Table of Contents

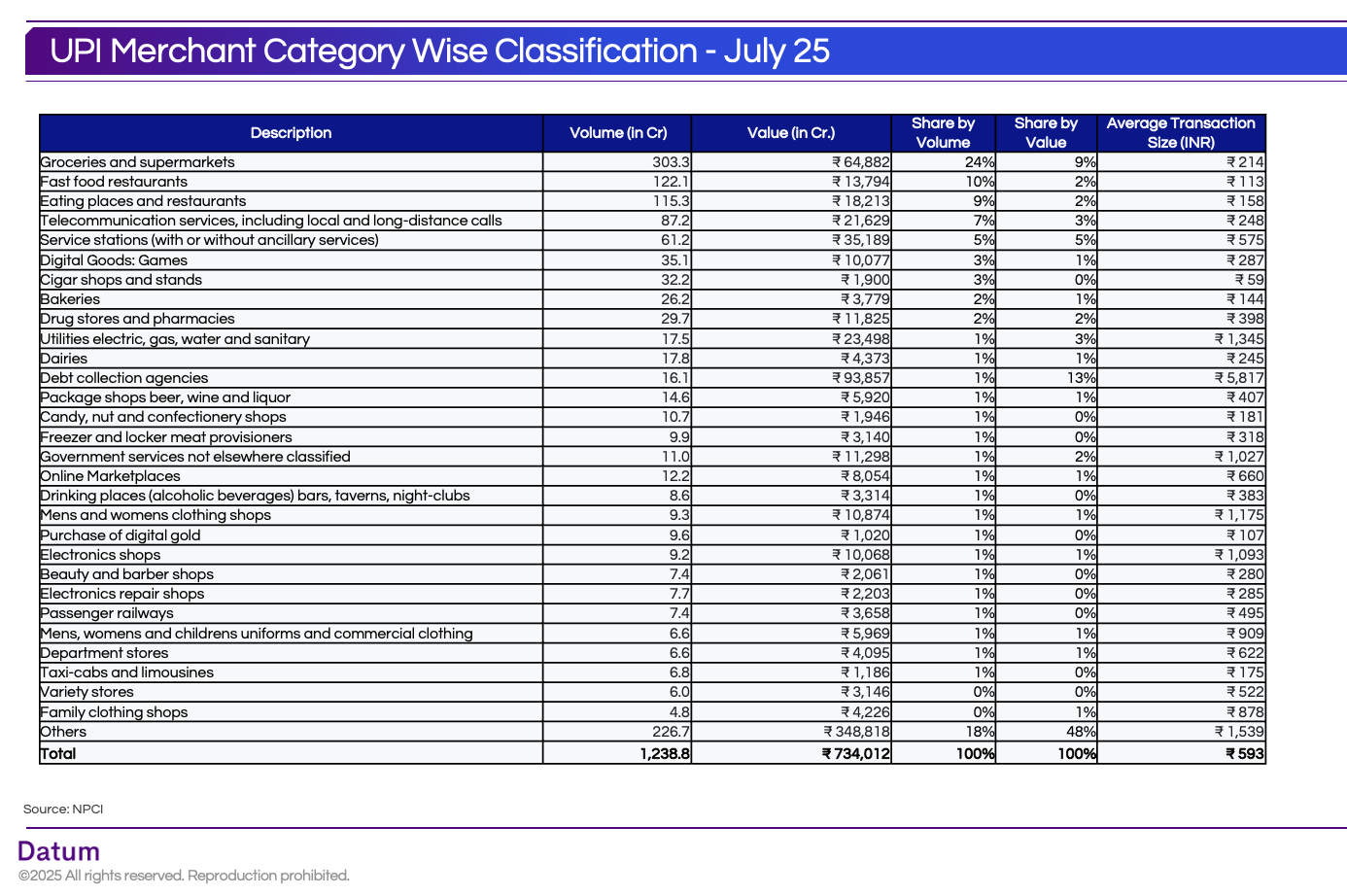

UPI (Unified Payments Interface) has transformed how India transacts, becoming the country’s default digital payment method across both urban and rural markets. With over 12.3 billion transactions valued at ₹7.34 lakh crore in the period analyzed, UPI is no longer just a payment mode - it’s the backbone of India’s digital commerce ecosystem.

This category-wise breakdown shows how UPI is being used across daily essentials, services, entertainment, and high-value payments, revealing fascinating patterns in how consumers engage with the platform.

Groceries & Supermarkets: Everyday Essentials Dominate

Volume: 3,032.59 million

Value: ₹64,882 crore

Share: 24% of total transactions by volume, 9% by value

Average Ticket Size: ₹214

UPI has firmly replaced cash at kirana stores, supermarkets, and convenience outlets. The low ticket size shows the dominance of small, frequent purchases — exactly where UPI thrives.

Food Services: The Second-Largest UPI Use Case

Fast Food Restaurants: 10% share by volume, ₹113 average ticket size

Eating Places & Restaurants: 9% share by volume, ₹158 average ticket size

Dining, whether quick-service or casual, is a massive driver of UPI usage. The low friction of scanning a QR code at the counter or table has made UPI the go-to payment method across F&B formats.

Telecom Services: Recurring Digital Payments

Volume: 871.88 million

Value: ₹21,629 crore

Average Ticket Size: ₹575

Recharge and bill payments are a natural fit for UPI. Its speed, no-fee structure, and instant confirmation make it ideal for recurring services like mobile plans and broadband.

High-Value, Low-Frequency Categories

While most UPI use cases are high-frequency, some categories see fewer but much higher-value transactions:

Debt Collection Agencies: ₹93,857 crore (13% of total value) with an average ticket size of ₹5,817

Utilities (Electricity, Gas, Water): ₹1,345 per transaction

Government Services: ₹1,027 per transaction

These categories show UPI’s growing role in formal, large-ticket payments that were once dominated by NEFT or cheques.

Digital Goods & Online Marketplaces

Digital Games: ₹287 per transaction, 3% volume share

Online Marketplaces: ₹8,054 crore total value, ₹660 per transaction

The e-commerce ecosystem is deeply tied to UPI adoption. Whether shopping on Amazon, Flipkart, or smaller D2C sites, UPI’s one-tap payments are becoming standard, reducing cart abandonment.

Fashion & Apparel Payments

Men’s & Women’s Clothing Shops: ₹1,175 average ticket size

Family Clothing Shops: ₹878 per transaction

Uniform & Commercial Clothing: ₹909 per transaction

Fashion is emerging as a notable UPI category, reflecting how digital payments have moved into discretionary spending beyond necessities.

The Bigger Picture of UPI Usage

From the macro lens:

- Top Volume Drivers: Groceries, restaurants, telecom, and pharmacies.

- Top Value Drivers: Debt repayment, utilities, government services.

- Frequency Play: Low-ticket categories like food, groceries, and beauty.

- Value Play: High-ticket services like electronics, gold, and government fees.

UPI’s adoption curve is no longer just about urban millennials — it’s mainstream across India’s spending economy. It powers both high-frequency, low-value daily spends and low-frequency, high-value transactions, proving its versatility.

For businesses, UPI data isn’t just about payments — it’s a live pulse check on consumer behavior in India.