Table of Contents

For the first time since 2020, Starbucks experienced a decline in U.S. same-store sales, dropping 3% alongside a 7% decrease in foot traffic. Revenue also fell 1.8% to $8.56 billion, driven by an 11% decline in sales in China, the company's second-biggest market.

As a result of these challenges, Starbucks lowered its sales outlook for the year, reflecting the impact of weakened consumer demand and shifting market dynamics.

Why is it struggling?

Starbucks is facing a combination of challenges that have contributed to its recent struggles, according to CEO Laxman Narasimhan. Inflationary pressures and increasingly cautious consumers have impacted the company's sales, while adverse weather conditions have also played a role in reducing customer traffic

We face a challenging operating environment. Headwinds discussed last quarter have continued. In a number of key markets, we continue to feel the impact of a more cautious consumer, particularly with our more occasional customer. And a deteriorating economic outlook has weighed on customer traffic, an impact felt broadly across the industry. - Laxman Narasimhan, Starbucks CEO

The China Factor

Starbucks see the biggest decline in sales of 11% in China and facing tough competition from local players like Luckin Coffee.

Aggressive Expansion

Over the past 12 months, Luckin Coffee has pursued an aggressive expansion strategy in China's rapidly growing coffee market. The Company added more than 9000 stores to double the number of stores in China as compare to around 900 stores by Starbucks.

Small Formats and Aggressive Pricing

Over the past year, Luckin Coffee has been pursuing an aggressive expansion strategy in China, driven by its focus on leveraging technology and targeting lower-tier cities.

The average size of a Luckin Coffee store in China is around 30-50 square meters, while the average size of a Starbucks store is around 150-200 square meters. This allows the Company to open stores much faster.

