Table of Contents

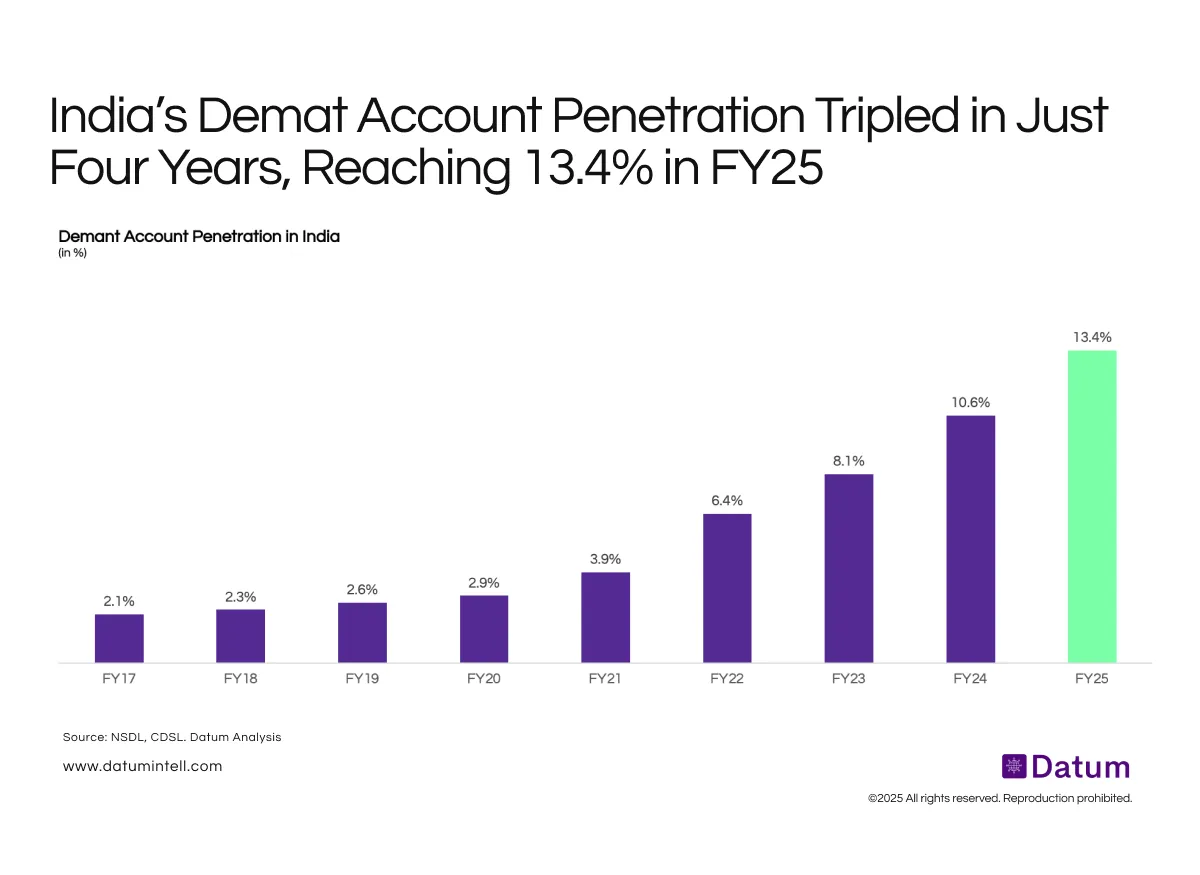

Demat account penetration in India has risen from just 3.9% in FY21 to 13.4% in FY25, reflecting a dramatic rise in retail participation in equity markets.

This acceleration mirrors the broader digital financial inclusion wave - powered by the proliferation of discount brokers, seamless digital KYC onboarding, and rising investor awareness post-pandemic.

What It Means

- Despite tripling in just four years, India’s equity participation remains low compared to developed markets (typically 40–50% of households), highlighting significant headroom for future growth.

- The shift toward mobile-first investing and commission-free trading platforms continues to onboard millions of first-time investors from smaller cities.

- Retail participation is likely to be a structural force in driving liquidity, domestic flows, and valuation resilience in Indian capital markets.