Table of Contents

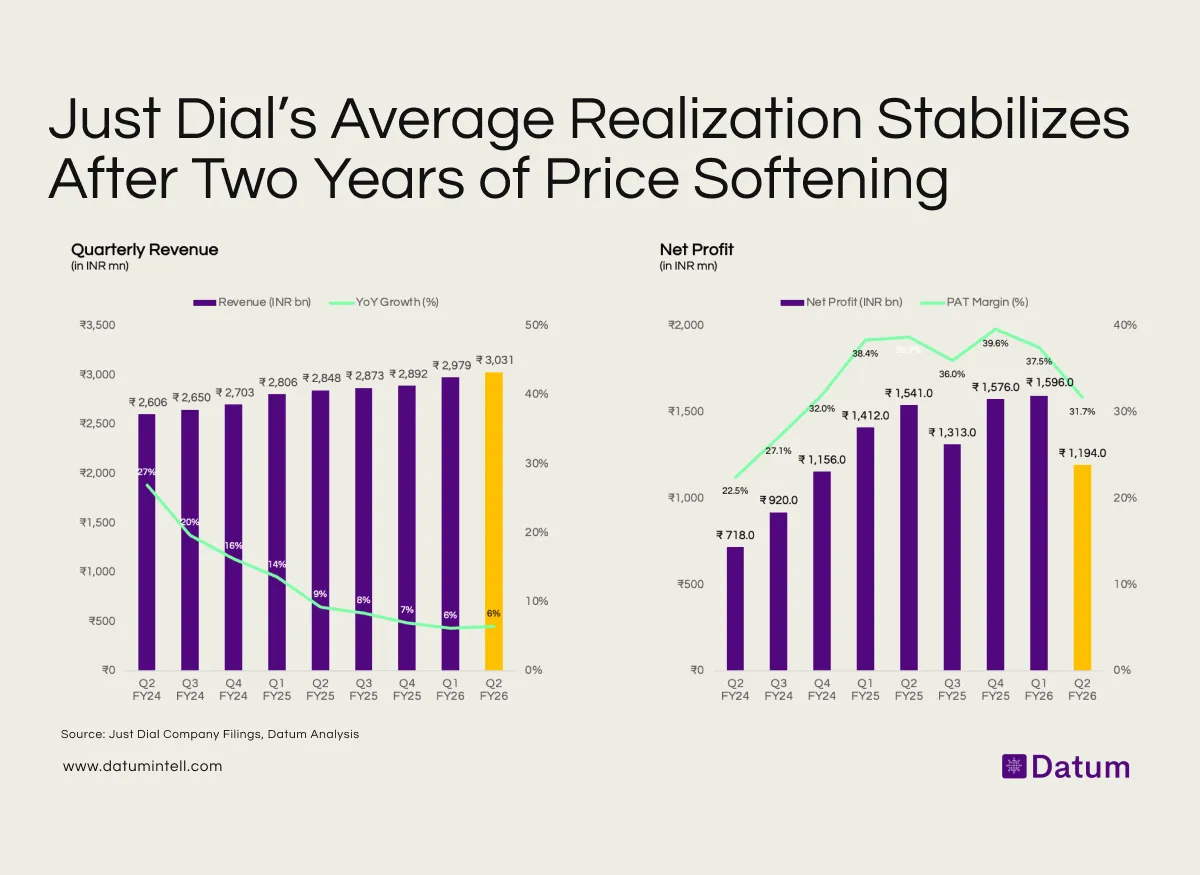

Just Dial reported steady topline growth in Q2 FY26, with revenue rising to ₹3,031 million, up 6% year-on-year and 2% sequentially. The company’s growth trajectory has slowed visibly over the past six quarters - from 27% in Q2 FY24 to mid-single digits now - reflecting a maturing base and plateauing advertiser expansion.

Despite the moderation in growth, Just Dial remains solidly profitable. Net profit came in at ₹1,194 million, representing a 31.7% PAT margin, which, although lower than the record highs of 37–39% seen in FY25, still reflects strong cost control and efficiency.

What It Means:

- The deceleration in growth underscores the post-COVID normalization of digital advertising spend and limited new advertiser additions.

- Profitability has dipped as Just Dial ramps up investments in technology, app ecosystem, and branding under Reliance ownership.

- The business has transitioned from a high-growth recovery phase to a steady, cash-generative model.

- Sustaining margins above 30% gives Just Dial ample cushion for reinvestment while maintaining strong free cash flow.

- Going ahead, growth will hinge on expanding paid campaigns in Tier-2/3 cities and driving better cross-product monetization.