Table of Contents

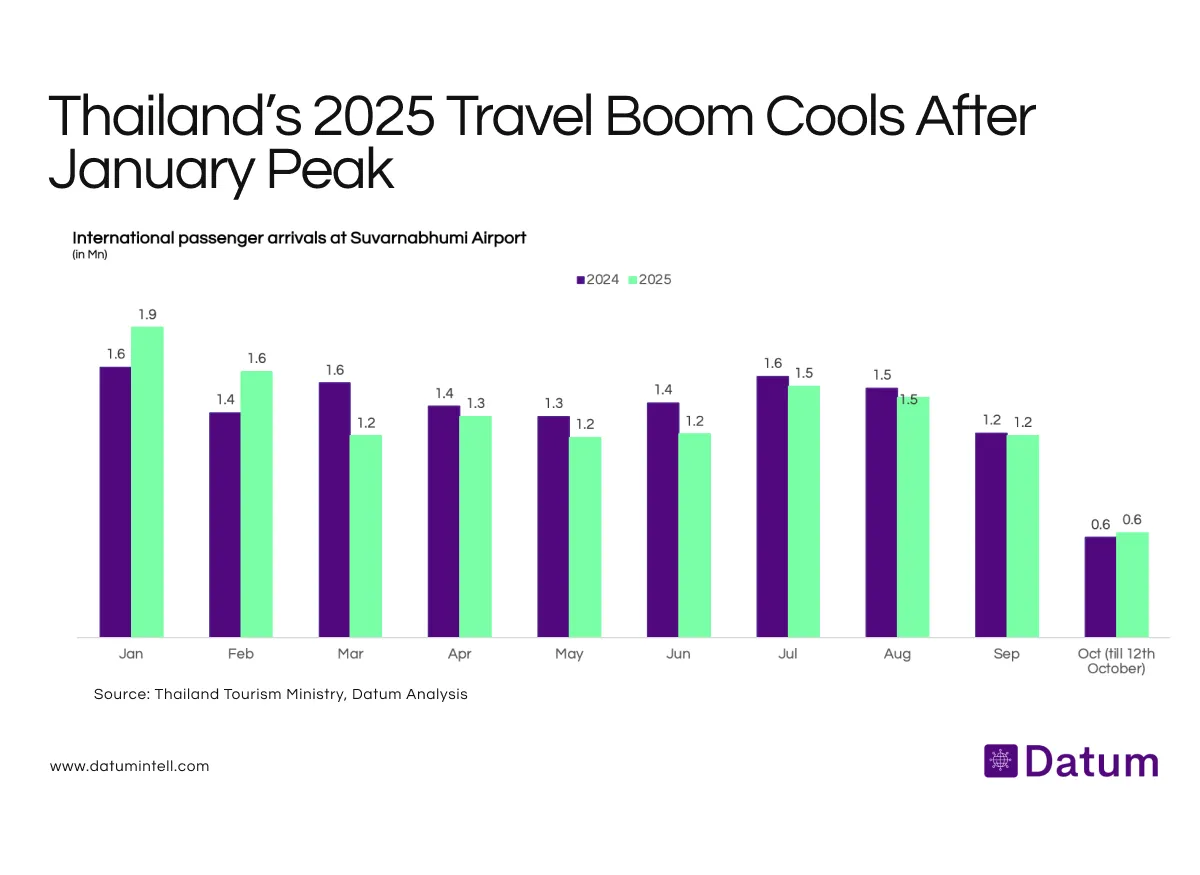

After a strong recovery in early 2025, Thailand’s inbound travel growth is showing clear signs of fatigue. Data from the Thailand Tourism Ministry and Datum Analysis reveals that international passenger arrivals at Suvarnabhumi Airport, Bangkok, started the year with robust momentum - peaking at 1.9 million visitors in January 2025, a 19% year-on-year surge. However, that momentum gradually softened, with arrivals sliding to 1.2 million by September 2025, signaling a sharp mid-year slowdown in travel demand.

This deceleration stands in contrast to the buoyant travel sentiment observed in early 2024, when Thailand was among Asia’s top tourism recovery stories. The country had reopened borders, expanded visa-free access for Chinese and Indian travelers, and benefited from pent-up global demand for leisure travel. However, sustaining that momentum into 2025 has proven challenging amid changing macroeconomic dynamics and external headwinds.

The Seasonal and Structural Slowdown

While part of the mid-year dip reflects typical seasonality — with lower arrivals between April and June — the underlying softness is more structural. Airfare inflation across Asia, a stronger Thai baht, and uneven economic recoveries in key feeder markets such as China and Malaysia have weighed on inbound volumes.

Chinese tourist arrivals, which accounted for nearly one-fourth of Thailand’s pre-pandemic inflow, have yet to return to full strength. The post-pandemic recovery in outbound China tourism remains below expectations, driven by slower domestic consumption and limited flight capacity. For Thailand, this translates into persistent pressure on high-volume tourist corridors that were once critical for retail and hospitality sectors.

At the same time, Western long-haul travel demand is plateauing. The combination of inflationary pressure, higher living costs, and geopolitical uncertainty has prompted travelers from Europe and the US to delay or shorten trips to Southeast Asia.

Implications for Thailand’s Tourism-Led Economy

Tourism remains Thailand’s most vital growth lever, contributing roughly 20% of GDP and employing nearly one in five Thais. The slowdown in passenger arrivals is not just an aviation story -it has direct implications for the country’s consumption cycle, from hotels and restaurants to retail, transport, and entertainment.

Bangkok’s hotel occupancy rates, which hovered near 75% in Q1 2025, have already fallen back into the mid-60s range by mid-year. Meanwhile, airport retail operators and QSR chains catering to foreign tourists report weaker ticket sizes and shorter average stays.

However, not all segments are under pressure. Domestic tourism continues to hold up, supported by government travel incentives and improving regional connectivity. Thailand’s airport operator, AOT, has also accelerated capacity expansions at Phuket and Chiang Mai to handle next year’s demand rebound ahead of The New Thailand 2026 campaign.

What to Watch

The last quarter of 2025 will be critical in determining whether Thailand’s tourism momentum can stabilize. Much depends on China’s outbound travel recovery, regional flight capacity restoration, and the success of Thailand’s visa-free and extended-stay programs.

For now, the trend is clear: Thailand’s 2025 travel wave has lost some altitude -but with the right policy mix and sustained demand from ASEAN markets, its tourism engine could still regain cruising speed in 2026.