Table of Contents

Avenue Supermarts (DMart) continues to demonstrate disciplined execution in a changing retail landscape.

While topline momentum has eased, the company’s focus on operational efficiency, core food categories, and disciplined expansion keeps its growth engine steady.

In this post, we break down DMart’s key performance metrics to understand what’s driving its steady momentum and how the retailer is positioning for sustained growth.

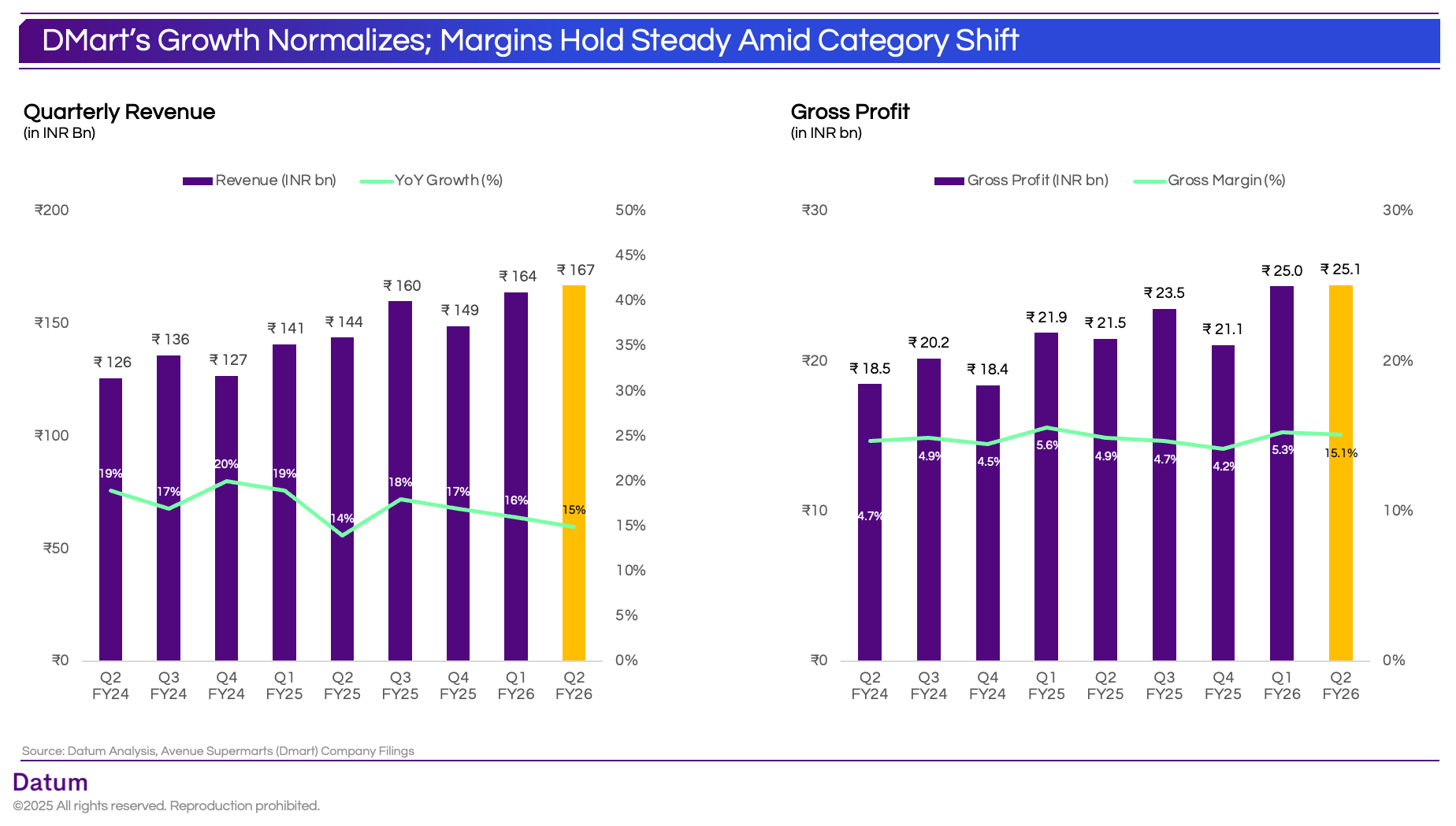

DMart’s Growth Normalizes; Margins Hold Steady Amid Category Shift

- Revenue growth moderates to 15% YoY. DMart’s topline reached ₹167 billion in Q2 FY26, up from ₹164 billion in Q1, marking a slight sequential uptick but slower YoY growth versus the 18–20% pace in FY25.