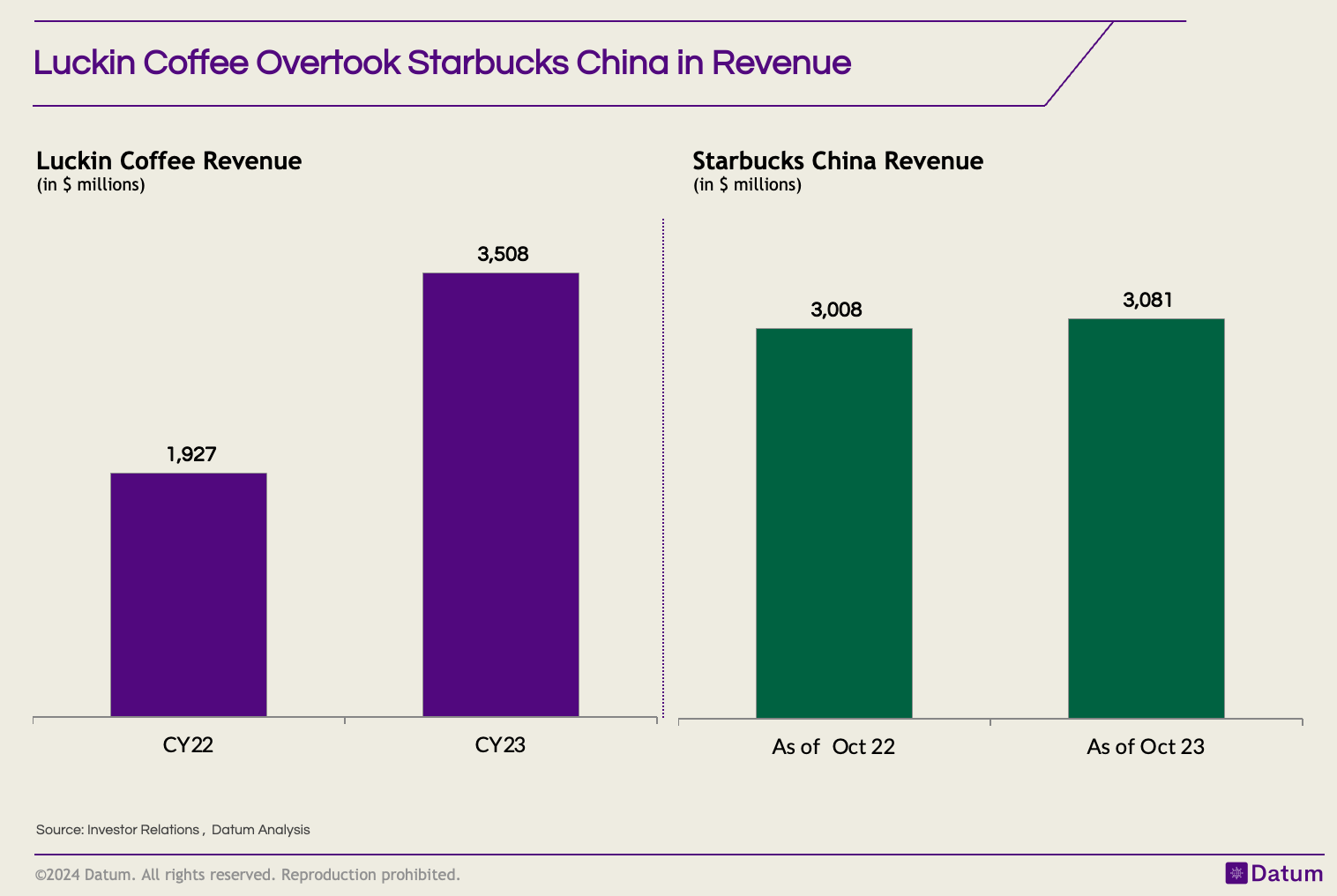

Luckin Coffee Overtook Starbucks China in Revenue

Luckin Coffee has overtaken Starbucks as the largest coffee chain in China in 2023. Luckin Coffee's annual sales for 2023 hit $3.5 billion, up 87.3 percent from the previous year's $1.9 billion . The chain brand's performance has outshone Starbucks' annual sales in China, which stood at $3.01 billion.

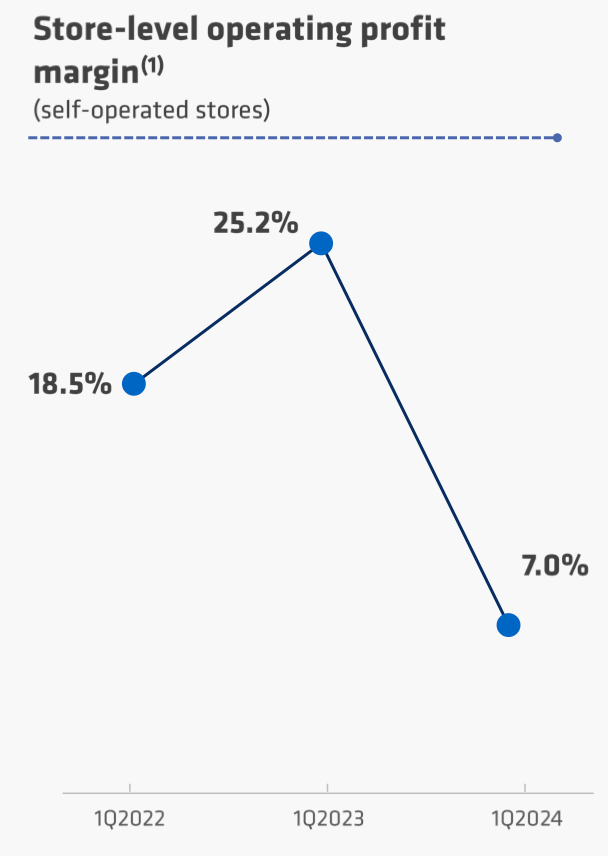

In response to the decline in sales, Starbucks' CEO Laxman Narasimhan has acknowledged that the company "didn't respond fast enough" to the changing market conditions. The company is now focused on improving its operational efficiency and expanding the number of promotions it offers in order to turn things around.