Titan EyeCare Shows Robust Start to FY26, Though Q2 Remains Soft

Titan EyeCare’s Q2 slowdown reflects seasonal normalisation rather than structural weakness, with FY26 still tracking a stronger growth base than previous years.

Data about important topics based on our proprietary research and over 1000 third party sources.

Titan EyeCare’s Q2 slowdown reflects seasonal normalisation rather than structural weakness, with FY26 still tracking a stronger growth base than previous years.

Exports, festive strength, and a premium SUV mix helped stabilise Hyundai’s Q2 performance, even as domestic volumes softened and Pune-plant costs loom.

Lemon Tree posts its strongest Q2 ever, signalling a structurally higher revenue base even as YoY growth normalises to single digits.

Marico’s move from low single-digit to 7–9% domestic volume growth marks a clear inflection, driven by rural revival, portfolio strengthening, and improving category dynamics.

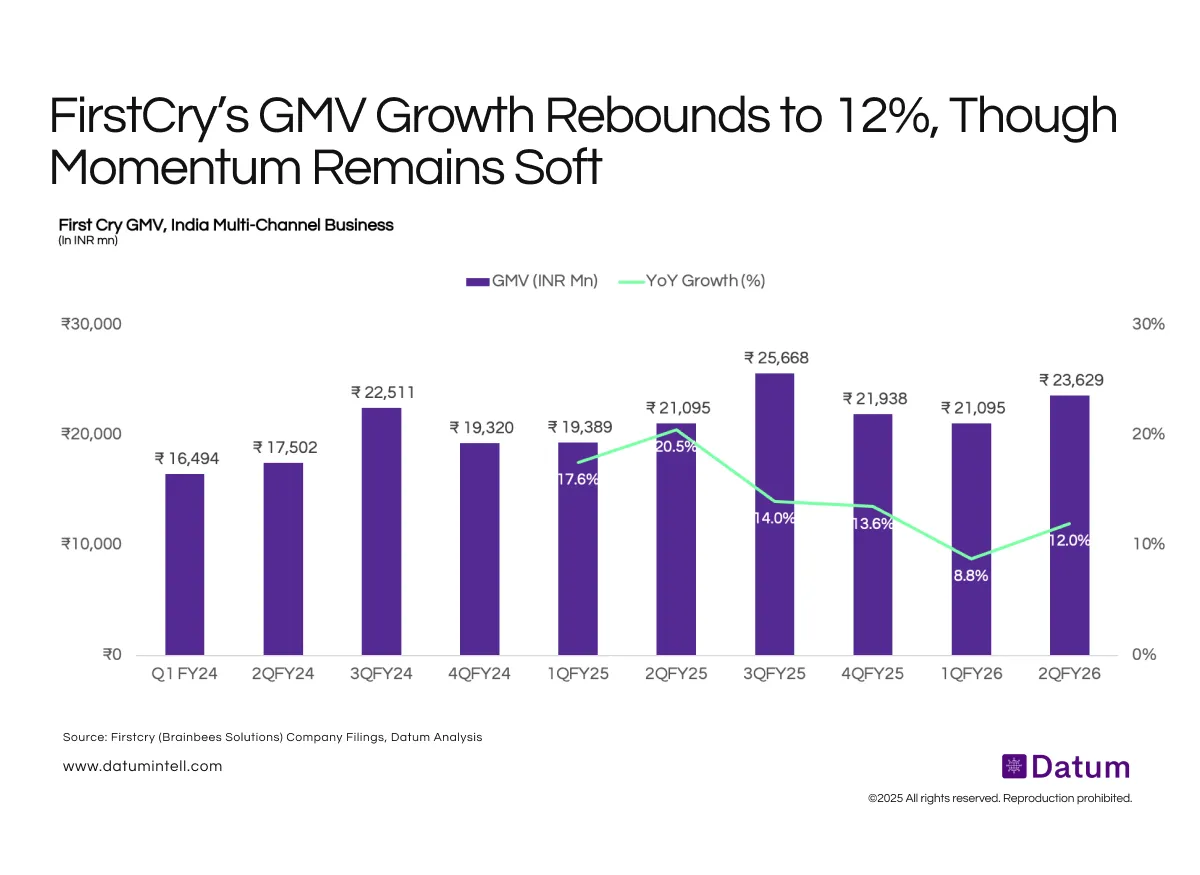

FirstCry maintains steady double-digit GMV growth, supported by strong omnichannel execution and sustained consumer demand across key baby and kids categories.

