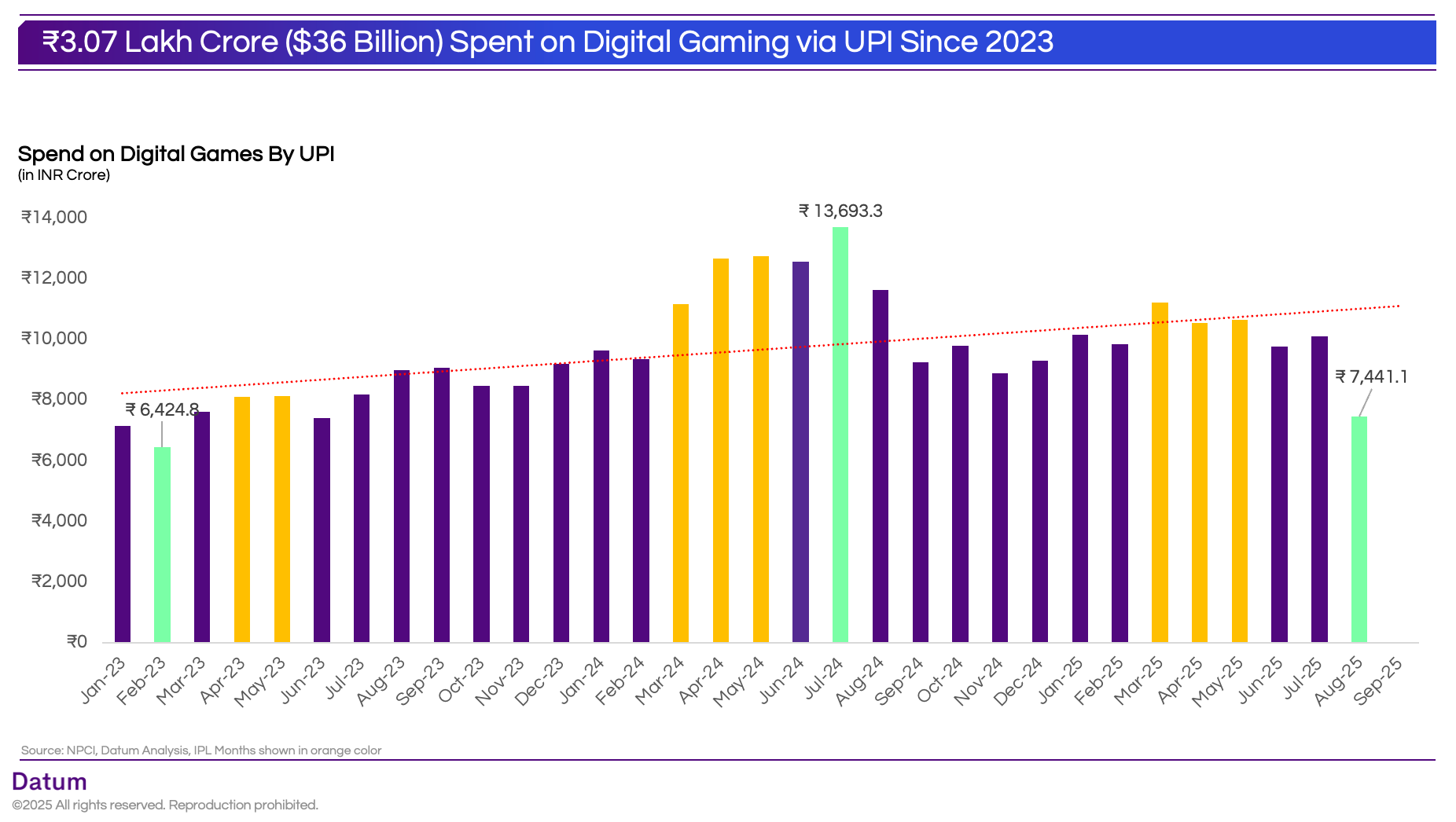

As we assess the impact of the RMG Bill, it’s important to first understand the scale of India’s gaming economy - specifically, how much money has been spent on digital games through UPI since 2023.

