Table of Contents

In a significant development in the Indian food industry, the Tata Group is in advanced talks to acquire a controlling stake in Haldiram's, one of India's most prominent snack food brands. Haldiram's, known for its range of savory snacks and sweets, is reportedly seeking a valuation of $10 billion for the proposed acquisition. The $10 billion valuation sought by Haldiram's for the deal translates to 6.6 times its annual revenue of $1.5 billion. This deal, if finalized, would have significant implications for the Indian snack food industry and would represent a major expansion for the Tata Group's portfolio of consumer goods businesses.

The market is driven by several factors, including the large and growing population, rising disposable incomes, and changing consumer preferences towards snacking. The market is dominated by established players such as Haldiram, Balaji, Bikaji, Bikano, Bikanerwala, ITC, Pratap Snacks and PepsiCo, but new entrants are making inroads by introducing innovative products and marketing strategies.

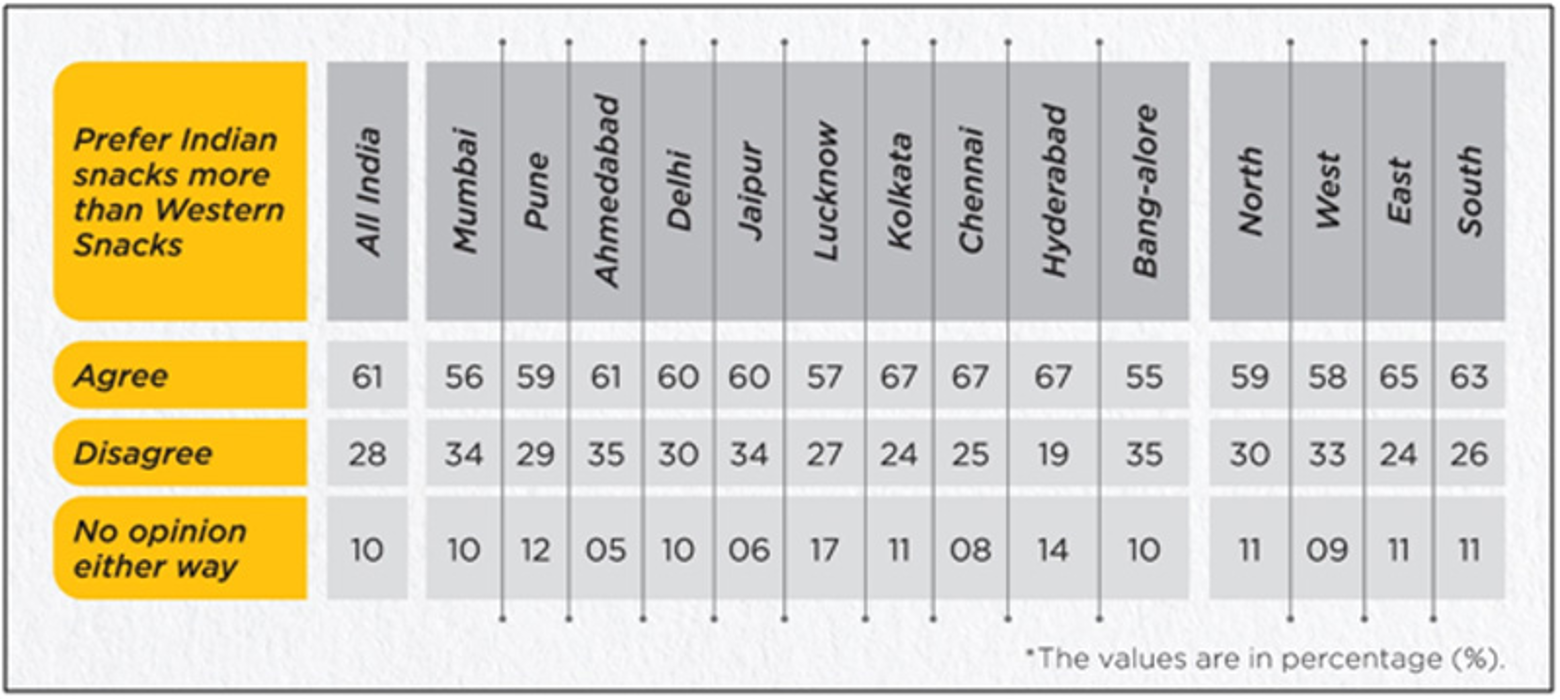

Indians love Indian snacks over Western Snacks

According to report titled STTEM – Safety, Technology, Taste, Ease & Mood Uplifter’ - The India Snacking Report (Volume I) by Godrej Yummiez, 61% Indians prefer Indian snacks over western snacks. The study was conducted across the North, South, West and East regions and covered 10 cities like Mumbai, Pune, Ahmedabad, Delhi, Jaipur, Lucknow, Kolkata, Chennai, Hyderabad, and Bangalore. This demonstrates a strong attachment to traditional flavors and ingredients that are unique to Indian cuisine, which holds significant cultural significance. The popularity of Indian snacks also indicates the potential for growth in the domestic market, as consumers continue to seek authentic and familiar flavors