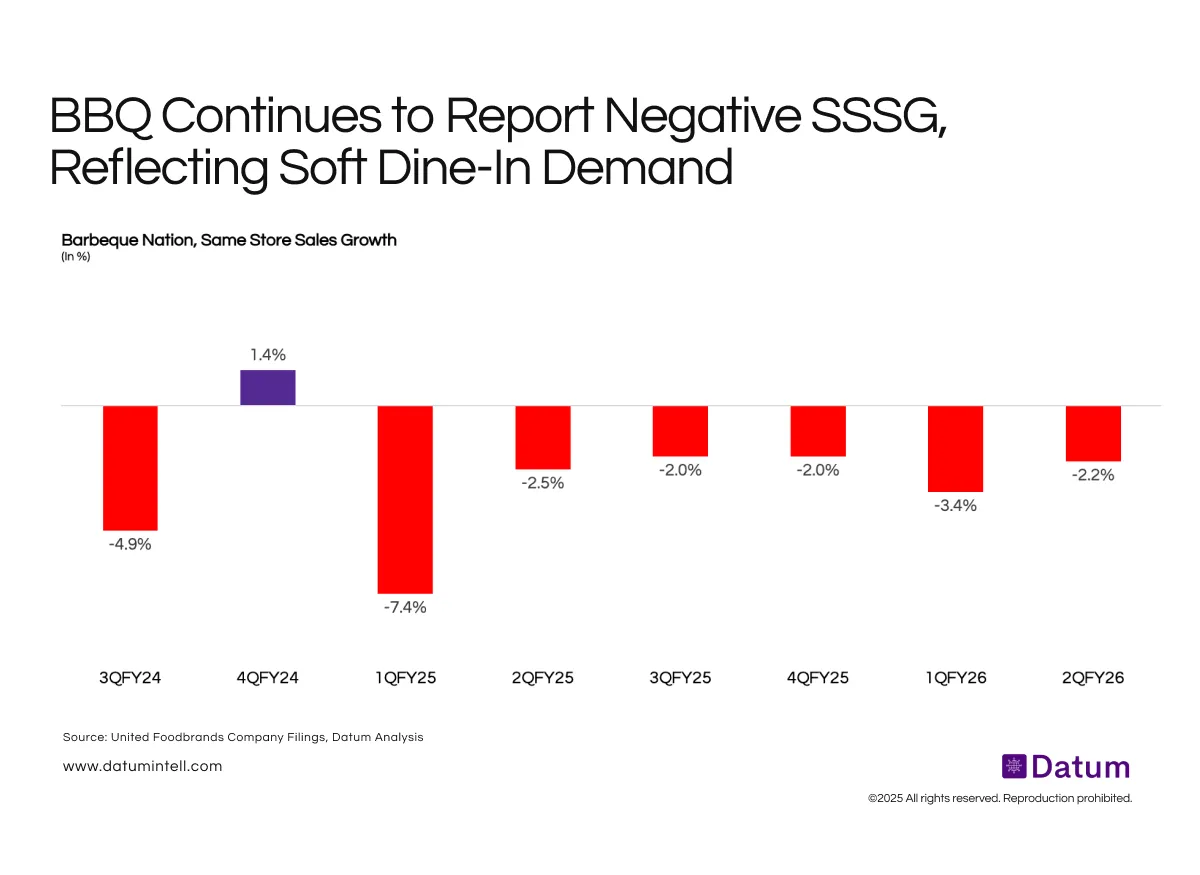

Barbeque Nation’s SSSG has stayed negative for most quarters, underscoring soft discretionary demand and limited unit-level momentum despite ongoing store expansion.

