Table of Contents

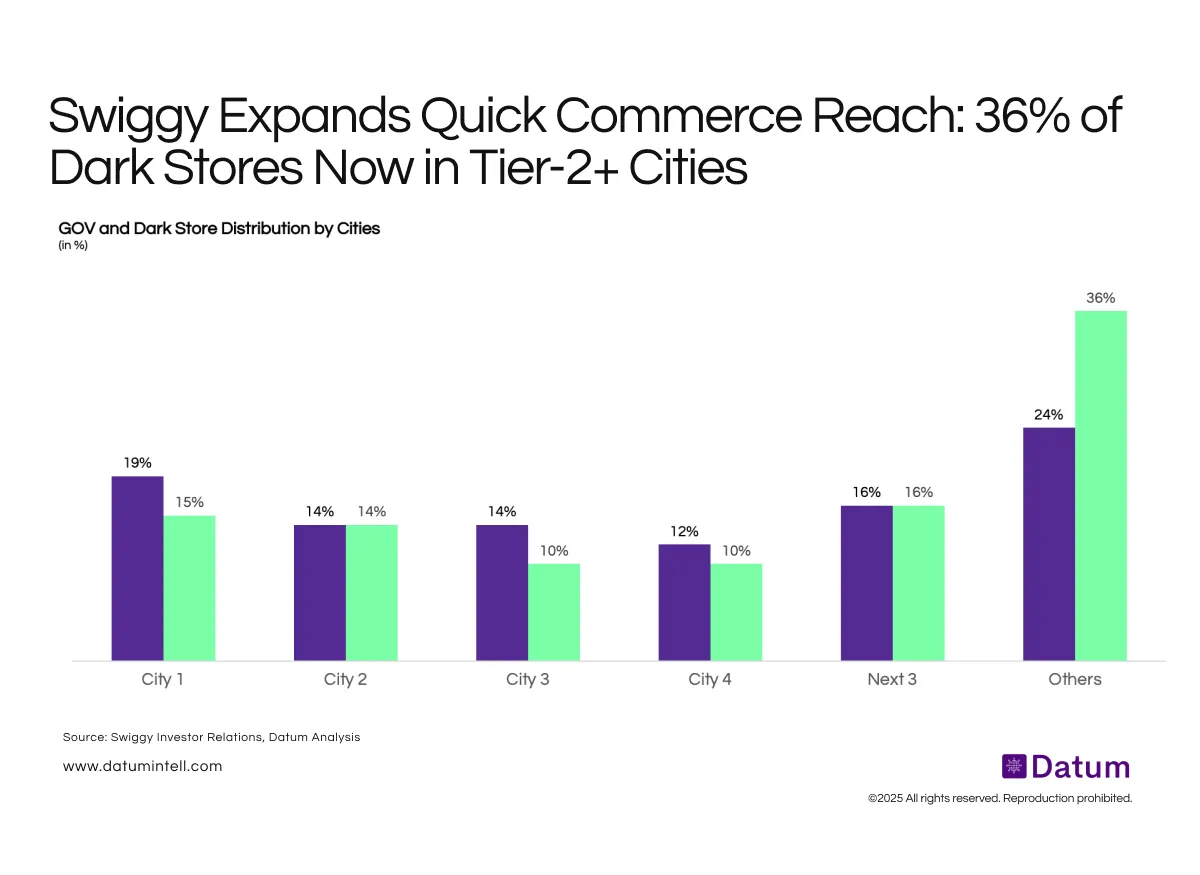

Swiggy’s quick commerce footprint is increasingly distributed across non-metro cities, reflecting the platform’s focus on scaling in India’s next consumption frontiers.

While City 1 (metros) contributes 19% of GOV and 15% of stores, a growing 36% of dark stores are now located in “Other Cities” (beyond top 10), highlighting Swiggy’s strategic expansion into emerging demand clusters.

The balanced GOV-to-store ratio in Tier-2 and Tier-3 cities also suggests that Swiggy is driving strong unit economics outside metros through efficient delivery radii and higher asset utilization.

What It Means

- Beyond Metros: Quick commerce growth is no longer metro-led; Tier-2 and Tier-3 cities are becoming key revenue and store growth drivers.

- Asset Deployment Shift: Expansion toward smaller cities shows a long-term push for market coverage, inventory depth, and proximity to new customer bases.

- Operational Leverage: GOV concentration remains healthy in larger cities even as the store mix diversifies - indicating operational efficiency gains.

This geographic diversification marks Swiggy’s transition from an urban convenience model to a nationwide consumption enabler in quick commerce.