Table of Contents

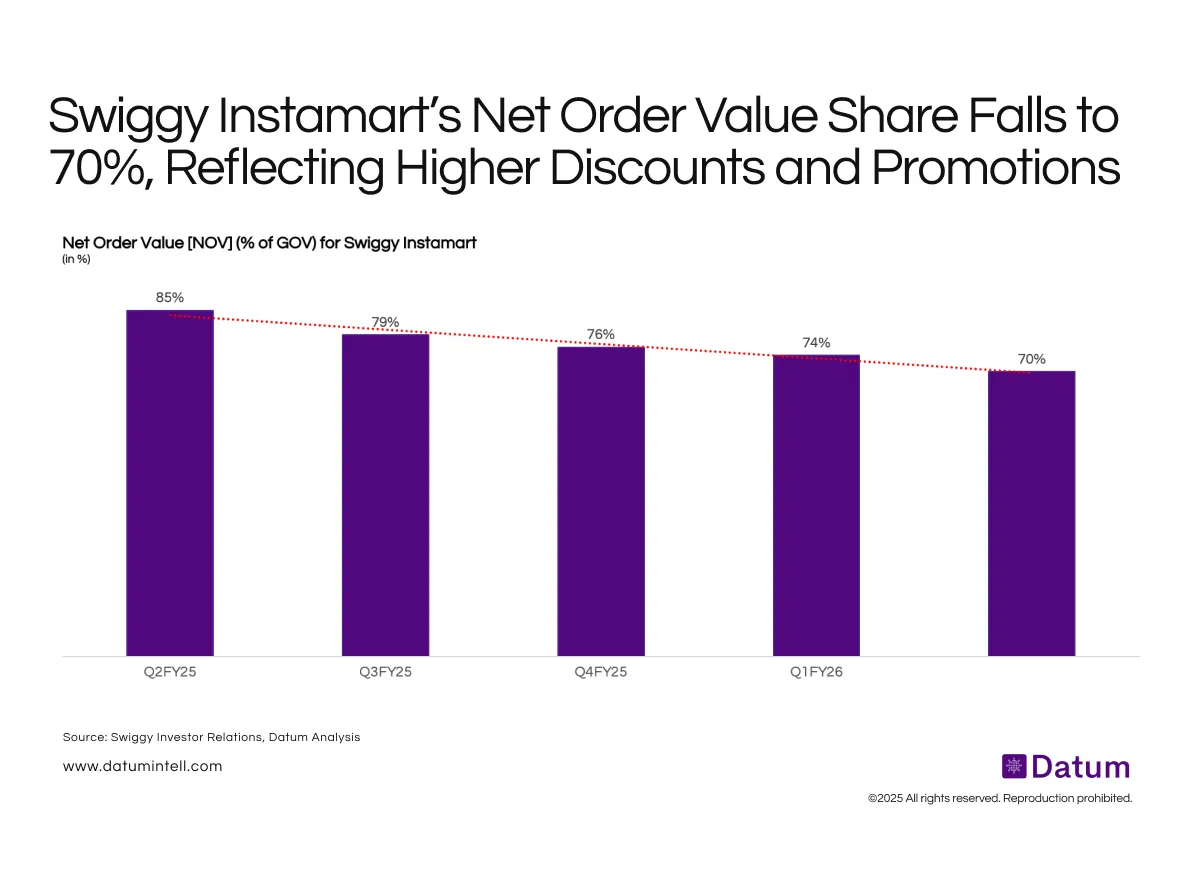

Swiggy Instamart’s Net Order Value (NOV) - the share of gross order value retained after discounts and delivery incentives — declined steadily from 85% in Q2 FY25 to 70% in Q2 FY26.

The consistent drop signals increased use of discounting and marketing spends to sustain order volumes amid intensifying competition from Blinkit and Zepto.

What It Means

- Erosion of Margin Efficiency: The fall in NOV indicates rising customer acquisition costs and delivery subsidies, putting pressure on Swiggy’s profitability.

- Competitive Response: With Blinkit’s surge in user growth and stronger integration with Zomato Gold, Swiggy appears to be matching price offers and expanding basket incentives to defend share.

- Shift in Growth Strategy: The focus has moved toward volume retention over contribution margin, suggesting a recalibration in short-term monetization priorities.