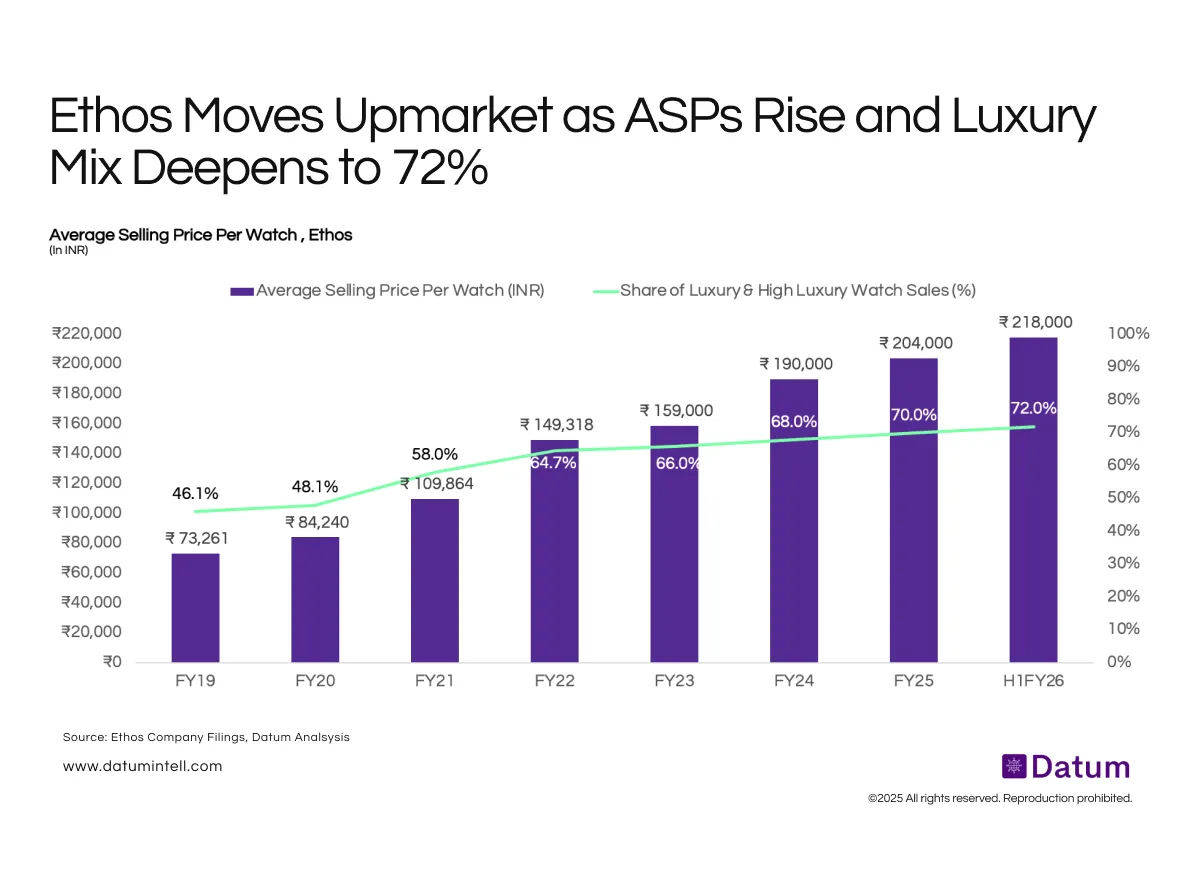

A sharp rise in ASPs and the luxury mix highlights Ethos’ successful pivot toward premium categories, reinforcing its position as India’s leading luxury watch retailer.

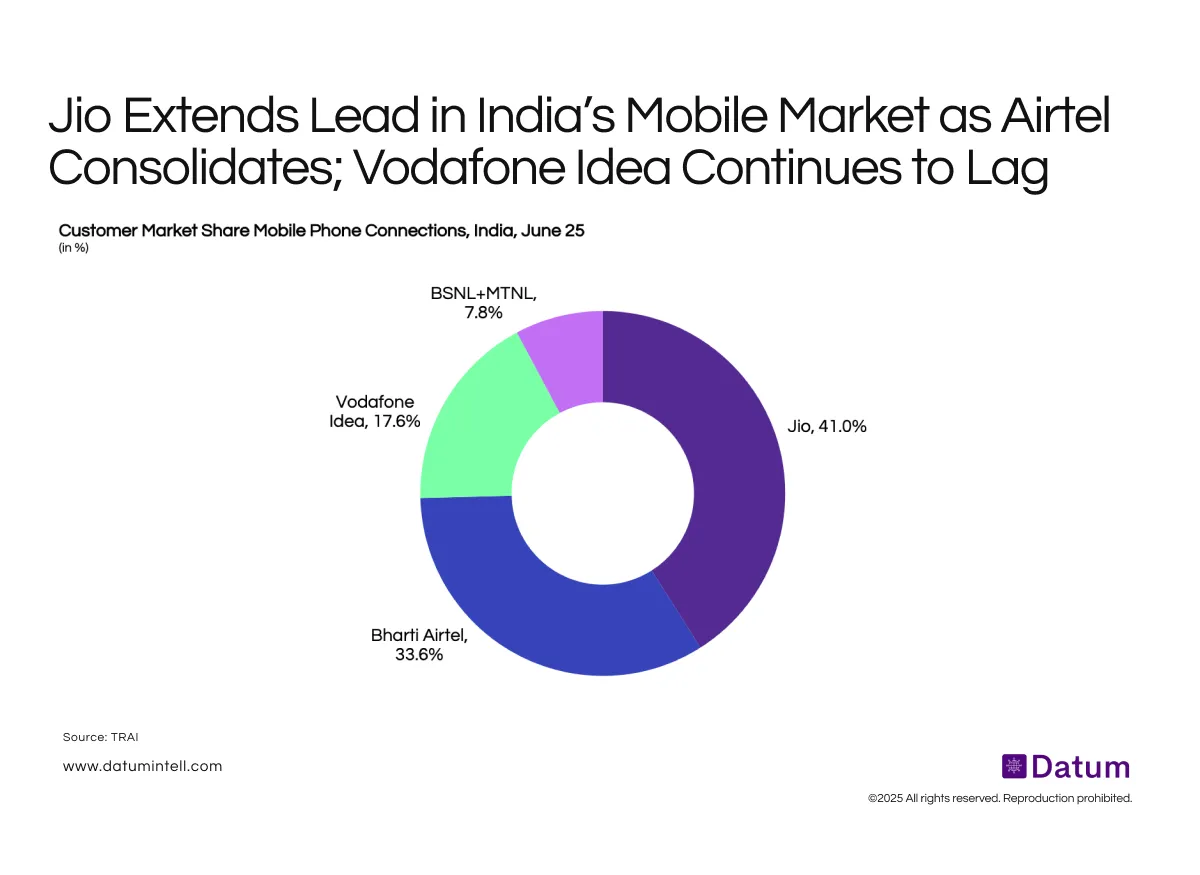

Jio and Airtel now control nearly three-quarters of India’s mobile connections, reflecting a structurally consolidated market. Vodafone Idea and state operators remain on the back foot, reinforcing a clear two-player leadership model.