India’s digital gaming market evolved from a niche pastime into a fintech powerhouse. Between January 2023 and August 2025, Indians spent an estimated ₹3.07 lakh crore ($36 billion) on gaming through UPI - underscoring how deeply micro-payments have embedded themselves in entertainment.

Monthly spends climbed from ₹6,424 crore in February 2023 to an all-time high of ₹13,693 crore in July 2024, before settling at ₹7,441 crore by August 2025 as new gaming regulations tightened payment flows. The seasonal spikes, marked in orange, coincide with IPL months, when gaming spends routinely surged 25–35% as users flocked to fantasy leagues and real-time contests.

In September 2025, Digital Games dropped out of NPCI’s Top 50 UPI merchant categories by transaction volume - the first time since 2023.Transaction count fell sharply from 270 million in August to below 50 million, marking an 80%+ month-on-month decline.

The 2024 IPL season was the inflection point, combining record participation, payout cycles, and aggressive marketing.

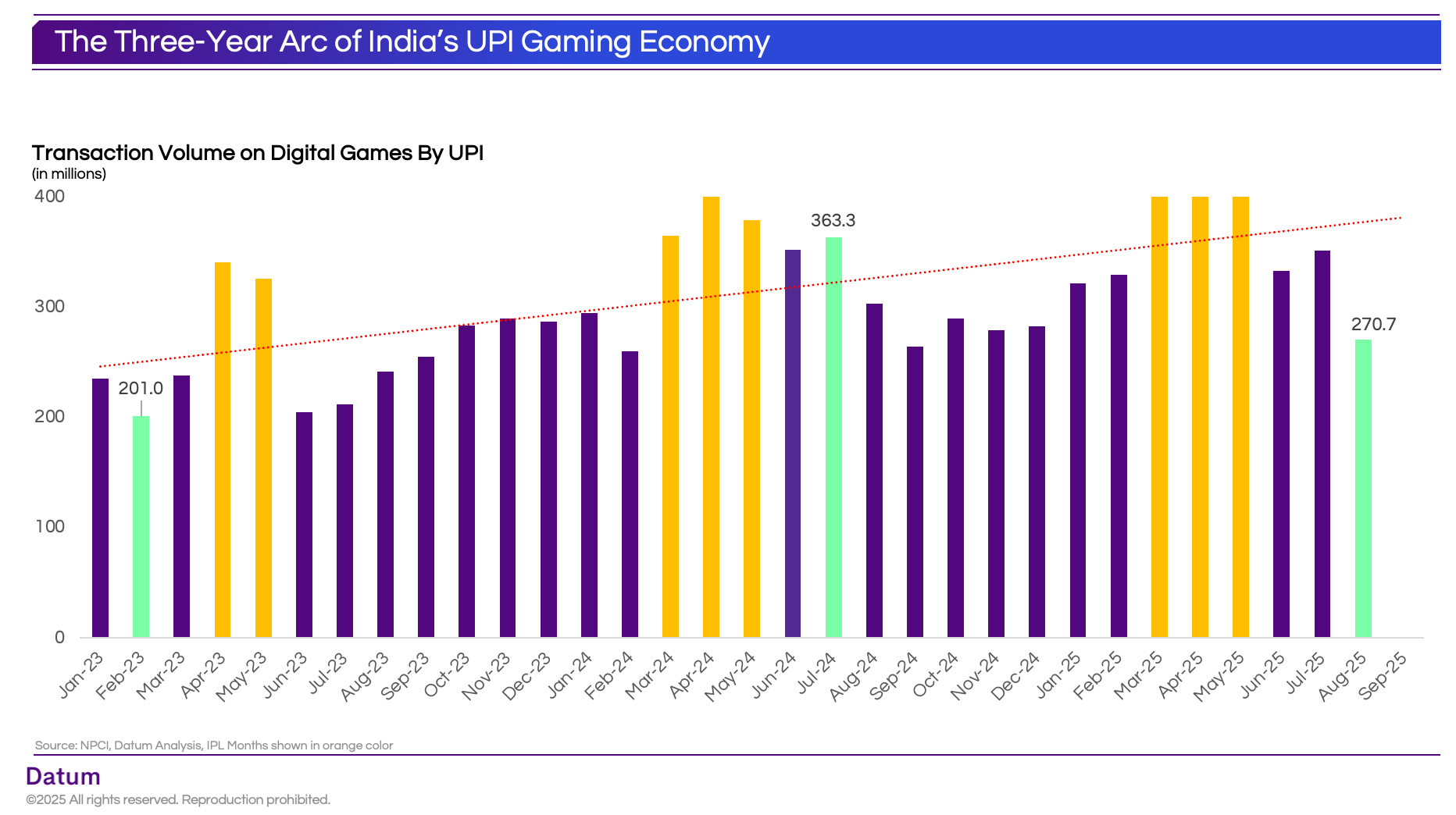

Transaction Volume on Digital Games via UPI Shows Sustained Growth Through 2025

Behind India’s ₹3 lakh-crore gaming economy lies a staggering surge in user activity. The number of UPI gaming transactions more than doubled between early 2023 and mid-2025, highlighting how gaming has evolved into one of the country’s most frequent digital payment use cases.

From 201 million transactions in February 2023, monthly volumes rose steadily to cross 363 million by July 2024 - the highest on record. Each IPL season (April–May, in orange) delivered visible spikes in transaction count, as millions of players joined fantasy contests and casual gaming platforms during match weeks.