- Margins remain resilient despite normalization. Gross profit improved to ₹25.1 billion, maintaining a 15.1% gross margin, signaling effective cost control and stable pricing in core essentials despite input cost volatility.

What It Means

DMart’s growth is stabilizing as it transitions from rapid expansion to operational efficiency. Strong food and FMCG sales are sustaining margins, even as discretionary demand stays muted. The company’s focus on store productivity and profitability over scale marks a shift toward a more mature, resilient retail model.

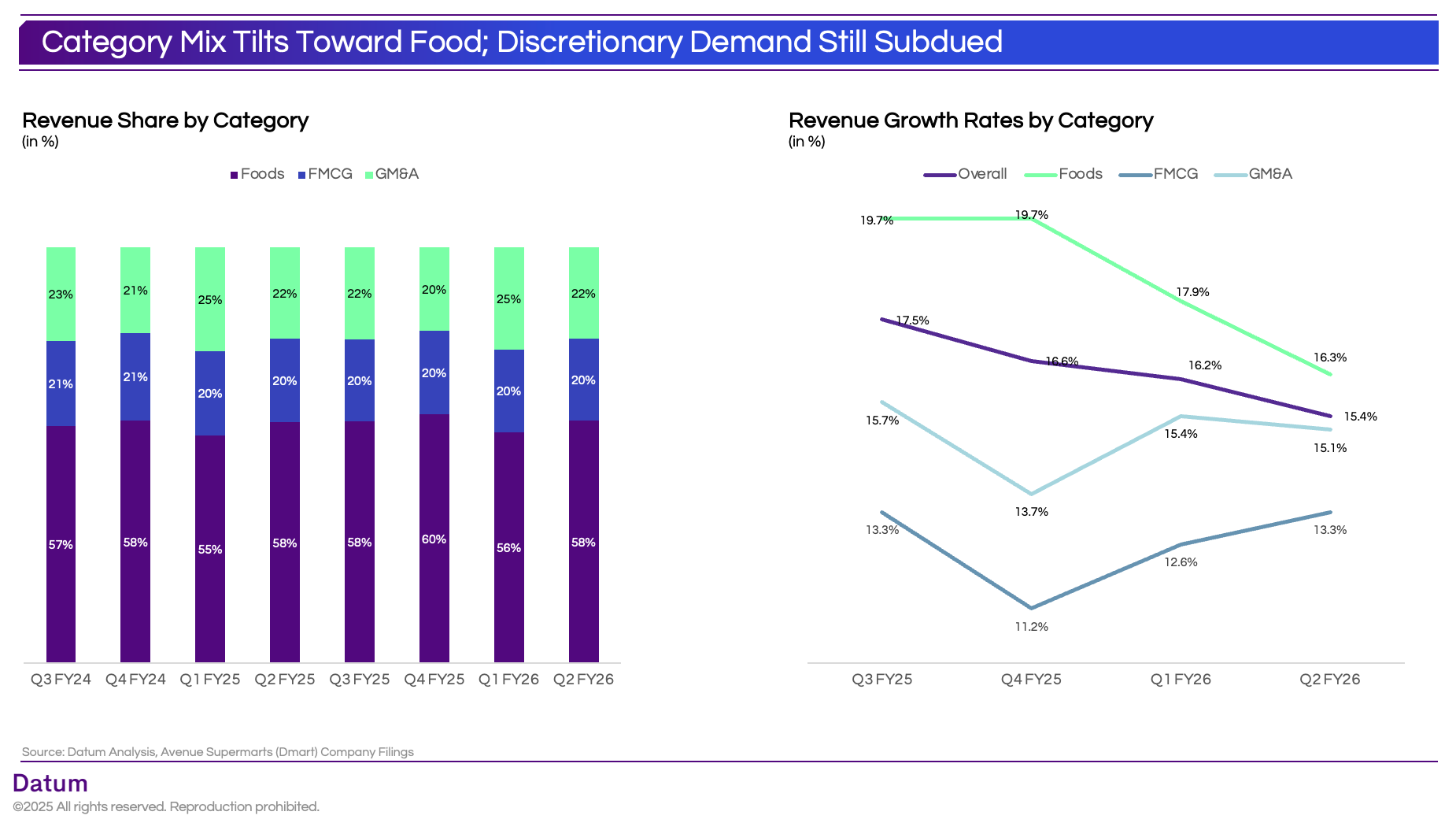

Category Mix Tilts Toward Food; Discretionary Demand Still Subdued

- Food leads the recovery, anchoring 58% of revenue. DMart’s core Food and Staples segment has strengthened its dominance, rising from 55% in Q1 FY25 to 58% in Q2 FY26, underscoring consistent consumer preference for essentials over discretionary categories.

- General Merchandise & Apparel (GM&A) remains soft. GM&A’s share slipped from 25% to 22%, with growth slowing to ~13% YoY, reflecting continued caution in non-essential household and apparel purchases despite easing inflation.

- FMCG contribution steady at 20%. The FMCG segment held stable, suggesting sustained repeat purchases in branded consumables. Growth of 13–15% YoY indicates resilience in smaller-ticket, frequency-driven items.

- Overall growth driven by essentials. While overall revenue growth eased to 15% YoY, it remains largely volume-led, supported by strong footfalls in food and FMCG categories and DMart’s value positioning in a cautious consumer market.

What It Means:

DMart’s category mix reveals a structural consumer shift toward essentials, with food and FMCG driving steady growth while discretionary recovery remains delayed. This pattern reinforces DMart’s strength in value retailing, but highlights the challenge of reigniting higher-margin GM&A sales - a critical lever for margin expansion in FY26 and beyond.