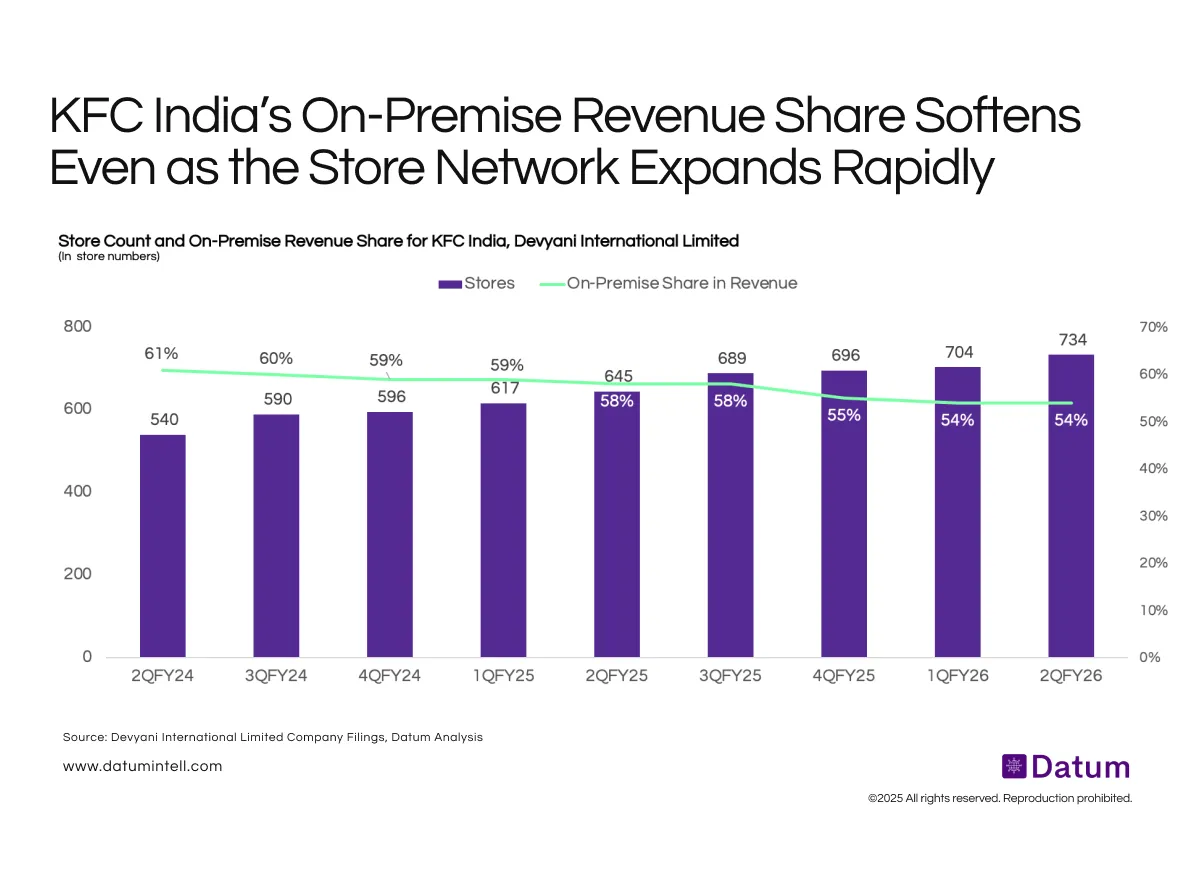

KFC India’s rapid footprint expansion is reshaping its channel economics, with off-premise consumption taking a larger share of revenue even as the store base grows. The gradual decline in dine-in contribution signals a structural evolution toward a delivery-first footprint across markets.