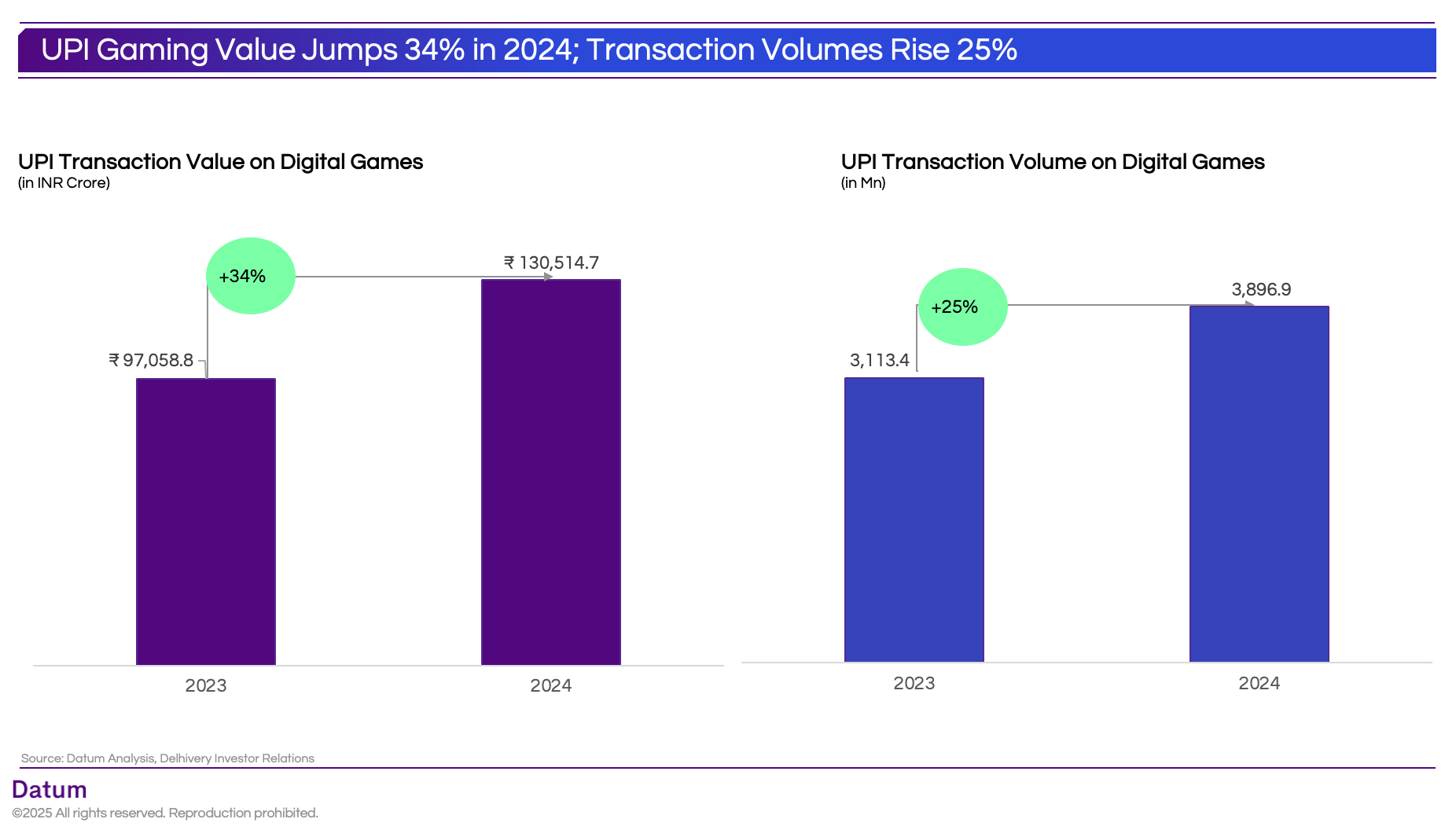

If we compare the full-year 2024 data with 2023, UPI gaming payments grew sharply across both value and volume metrics. Total transaction value increased by 34%, rising from ₹97,058 crore in 2023 to ₹1,30,515 crore in 2024, while transaction volumes climbed 25%, from 3.1 billion to 3.9 billion payments.

The data reflects not only the expansion of India’s gaming user base but also deeper engagement per player, as average spend per transaction rose with larger contest entries and reward-based play. Much of this momentum was fueled by the IPL 2024 season, which delivered record spikes in UPI gaming activity and cemented fantasy and skill-based gaming as key drivers of digital payment growth.

July 2024’s record UPI gaming transaction value wasn’t driven by new gameplay, but by the financial after-shock of two consecutive cricket spectacles - the IPL and the T20 World Cup - whose reward and payout settlements converged within a single accounting cycle.

