Table of Contents

On 31st Jan 2024 RBI issued a directive, “Action against Paytm Payments Bank Ltd under Section 35A of the Banking Regulation Act, 1949”.

According to this Reserve Bank of India directed Paytm Payments Bank (PPBL) as below

- No further deposits or credit transactions or top ups shall be allowed in any customer accounts, prepaid instruments, wallets, FASTags, NCMC cards, etc. after February 29, 2024, other than any interest, cashbacks, or refunds which may be credited anytime.

- Withdrawal or utilisation of balances by its customers from their accounts including savings bank accounts, current accounts, prepaid instruments, FASTags, National Common Mobility Cards, etc. are to be permitted without any restrictions, upto their available balance.

- No other banking services, other than those referred in (ii) above, like fund transfers (irrespective of name and nature of services like AEPS, IMPS, etc.), BBPOU and UPI facility should be provided by the bank after February 29, 2024.

- The Nodal Accounts of One97 Communications Ltd and Paytm Payments Services Ltd. are to be terminated at the earliest, in any case not later than February 29, 2024.

- Settlement of all pipeline transactions and nodal accounts (in respect of all transactions initiated on or before February 29, 2024) shall be completed by March 15, 2024 and no further transactions shall be permitted thereafter.

On 16th Feb, 2024 RBI issued a FAQ where deadline for some items above was extended to 15th March,2023.

Datum conducted a survey of 2,000 merchants using payment apps for accepting payments across 12 cities in India to understand the impact of RBI directive on Paytm.