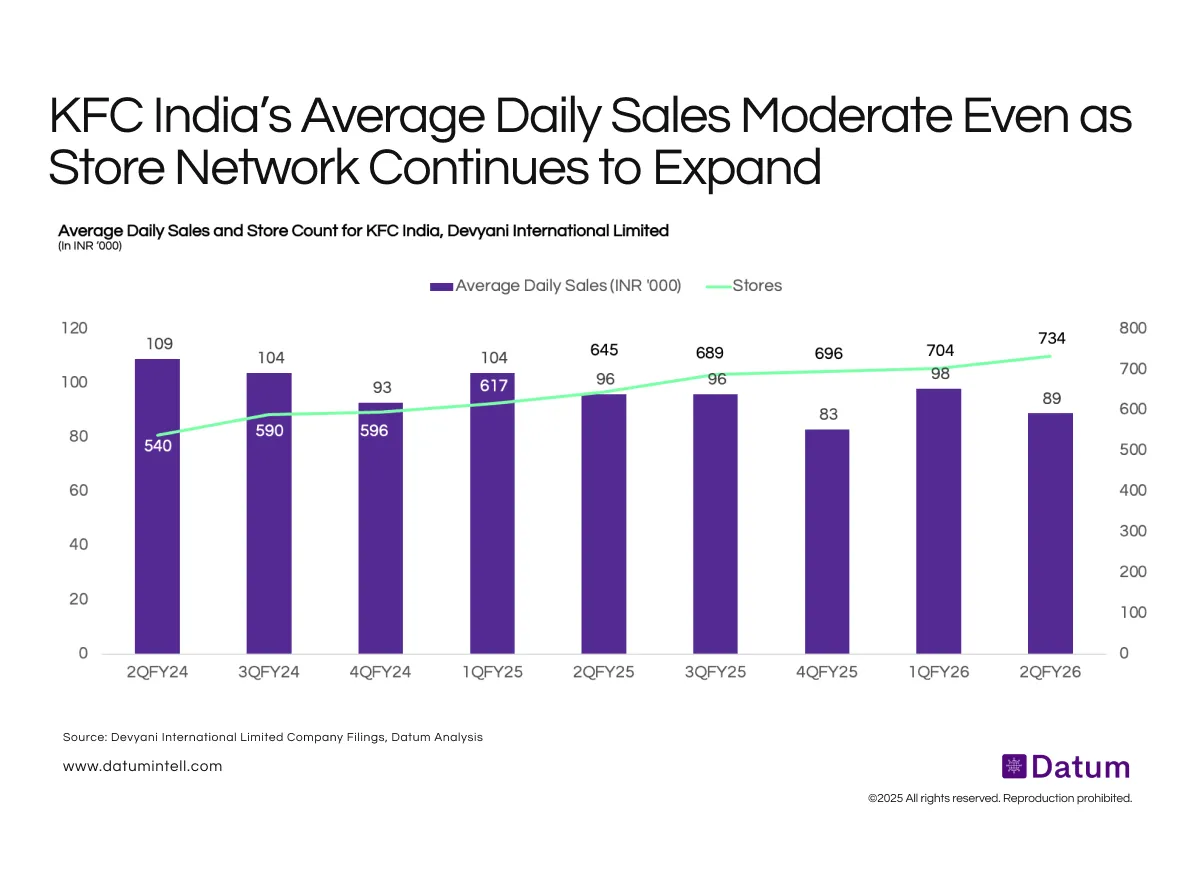

KFC India continues to enlarge its footprint, but average daily sales per store have softened over eight quarters, signalling unit-level pressure amid aggressive expansion. The slight recovery in FY26 indicates stabilisation, but productivity remains below FY24 peaks.

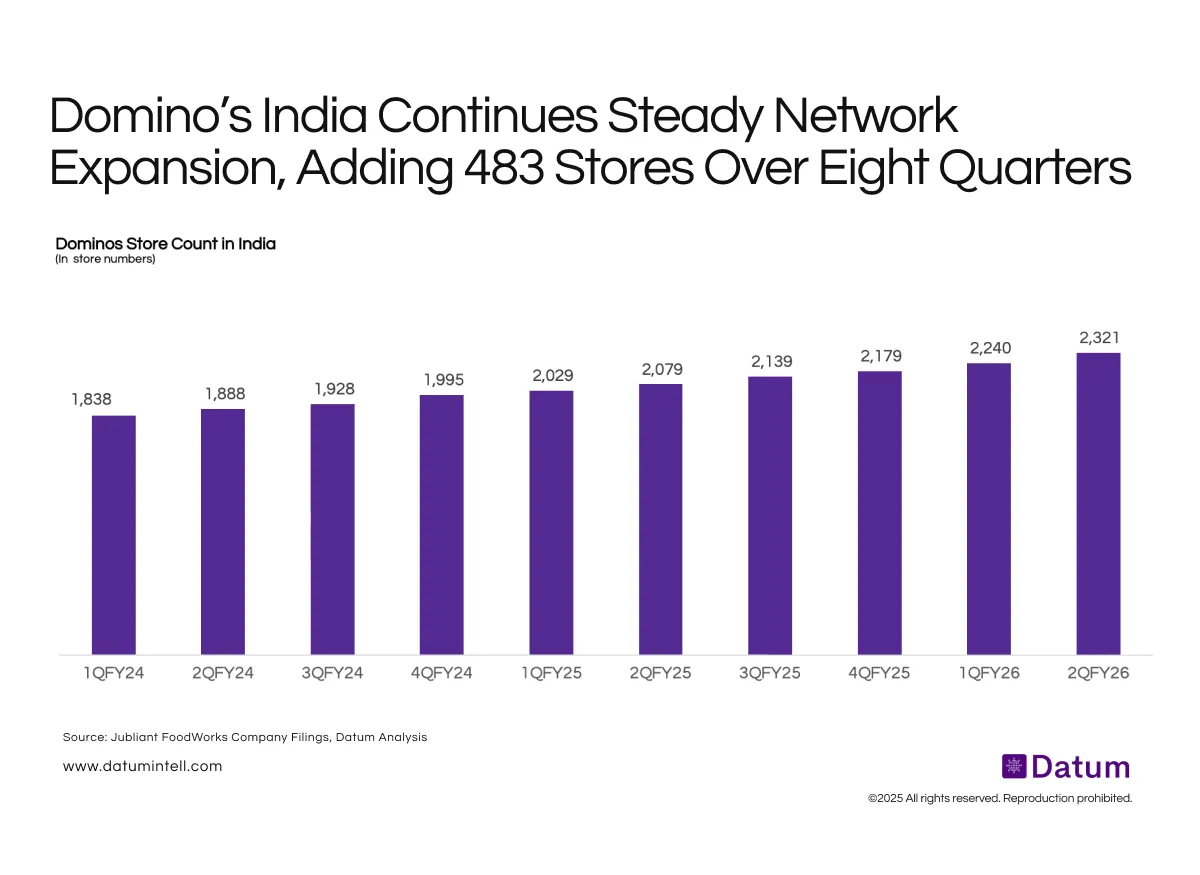

Domino’s added 483 stores over eight quarters, reinforcing its leadership position and deepening reach across India. Its expansion strategy remains footprint-led, with continued push into Tier 2/3 markets and a delivery-first model enabling rapid scale.