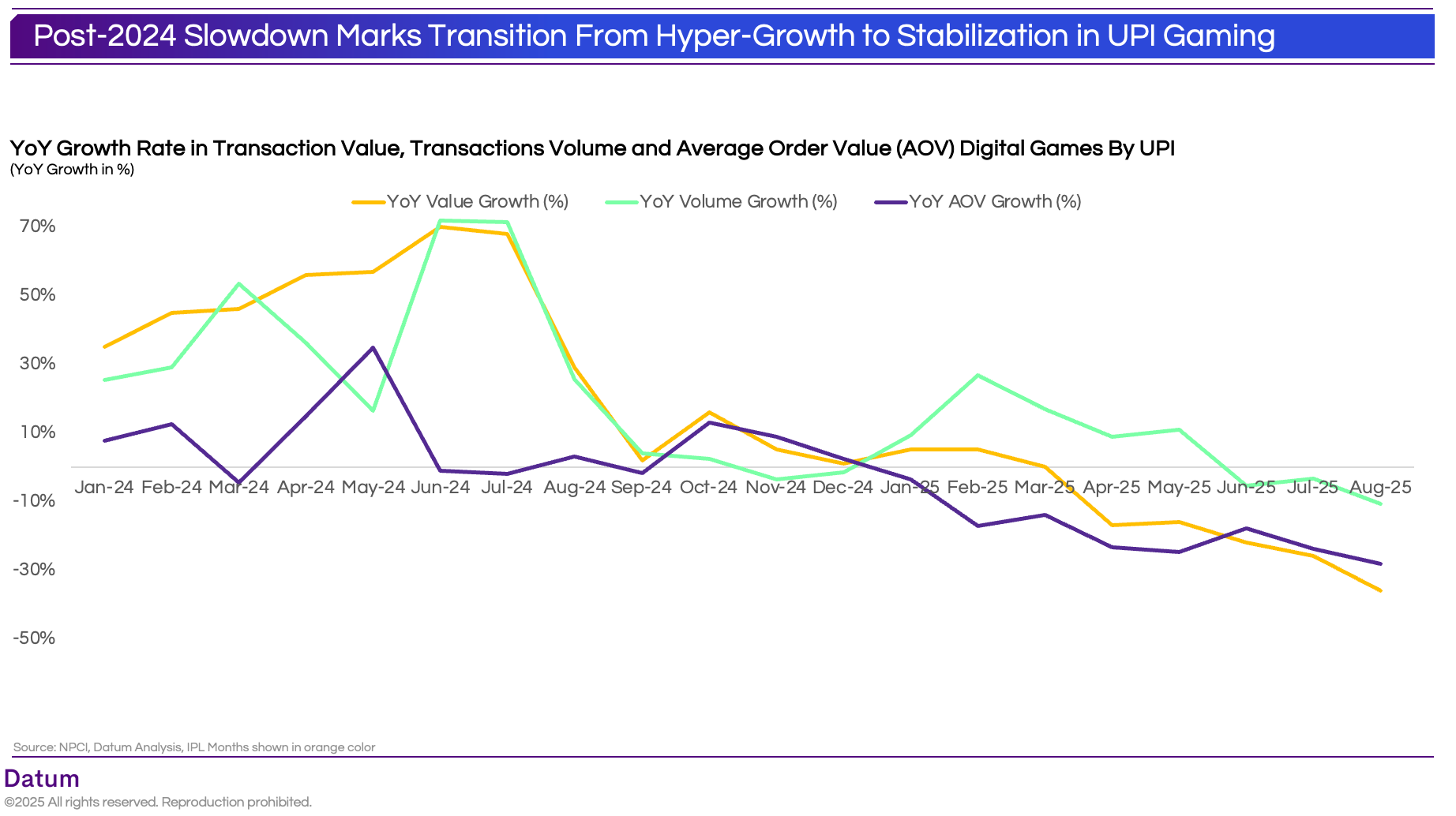

The UPI gaming ecosystem witnessed its steepest growth curve in mid-2024, with transaction values and volumes soaring by nearly 60–70% year-on-year during the IPL and T20 World Cup months. However, this momentum quickly tapered after July 2024 as the combined impact of the 28% GST regime (implemented from October 2023) and the tightened online gaming compliance framework reshaped market dynamics.

Average Order Value (AOV) began to decline steadily, reflecting smaller but more frequent wagers as gaming expanded beyond high-value users into a broader base of casual participants. By mid-2025, both value and volume growth had slipped into decline, reflecting the industry’s post-regulation cool-off after two years of rapid expansion. The focus for gaming platforms has now moved from rapid acquisition to retention, trust, and payout efficiency - marking the evolution of India’s real-money gaming industry into a more sustainable, compliance-led ecosystem.