Some of the key findings are as follows

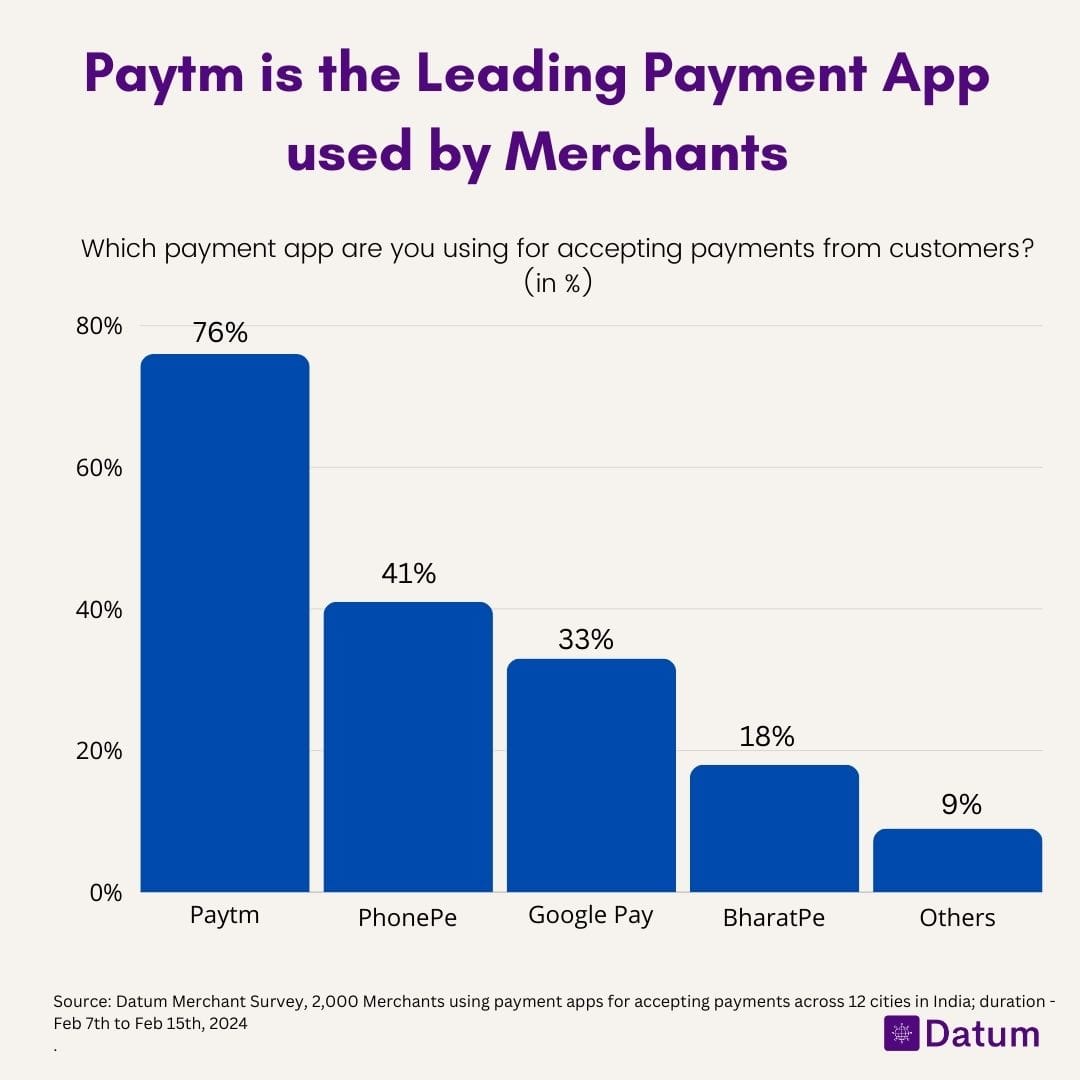

Paytm is the Leading Payment App used by Merchants followed by PhonePe

Paytm holds the leading position as the preferred payment app among merchants, with PhonePe following closely behind.

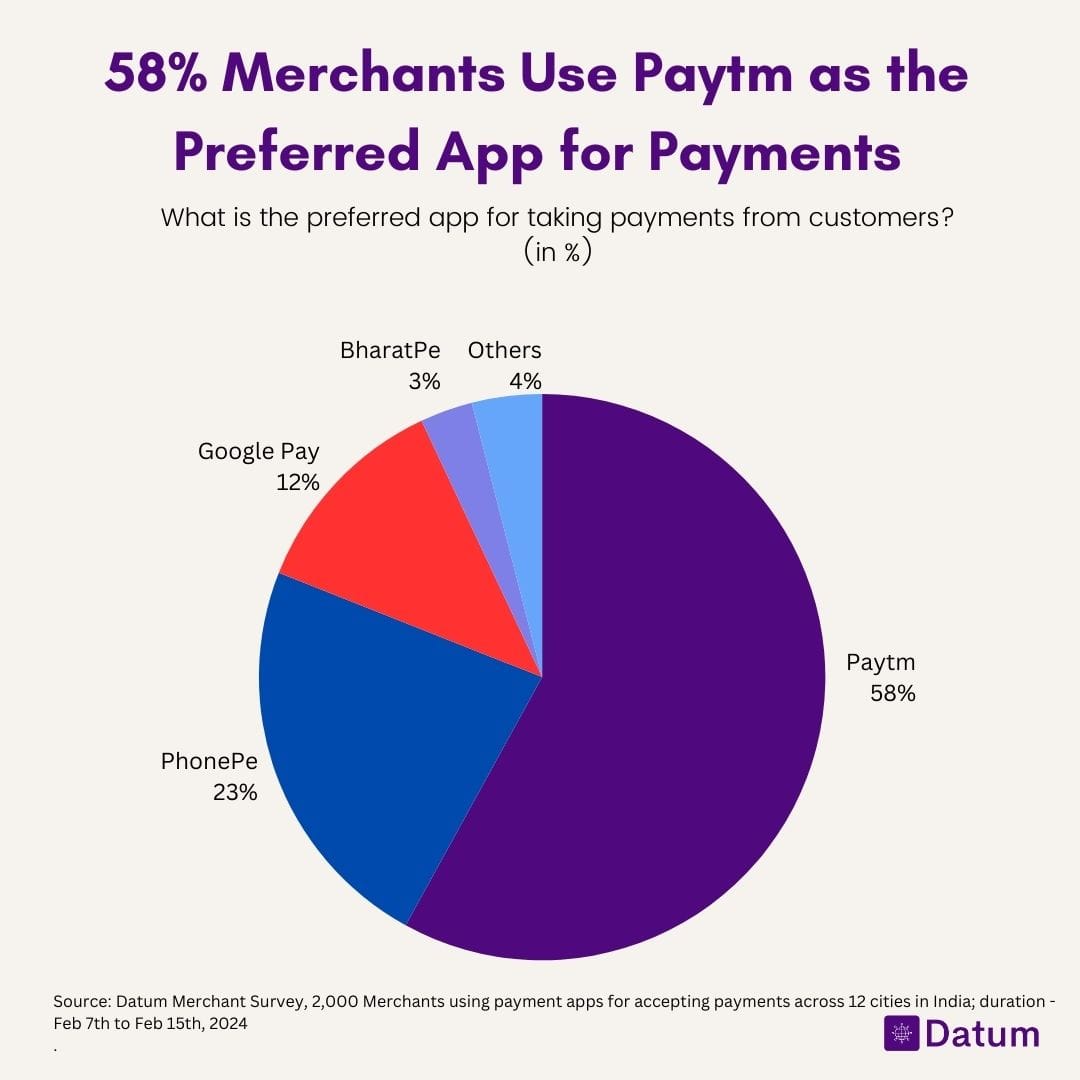

58% Merchants Use Paytm as the Preferred App for Payments

58% of merchants in India prefer using Paytm as their go-to payment app. Paytm's widespread adoption among merchants can be attributed to its user-friendly interface, robust security features, and innovative payment solutions. This explains the focus of Paytm on merchants instead of P2P payments on UPI.