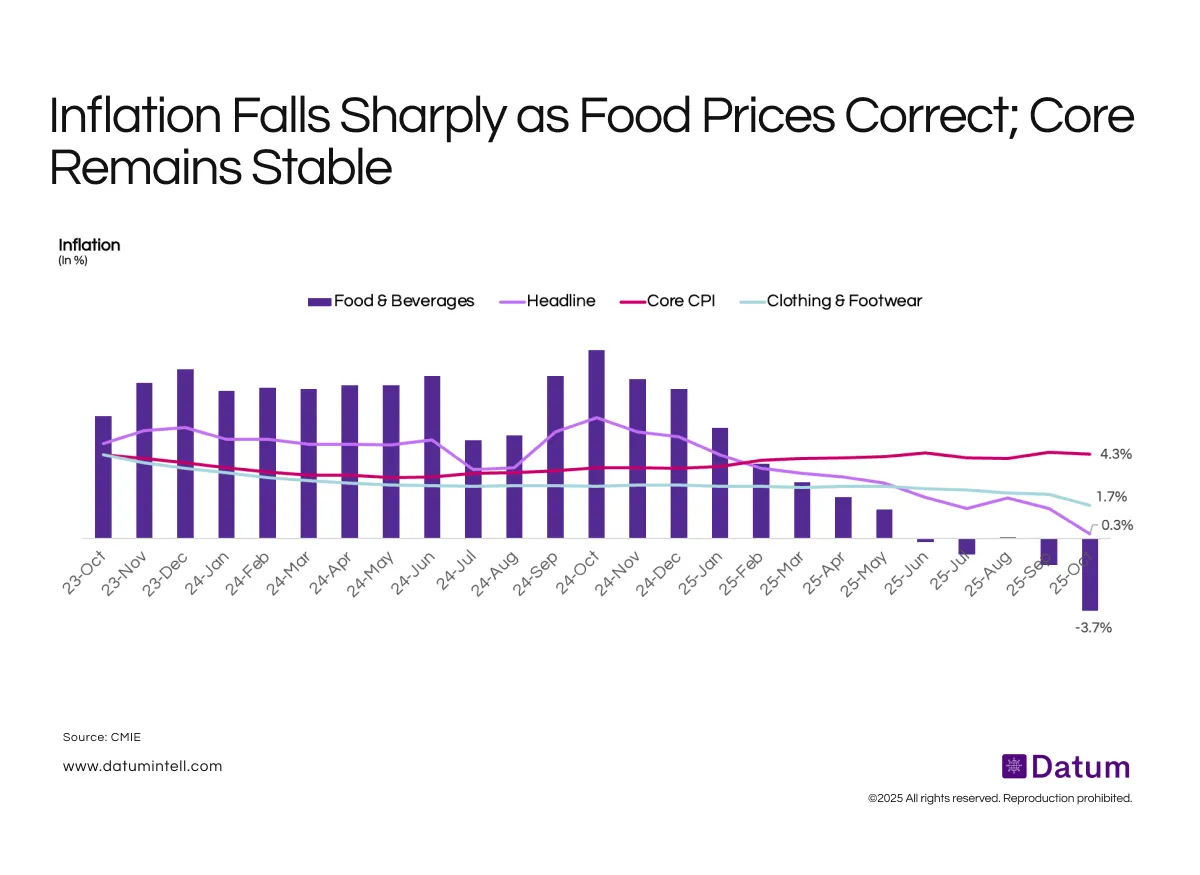

A steep correction in food prices has pulled headline inflation close to zero, even as core remains steady. The combination of food disinflation, soft fuel costs, and stable underlying demand sets a supportive backdrop for consumption and growth.