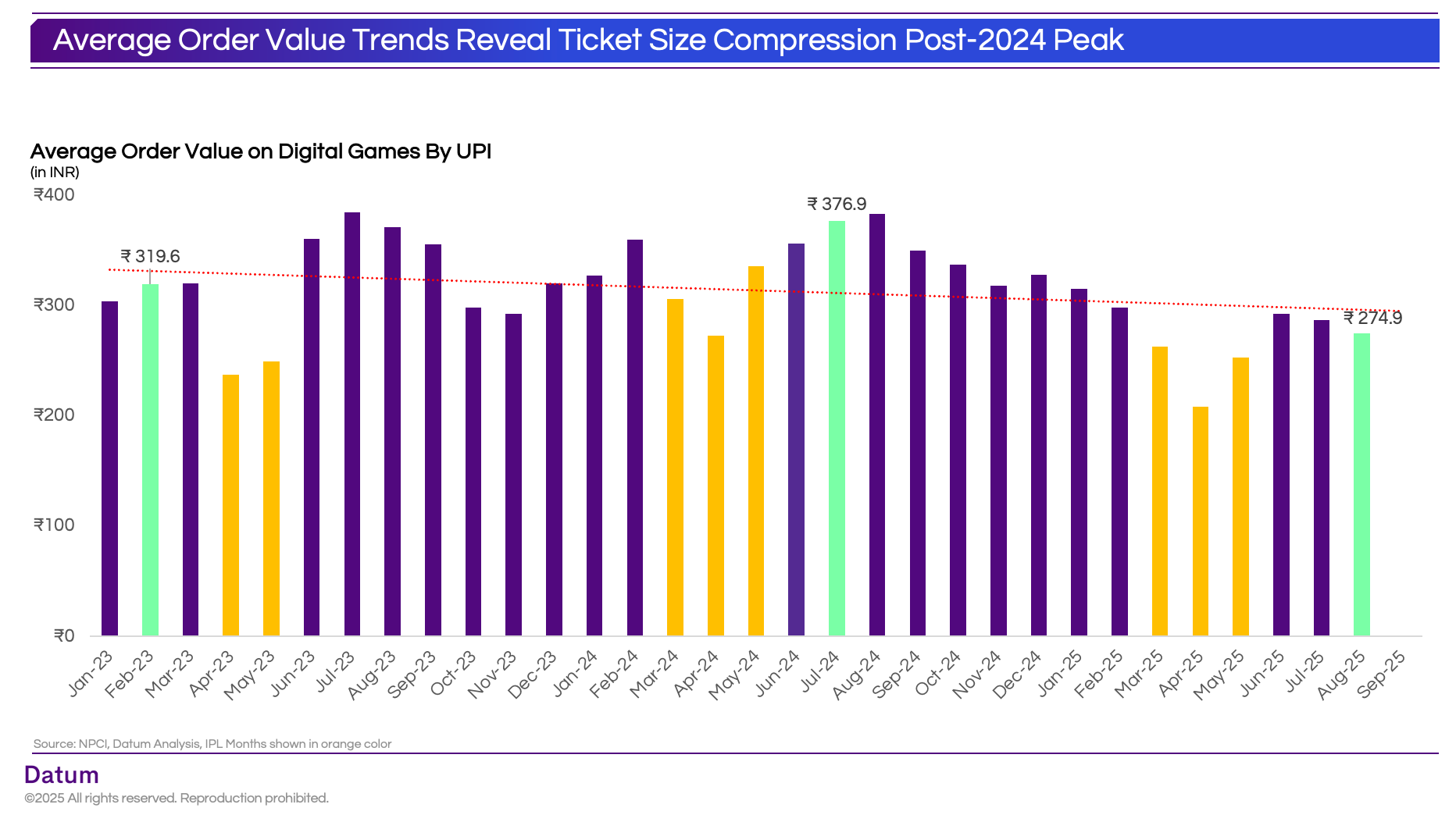

Average Transaction Value (Ticket Size) Trends

Average UPI payment size for digital gaming, by month. The AOV saw a whipsaw pattern – climbing through 2023 (₹300±) to a peak of ~₹380 in mid-2024, then plunging to ₹208 in April 2025 (IPL) before partially rebounding. Smaller ticket sizes in 2025 reflect the flood of micro-payments (fantasy games, etc.).

2025 saw a dramatic dip in AOV. By April 2025, the average UPI gaming transaction plunged to just ₹208 – nearly half the size from eight months prior. This was the direct result of massive growth in small-value transactions. The IPL 2025 season brought millions of new or casual players making tiny bets and entry fees (often ₹50–₹200 each). UPI enabled these micro-payments seamlessly, so the influx of low-ticket payments dragged the average down. In other words, gaming expanded “down-market” to the masses.

Post-RMG Bill Impact: UPI Gaming Spend Collapses, Category Falls Out of Top 50

The RMG Bill has structurally reshaped India’s digital gaming payment landscape.

Gaming’s exit from the top 50 UPI merchant categories underscores a formal-to-informal migration, with real-money flows moving off-regulated channels. For fintechs, this signals compliance-led contraction in one of UPI’s fastest-growing verticals - and a test case for how regulation can realign an entire payment ecosystem.

Gaming platforms will now face an uphill battle to regain user trust and restore transaction volumes to pre-RMG Bill levels - requiring significant effort in compliance, payment integration, and consumer re-engagement.