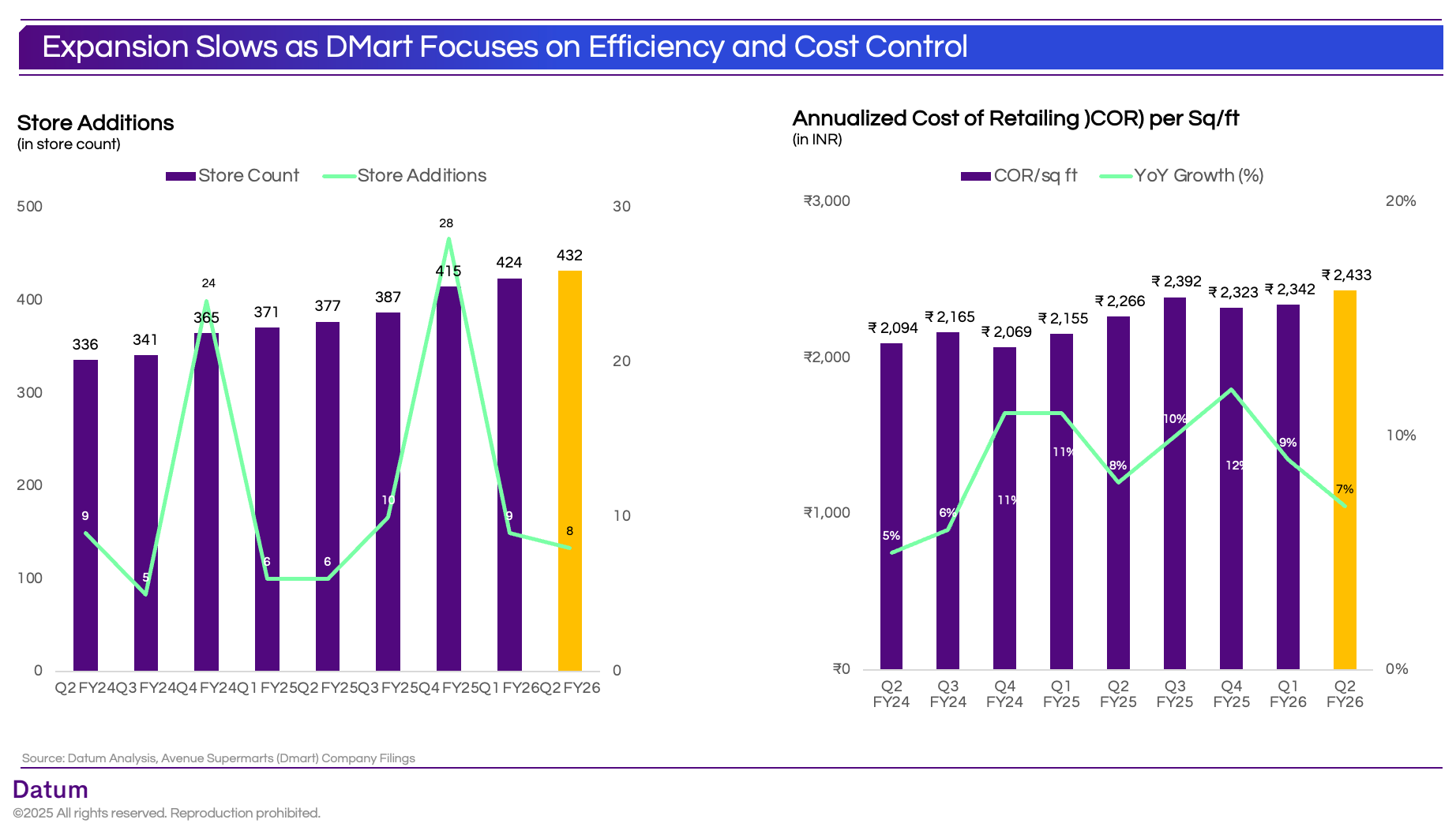

Expansion Slows as DMart Focuses on Efficiency and Cost Control

- Store expansion moderates after a high-growth year. Store additions slowed to 8 in Q2 FY26, compared to 28 in Q4 FY25, bringing the total count to 432 stores. This reflects a deliberate move away from rapid physical expansion toward consolidation and operational focus.

- Retail area expansion steadies. The cumulative retail space crossed ~17.9 million sq. ft., signaling that DMart is entering a phase of network maturity, where incremental store growth adds less to topline momentum but more to long-term efficiency.

- Cost of Retailing per sq. ft. rises 7% YoY. The annualized Cost of Retailing (CoR) increased to ₹2,433/sq. ft., up 7% YoY, marking a moderation from the double-digit growth seen through FY25. This suggests stabilization in operating expenses amid inflationary pressures on manpower, logistics, and utilities.

- Shift from scale to productivity. DMart’s recent quarters show a clear transition from scale-led growth to efficiency-led performance, with greater emphasis on store-level profitability and operational discipline.

What It Means:

DMart is entering a mature growth phase, prioritizing efficiency over expansion. With costs stabilizing and store additions slowing, the focus is shifting to driving profitability and productivity across its existing network rather than aggressive footprint growth.

