Table of Contents

India’s digital payment infrastructure has witnessed a dramatic expansion since 2019, driven by UPI adoption, interoperability, and policy-led digitisation.

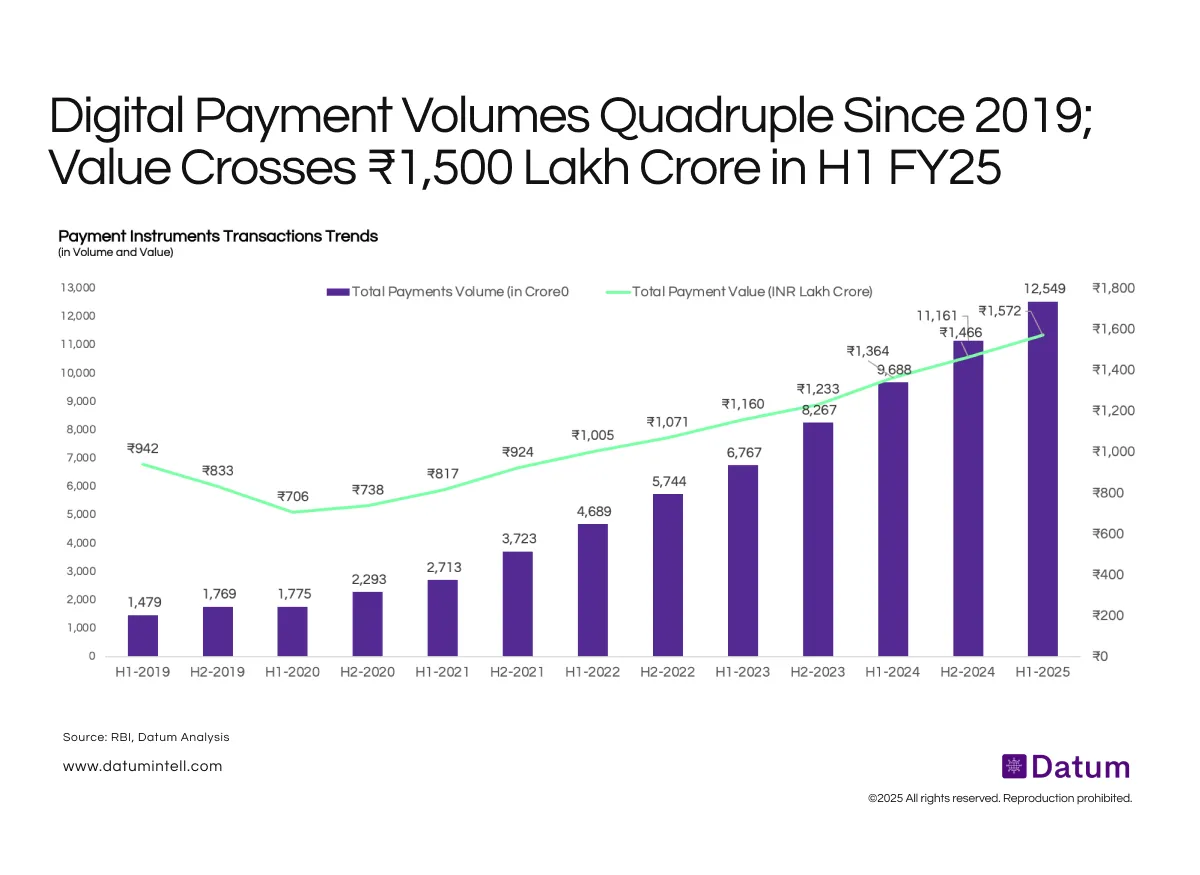

Total payment volumes have grown 8.5× - from 1,479 crore in H1 2019 to 12,549 crore in H1 2025, reflecting the deepening of digital financial inclusion across consumer and business use cases.

Meanwhile, total transaction value has nearly doubled from ₹942 lakh crore to ₹1,572 lakh crore, underscoring not just frequency growth but also a gradual upshift in average ticket size as digital transactions move into high-value segments like bill payments, investments, and B2B settlements.

What It Means

- UPI’s Dominance is Structural: The sustained surge in payment volume since 2020 aligns with the mass-scale rollout and adoption of UPI, supported by merchant integration and government services digitisation.

- Formalisation of Consumption: The steady climb in payment value indicates a wider formalisation of consumer spending and small business transactions, with digital channels replacing cash in high-value categories.

- India’s Transition to a Cash-Light Economy: With payment volume continuing to grow faster than GDP or household consumption, India is entering a digitally saturated phase, where innovation will shift from access to monetisation and efficiency.