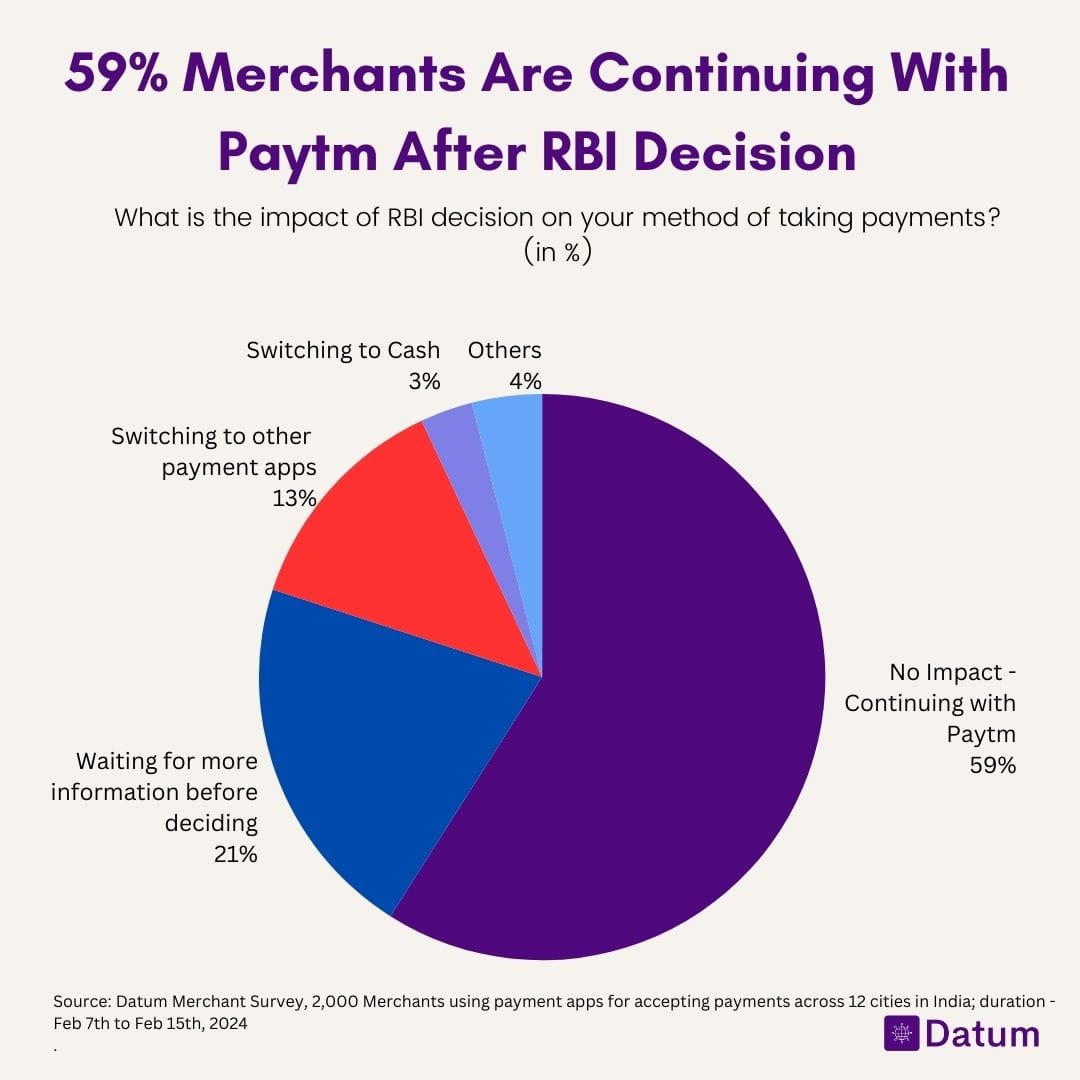

59% Merchants Are Continuing With Paytm After RBI Decision

While 13% of merchants have switched to other payment apps following the RBI's decision, the majority have chosen to remain with Paytm. This may be due to the app's extensive range of services and the convenience it offers to both merchants and consumers.

