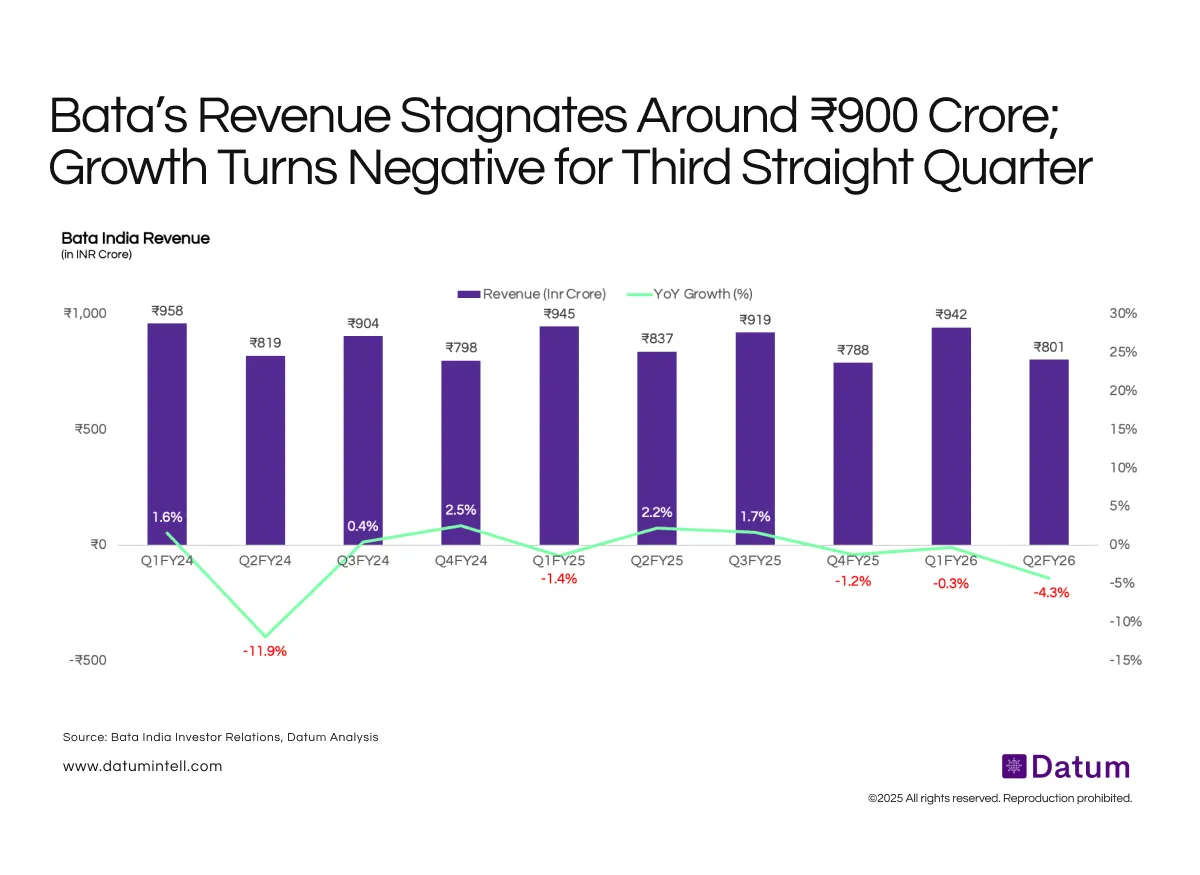

Muted Consumer Demand Keeps Bata’s Sales Flat at ₹900 Cr Run Rate

Bata India’s revenue slipped to ₹801 crore in Q2 FY26, down 4.3% YoY - the brand’s third consecutive quarter of negative growth. Despite steady topline around ₹900 crore, Bata’s recovery remains uneven amid muted consumer sentiment in discretionary retail.