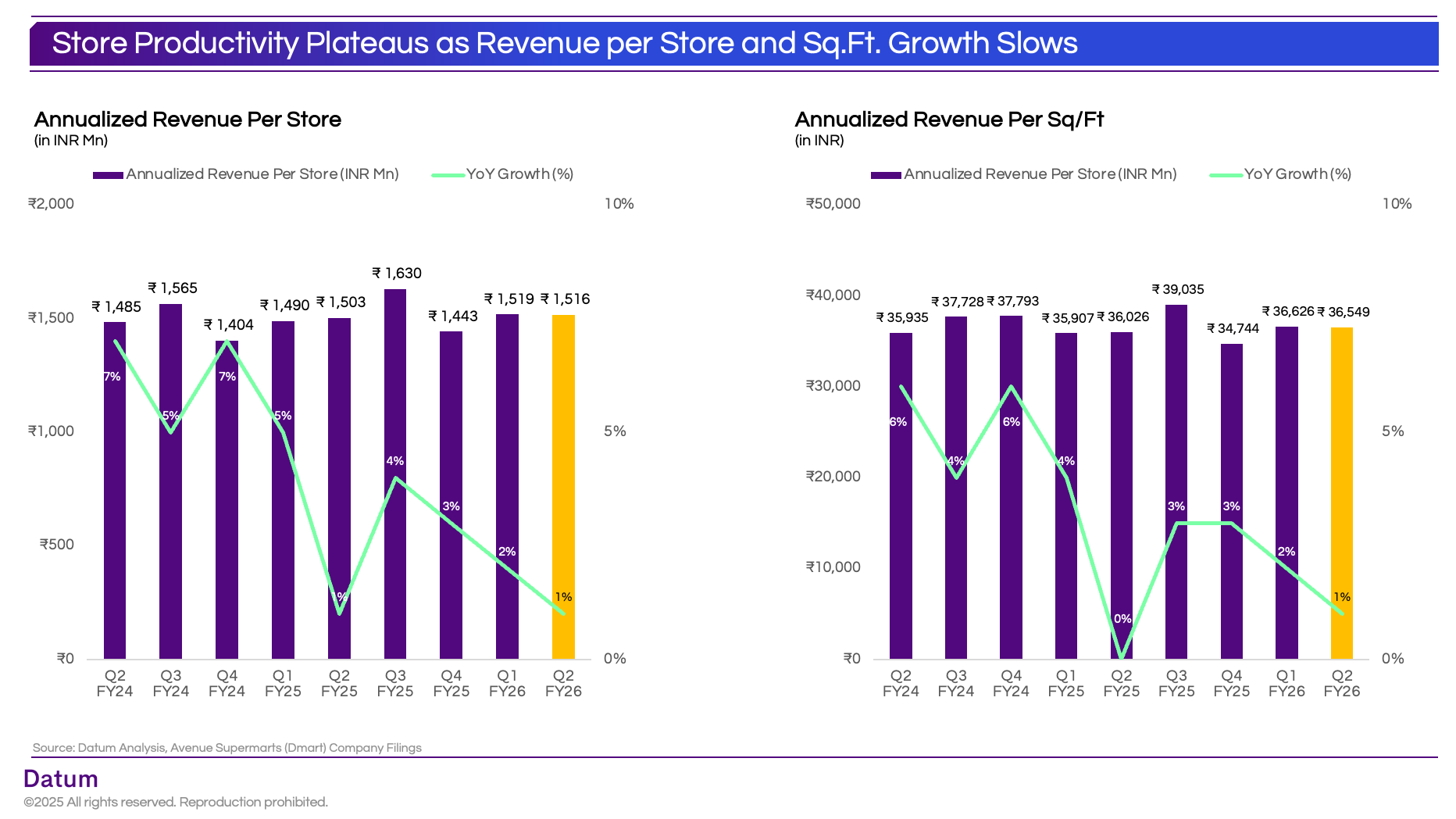

Store Productivity Plateaus as Revenue per Store and Sq.Ft. Growth Slows

- Per-store revenue stabilizes after FY25 peak. Annualized revenue per store stood at ₹1,516 Mn in Q2 FY26, nearly flat YoY, signaling that maturity in store network and limited like-for-like sales growth are tempering incremental gains.

- Revenue per sq. ft. moderates to ₹36,549. Revenue productivity per sq. ft. remained stable, up just 1% YoY, compared to 3–6% growth in prior quarters, reflecting normalization in footfalls and ticket sizes post the strong FY25 base.

- Growth trend shifts from expansion to efficiency. With both per-store and per-area metrics flattening, DMart’s growth now depends more on operational efficiency and category mix optimization rather than sheer volume expansion.

What It Means :

DMart’s store network has entered a steady-state phase, where future growth will hinge on margin improvement and productivity gains rather than rapid sales acceleration.

Despite facing a subdued demand environment in recent years, DMart’s renewed emphasis on store productivity, profitability enhancement, and the revival of its General Merchandise & Apparel (GM&A) segment reflects a deliberate course correction. The management highlighted that, following recent GST reforms, the company has passed on rate benefits to customers where applicable - reinforcing its value-led positioning. With consumer sentiment gradually improving, macroeconomic stability returning, and GST 2.0 reforms coupled with a strong festive season in H2 FY26, DMart is well-positioned to reignite growth in its higher-margin GM&A portfolio. However, a slower-than-expected demand recovery and rising competitive intensity remain key watchpoints.

Questions or feedback? Write to us at hello@dautmintell.com