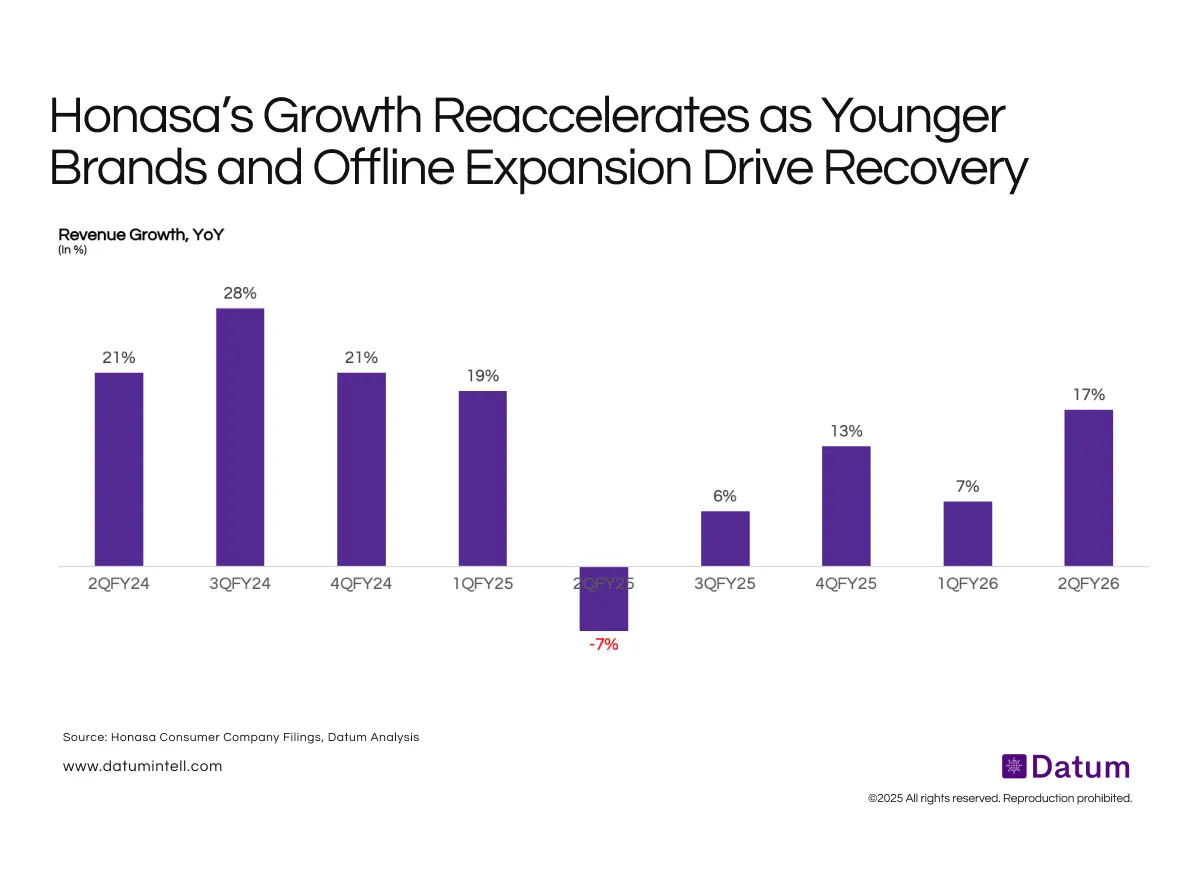

After a temporary dip, Honasa’s revenue growth has stabilised at mid-teen levels, supported by strong LFL recovery, expanding distribution, and rapid scale-up of younger brands like The Derma Co. and Aqualogica. The business enters 2HFY26 with strengthened fundamentals and broader category momentum.