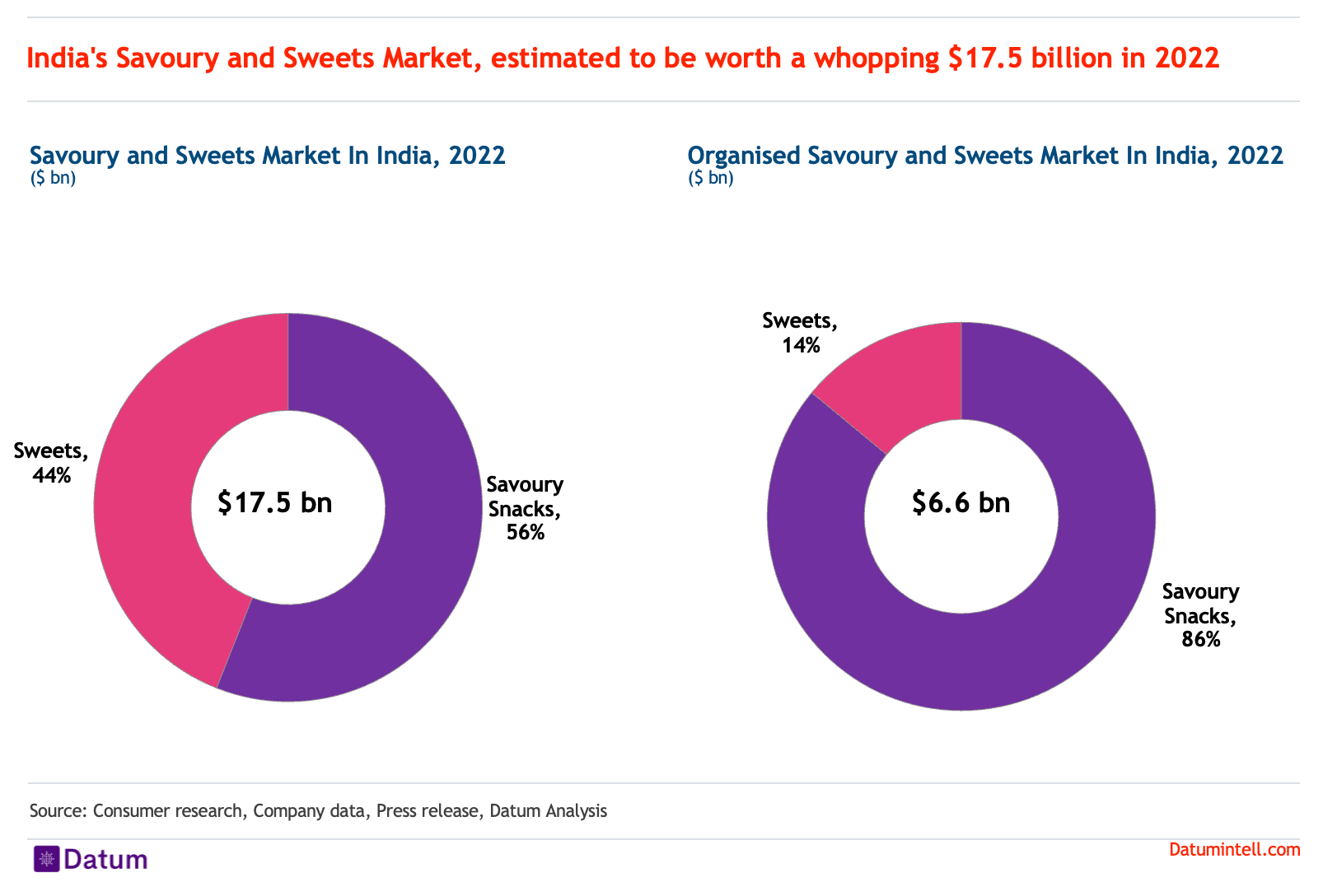

$17.5 Bn Indian Savoury and Sweets Market in 2022

The market for Indian Savoury and Sweets is estimated to be $17.5 bn in 2022 with 56% coming from Savoury snacks and 44% from Sweets. This provides the massive opportunity to a group like Tata to tap into this market and expand the portfolio of offerings to customers.

We expect the market is expected to reach $25 billion by 2026 driven by the increasing disposable income.

Only 37% of the Market is organised

The organized market, which is the more formal and structured segment, accounts for around 37% of the market, worth about $6.6 billion in 2022. This market is dominated by the likes of Haldiram, Balaji, Bijkaji, Bikano, Bikanerwala, ITC and other. Only 10% of the sweet industry is organised, leaving a huge possibility for this category. The Savaoury Snacks sector is more organised, with 58% of sales coming from organised companies.

The organised Savaoury snakcs and sweets market is expected to reach $10 bn by 2025

Opportunity to Grow

The market is all set to touch $25 bn by 2026 powered by the changing consumer purchasing and eating behaviour

- Growing urbanization and rising disposable incomes create a lucrative market for packaged and premium sweets.

- Increased demand for healthy and nutritious sweets with natural ingredients and lower sugar content.

- Growth of e-commerce and the rise of online food delivery platforms opens up new channels for distribution and promotion

- Emergence of niche and fusion sweets that cater to the evolving tastes and preferences of consumers

Irrespective to the outcome of these discussions the Indian savoury snacks and sweets market is all set for continued growth.