Table of Contents

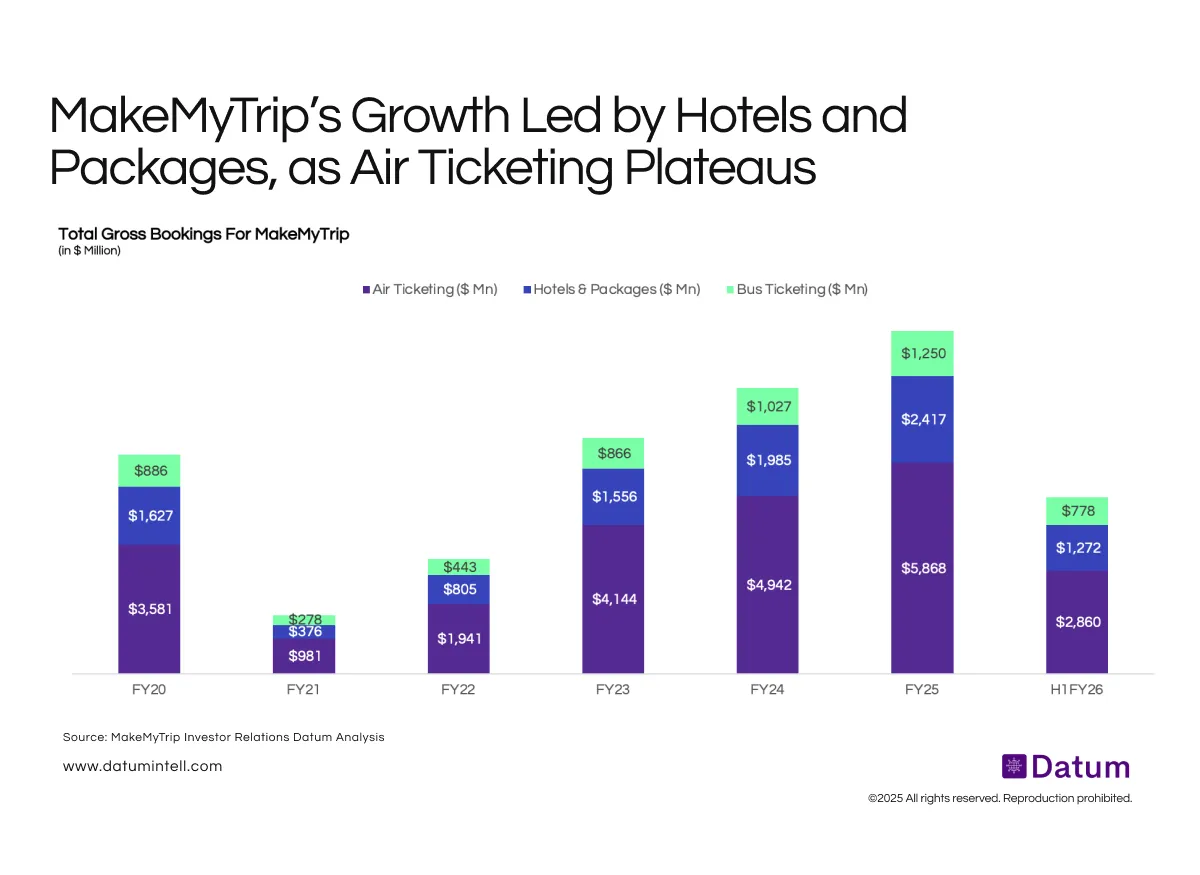

Segment-level data shows a clear shift in MakeMyTrip’s revenue mix, with non-air verticals driving growth in recent years.

- Air ticketing rose modestly from $4.9 B in FY24 to $5.9 B in FY25, signaling volume stabilization after the post-pandemic rebound.

- Hotels and packages surged to $2.4 B in FY25, nearly 1.6× higher than FY23, driven by premium leisure and international travel.

- Bus ticketing also maintained steady growth, reaching $1.25 B, aided by Tier-2 adoption and digital expansion.

- H1 FY26 bookings totaled $2.9 B in air, $1.3 B in hotels, and $0.8 B in bus, putting the platform on track for another record year.

What It Means

- Category diversification: MakeMyTrip’s dependency on air travel continues to decline, with 42% of total bookings in FY25 coming from non-air categories.

- Premium travel mix: Growth in hotels and packages underscores a structural shift toward higher-value, experiential travel.

- Sustained platform strength: The company’s ability to scale across verticals highlights ecosystem maturity and resilience against air travel cyclicality.