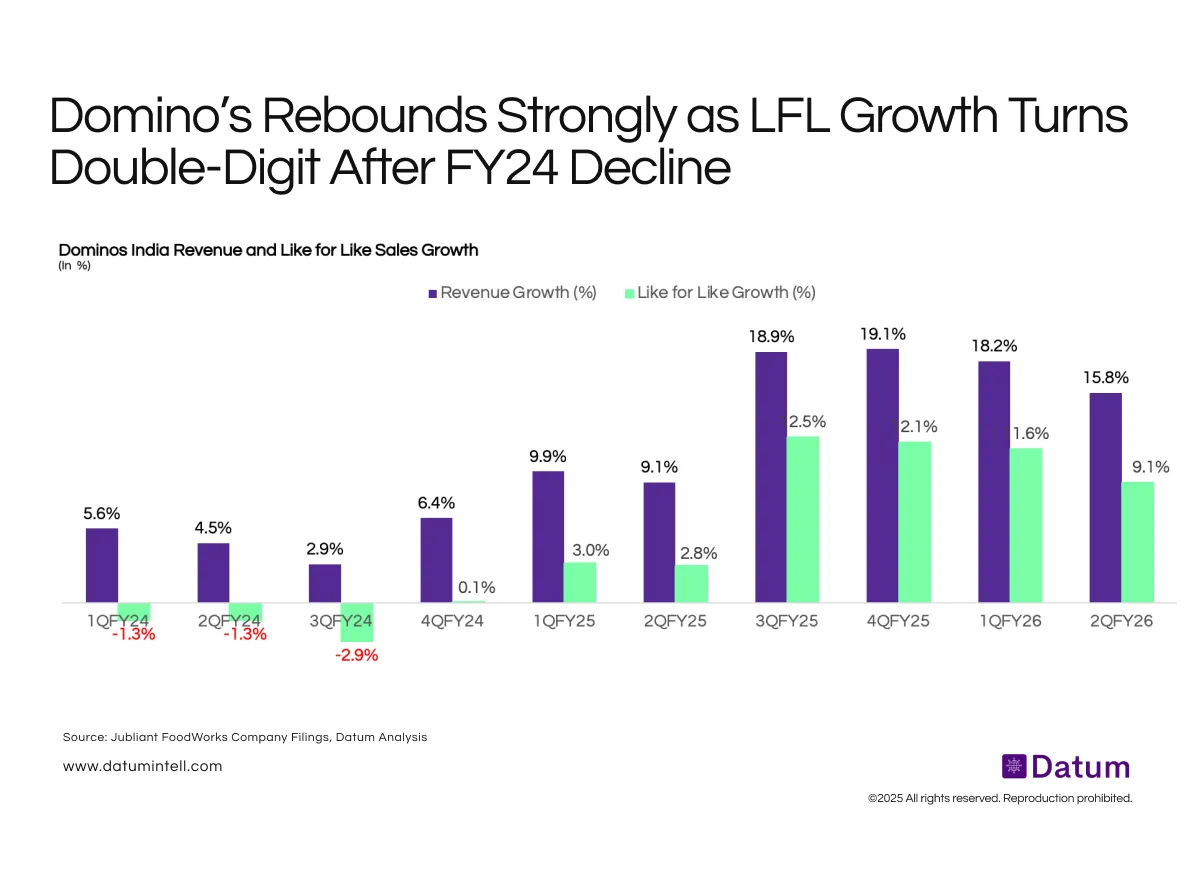

Domino’s has transitioned from negative LFL growth in FY24 to strong double-digit gains in FY25, lifting revenue growth to ~19%. Though moderating in FY26, the improved LFL trajectory highlights a healthier base and stronger underlying demand.

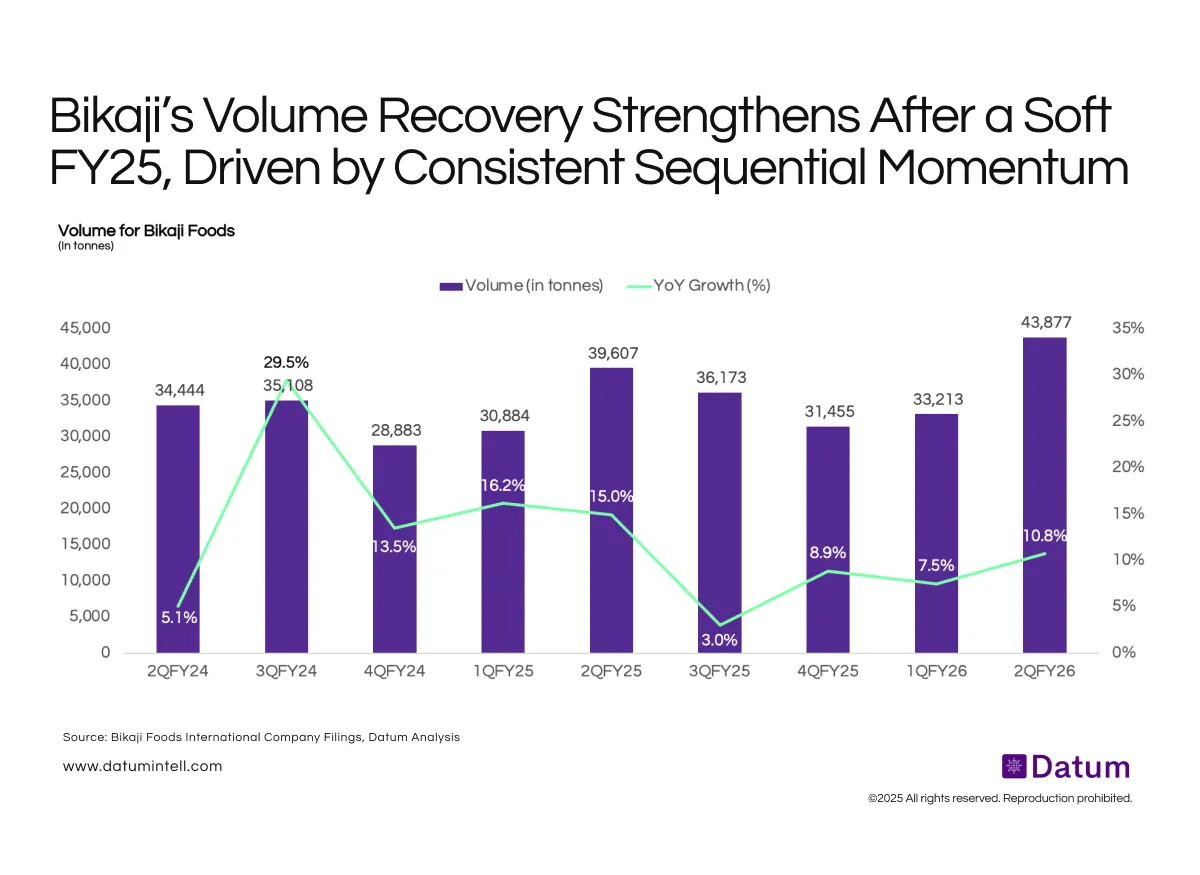

Bikaji’s volumes bounced back to their highest levels in 2QFY26, signalling resilient demand and stronger operational execution after a volatile FY25. While YoY growth remains uneven, the consistent sequential uptick underscores a broader consumption recovery and improved momentum across channels.

Domino’s delivery channel now contributes nearly three-fourths of revenue, fuelled by strong order and revenue growth, while dine-in remains flat. The trend reinforces Domino’s shift toward a delivery-first model shaped by convenience, aggregator penetration, and evolving consumer behaviour.