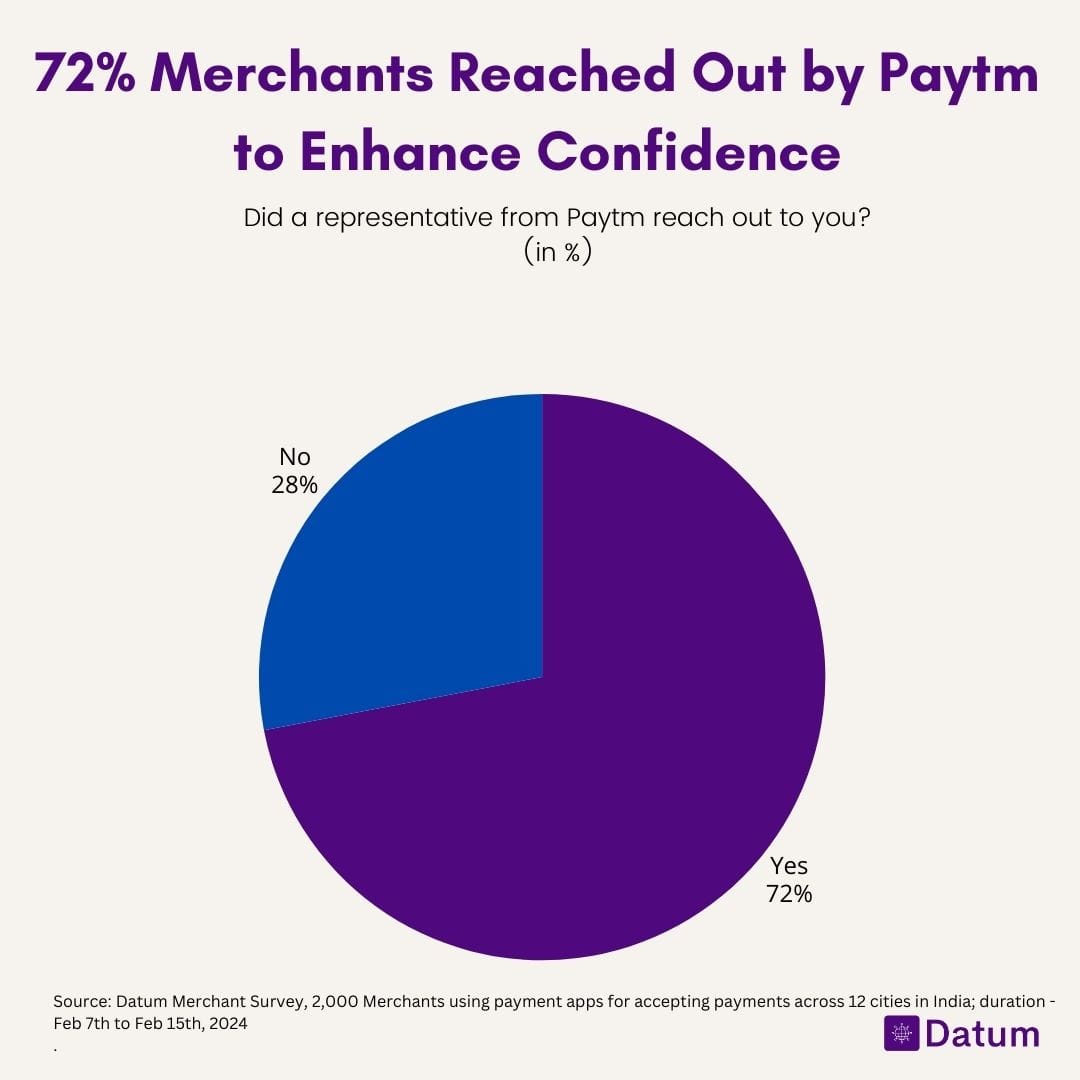

Paytm is Reaching out to Merchant Aggressively

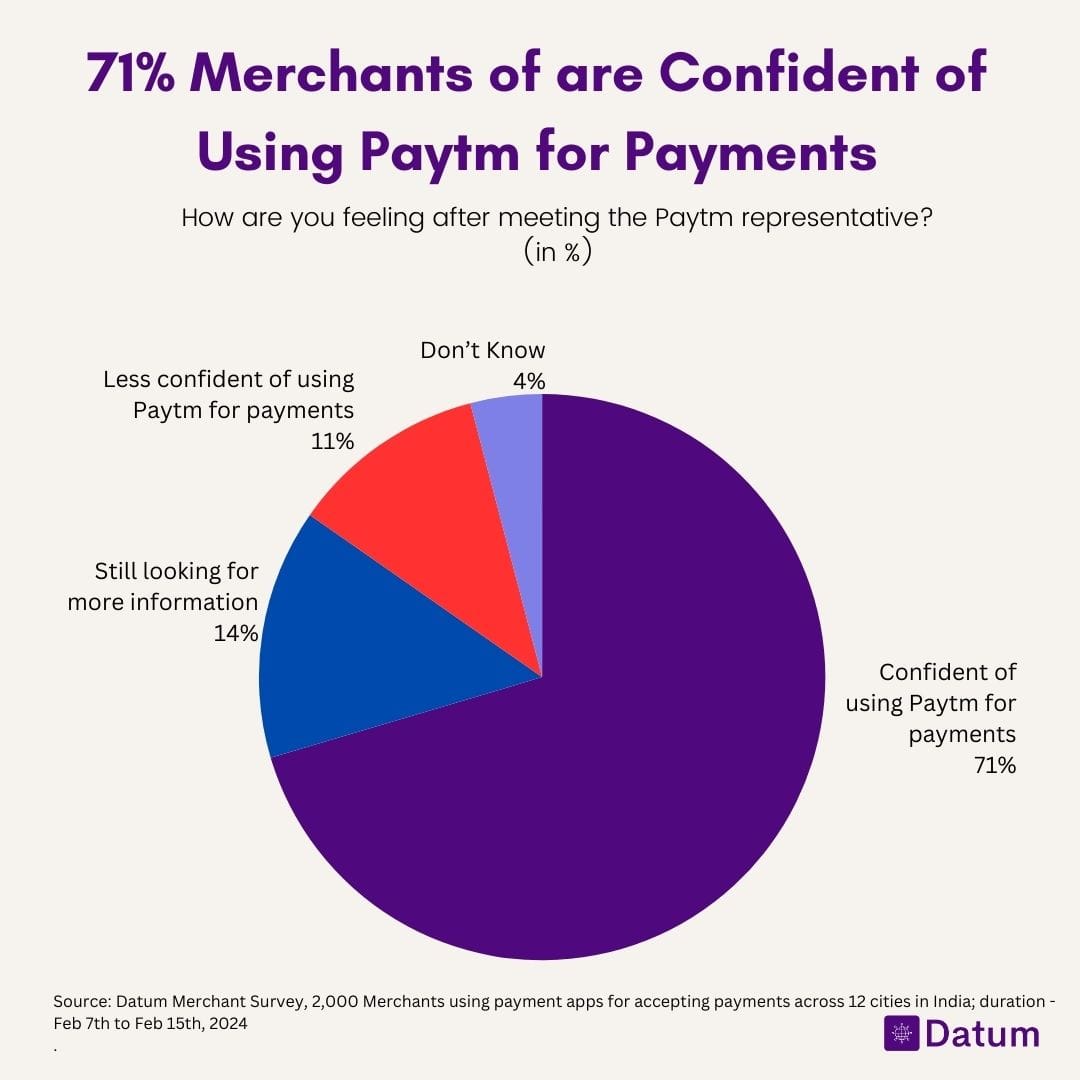

In a proactive move to bolster merchant confidence, Paytm reached out to a significant 72% of merchants following the Reserve Bank of India's (RBI) decision to ban Paytm Payments Bank. This outreach effort showcases Paytm's dedication to addressing merchant concerns and assuring them of the continued reliability and security of its services.The company's swift response demonstrates a strong commitment to maintaining the trust of its merchant partners and the broader digital payments ecosystem.

More Merchants Continuing with Paytm After Reachout

Paytm's proactive outreach efforts are yielding positive results, with more merchants choosing to continue using the app following the RBI's decision. Despite initial concerns about the potential impact on Paytm's business, the company's commitment to open communication with its merchant partners appears to be paying off.

A majority of merchants reported that recent events have not had a significant impact on their usage of Paytm's payment solutions. This highlights the continued trust and reliance that merchants place on Paytm for their payment processing needs. We believe that this reflects positive response from merchants regarding Paytm's outreach efforts in the wake of the RBI directive where 72% merchants are reached out by a Paytm representative since the directive.

Overall, the impact is limited on the merchant business and Paytm is engaging with merchants to reduce the damage and merchants are also waiting before deciding on alternatives. However, with the tendency of Indian consumers/merchants to wait till last date we may see some change in this closer to 15th of March 2024 when the deadline ends.

Survey Methodology

Survey Duration – Feb 7th to Feb 15th, 2024

Survey – Survey of 2,000 Merchants using payment apps for accepting payments across 12 cities in India