Table of Contents

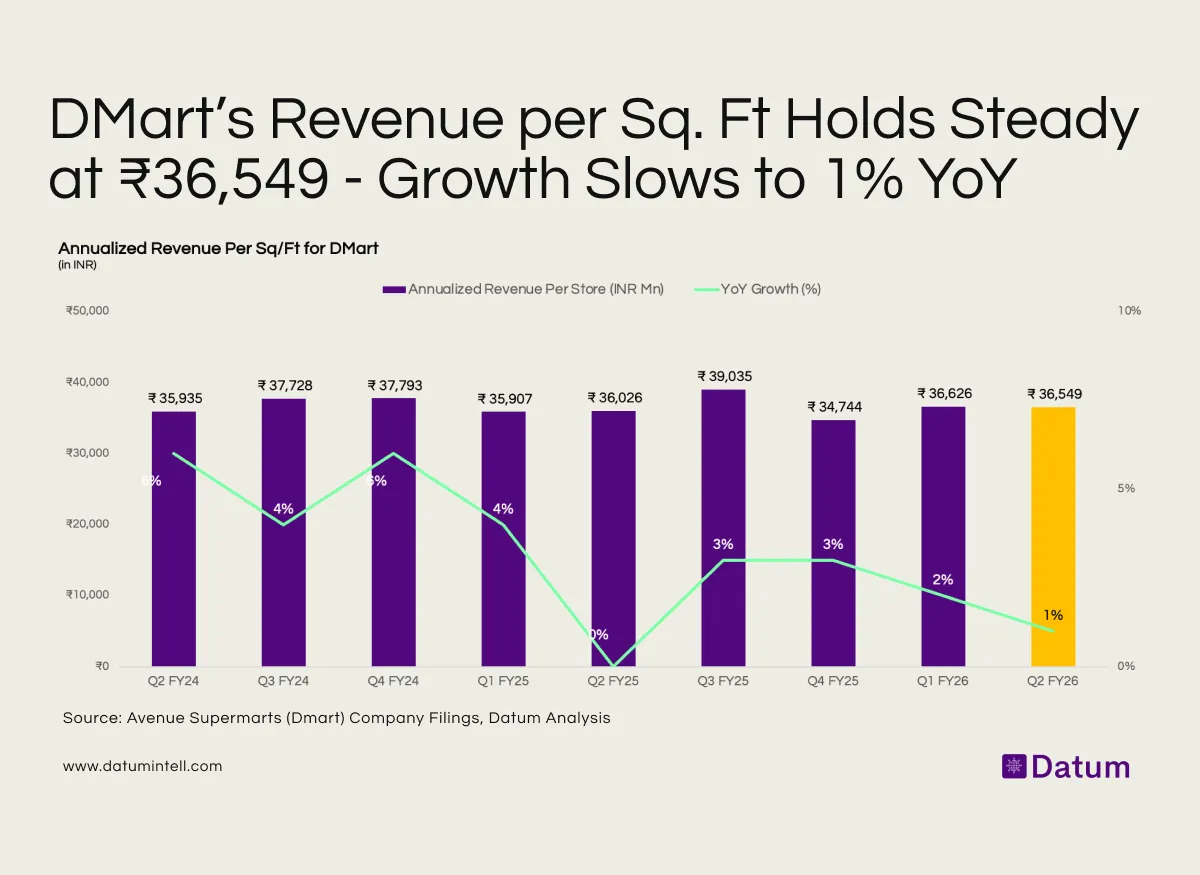

n Q2 FY26, DMart’s annualized revenue per sq. ft stood at ₹36,549, reflecting a modest 1% YoY growth. This stability comes after a period of strong post-pandemic recovery, during which per-square-foot revenue had climbed steadily from FY23 through FY25. The marginal growth rate suggests that store productivity has plateaued, in line with a broader slowdown in discretionary spending.

When benchmarked against peers, DMart still outperforms most value retailers on per-sq-ft efficiency - averaging 1.5–2x higher than Trent’s Zudio or Aditya Birla’s Pantaloons, though it trails behind premium supermarkets like Nature’s Basket or Star Bazaar, which command higher basket values but smaller scales.

What it Means:

The numbers underscore DMart’s mature phase of expansion, where efficiency and margin control take precedence over top-line growth. With limited price inflation and muted consumer upgrades, sustaining revenue density will hinge on optimizing category mix, expanding private labels, and improving throughput from existing stores.