Table of Contents

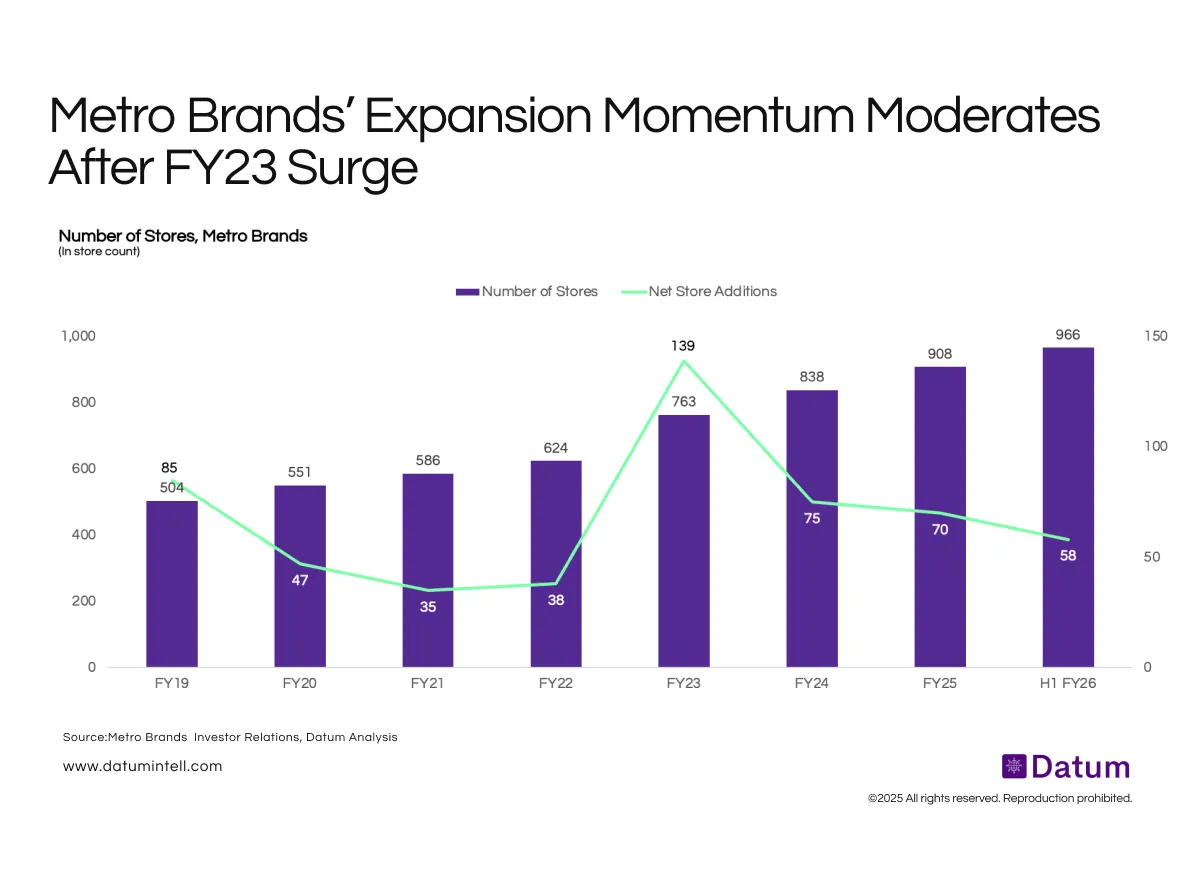

Metro Brands expanded aggressively in FY23, adding 139 new stores - nearly 4× the pace of the prior year - taking its total to 763 stores. Since then, growth has steadied, with 75 additions in FY24 and 58 in H1 FY26, bringing the total network to 966 stores.

The Metro format accounted for the largest share of new stores, with 28 additions, representing 40% of total net additions, consistent with the previous year. Mochi added 19 stores, though its contribution to overall additions moderated from 39% in FY24 to 27% in FY25.

Store expansion under Walkway, FitFlop, and FILA remained limited. However, management has turned more optimistic about Walkway’s unit economics and intends to scale this format selectively.

Overall store additions were constrained by elevated rental costs for new locations, which affected store-level profitability and led to a more cautious expansion approach. With rentals now easing from peak levels, conditions are gradually becoming more conducive for renewed expansion in the coming quarters.

What it Means

After a rapid post-pandemic expansion phase, Metro Brands appears to be normalizing its store growth trajectory. The moderation likely reflects a strategic shift toward optimizing productivity and same-store sales rather than pure footprint expansion. The base is now large enough that incremental additions yield smaller percentage growth but higher operational depth.